重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

更多“half its 2,000 cash machines out of service and caused delays”相关的问题

更多“half its 2,000 cash machines out of service and caused delays”相关的问题

第1题

听力原文:W: Hey! What's the rush?

M: The bank closes in half an hour and I need to cash a check.

W: I can lend you some money.

M: I need to cash a check because I am going on a trip this weekend. Actually, I want to buy some traveller's checks.

W: Hmm. Can I help you in any way?

M: You can drive me to the bank if you want to . My car is out of gas.

W: Yeah. Glad to. Let's go.

M: Wait just a minute. I have to get my checkbook out the desk.

What is the man going to do this weekend?

A.Go on a trip.

B.Do some shopping.

C.Borrow some money.

第2题

听力原文:W: Hey! What's the rush?

M: The bank closes in half an hour and I need to cash a check.

W: I can lend you some money.

M: I need to cash a cheek because I am going on a trip this weekend. Actually, I want to buy some traveler's cheeks.

W: Hmm. Can I help you in any way?

M: You can drive me to the bank if you want to. My ear is out of gas.

W: Yeah. Glad to. Let's go.

M: Wait just a minute. I have to get my checkbook out the desk.

What is the man going to do this weekend?

A.Go on a trip.

B.Do some shopping.

C.Borrow some money.

第3题

When this happens, the average and professional investors alike tend to overlook the company because they become familiar with the trading range.

Take, for example, Wal-Mart. Over the past five years, the retailing behemoth has grown sales by over 80%, profits by over 100%, and yet the stock price has fallen as much as 30% during that timeframe. Clearly, the valuation picture has changed. An investor that read the annual report back in 2000 or 2001 might have passed on the security, deeming it too expensive based on a metric such as the price to earnings ratio. Today, however, the equation is completely different--despite the stock price, WalMart is, in essence, trading at half its former price because each share is backed by a larger dividend, twice the earnings power, more stores, and a bigger infrastructure. Home Depot is in much the same boat, largely because some Wall Street analysts question how fast two of the world's largest companies can continue

to grow before their sheer size slows them down to the rate of the general economy.

Coca-Cola is another excellent example of this phenomenon. Ten years ago, in 1996, the stock traded between a range of $ 36.10 and $ 54.30 per share. At the time, it had reported earnings per share of $1.40 and paid a cash dividend of $ 0.50 per share. Corporate per share book value was $ 2.48.Last year, the stock traded within a range of $ 40.30 and $ 45.30 per share; squarely in the middle of the same area it had been nearly a decade prior! Yet, despite the stagnant stock price, the 2006 estimates Value Line Investment Survey estimates for earnings per share stand around $ 2.16 (a rise of 54%), the cash dividend has more than doubled to $1.20, book value is expected to have grown to $ 7.40 per share (a gain of nearly 300%), and the total number of shares outstanding (未偿付的,未完成的)has actually decreased from 2.481 billion to an estimated 2.355 billion due to the company's share repurchase program.

16.This passage is probably a part of______.

A.Find Hidden Value in the Market B.Become Richer

C.Get Good Bargains D.Identify Good Companies

17.The italicized word “stagnant” (line 4, Para. 1)can be best paraphrased as______.

A.prominent B.terrible C.unchanged D.progressing

18.Wal-Mart is now trading at a much lower price because

A.it has stored a large quantity of goods

B.it has become financially more powerful

C.it has been eager to collect money to prevent bankruptcy

D.it is a good way to compete with other retailing companies

19.All the following are shared by Wal-Mart and Coco-Cola EXCEPT______.

A.the cash dividend has increased

B.the earning power has become stronger

C.both businesses have continued to grow

D.the stock price has greatly decreased

20.According to the author, one had better______.

A.buy more shares when the stock price falls down

B.sell out the shares when the stock price falls down

C.do some research on the value. of a business when its stock price falls down

D.invest in the business when its stock price fails down

第4题

W: Only if I had a cash cow! My husband would divorce me if he knows I spend half of his month pay on that one-hour pleasure.

Q: What do we learn from the conversation?

(19)

A.The SPA health club charges high prices.

B.The woman is divorcing with her husband.

C.The woman spent half of her husband's salary for the SPA experience.

D.The woman has no idea about the SPA club.

第5题

A.Company L Company L

B.Company L Company M

C.Company M Company L

第6题

White Corp.抯 financial statements for the year ended December 31, 2001 included the

following:

Income Statement

Sales $8,000,000

Cost of Goods Sold (3,800,000)

Gross Profit 4,200,000

Wages (1,000,000)

Depreciation (600,000)

Interest (500,000)

Taxes (600,000)

Net Income $1,500,000

Selected Balance Sheet Accounts

Dec. 31, 2000 Dec. 31, 2001

Accounts Receivable $1,200,000 $1,500,000

Inventory 800,000 1,000,000

Accounts Payable 600,000 400,000

Equipment 5,300,000 5,500,000

White prepares its Statement of Cash Flow using the direct method.

The Cash Flow from Operations (CFO) section of the statement will show Cash Collections of:

A.$7,700,000.

B.$7,100,000.

C.$6,900,000.

D.$6,700,000.

第7题

A stamp is worth a million and a half times its original value because__________

A.it was misprinted a hundred years ago

B.of its rareness and age

C.few collectors have it

D.it was made in British colonies

第8题

SECTION A CONVERSATIONS

Directions: In this section you will hear several conversations. Listen to the conversations carefully and then answer the questions that follow.

听力原文:M: Good morning! Is this desk open? I'm leaving today. Can I see my bill, please?

W: Just a moment, Mr. White, I'll draw up your bill for you. That's the total cost you owe the hotel.

M: This figure looks too much. Could you explain it a little bit?

W: Sure. This is an itemized bill. A-P-T-S here stands for apartments, that is, your room charge. You stay here 5 nights, so the figure is repeated five times. Below are charges for the meals and drinks you put on your tab.

M: That's right. I had three drinks and three lunches at the lobby bar. But what is the next figure for?

W: This is the charge for the drinks that you took from the mini-bar in your room.

M: Oh, I see. So that' accounted for. What is the figure under the item T-E-L-I-D-D?

W: That means Telephone Subscriber International Direct Dialing. That's the charge for your international calls from your room. International calls are rather expensive.

M: I know, but all of my calls were made during discount hours.

W: I'm sorry to tell you that there is no discount rate, or peak rate or any other rate. There is only standard rate.

M: That's incredible. I have not enough cash on me. What credit cards are all right?

W: We only accept American express card, master card, and visa. M: Well, I want to pay the bill half in cash and half by traveler's check.

How about the international calls service in the hotel?

A.It is not expensive.

B.There is peak rate service.

C.The guests can enjoy discount rate.

D.There is only standard rate.

第9题

Waters Co operates a chain of cinemas across the country. Currently its cinemas are out of date and use projectors which cannot show films made using new technology, which are becoming more popular. Management is planning to invest in all of its cinemas in order to attract more customers. The company has sufficient cash to fund half of the necessary capital expenditure, but has approached its bank with a loan application of $8 million for the remainder of the funds required. Most of the cash will be used to invest in equipment and fittings, such as new projectors and larger screens, enabling new technology films to be shown in all cinemas. The remaining cash will be used for refurbishment of the cinemas.

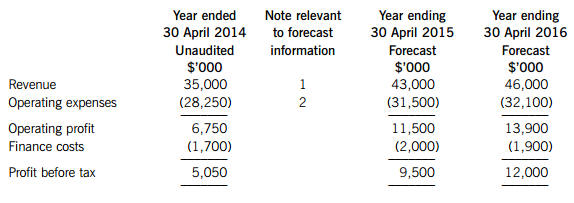

The draft forecast statements of profit or loss for the years ending 30 April 2015 and 2016 are shown below, along with the key assumptions which have been used in their preparation. The unaudited statement of profit or loss for the year ended 30 April 2014 is also shown below. The forecast has been prepared for use by the bank in making its lending decision, and will be accompanied by other prospective financial information including a forecast statement of cash flows.

Forecast statement of profit or loss

Note 1: The forecast increase in revenue is based on the following assumptions:

(i) All cinemas will be fitted with new projectors and larger screens to show new technology films by September 2014.

(ii) Ticket prices will increase from $7·50 to $10 from 1 September 2014.

Note 2: Operating expenses include mainly staff costs, depreciation of property and equipment, and repairs and maintenance to the cinemas.

Required:

(a) (i) Explain the matters to be considered by Hunt & Co before accepting the engagement to review and report on Waters Co’s prospective financial information. (6 marks)

(ii) Assuming the engagement is accepted, describe the examination procedures to be used in respect of the forecast statement of profit or loss. (8 marks)

(b) The audit strategy relevant to the audit of Waters Co concludes that the company has a relatively high risk associated with money laundering, largely due to the cash-based nature of its activities. The majority of customers purchase their cinema tickets and refreshments in cash, and the company transfers its cash to overseas bank accounts on a regular basis.

Required:

(i) Explain the stages used in laundering money, commenting on why Waters Co has been identified as high risk. (5 marks)

(ii) Recommend FOUR elements of an anti-money laundering programme which audit firms such as Hunt & Co should have in place. (6 marks)

第10题

Section A – BOTH questions are compulsory and MUST be attempted

Pursuit Co, a listed company which manufactures electronic components, is interested in acquiring Fodder Co, an unlisted company involved in the development of sophisticated but high risk electronic products. The owners of Fodder Co are a consortium of private equity investors who have been looking for a suitable buyer for their company for some time. Pursuit Co estimates that a payment of the equity value plus a 25% premium would be sufficient to secure the purchase of Fodder Co. Pursuit Co would also pay off any outstanding debt that Fodder Co owed. Pursuit Co wishes to acquire Fodder Co using a combination of debt finance and its cash reserves of $20 million, such that the capital structure of the combined company remains at Pursuit Co’s current capital structure level.

Information on Pursuit Co and Fodder Co

Pursuit Co

Pursuit Co has a market debt to equity ratio of 50:50 and an equity beta of 1·18. Currently Pursuit Co has a total firm value (market value of debt and equity combined) of $140 million.

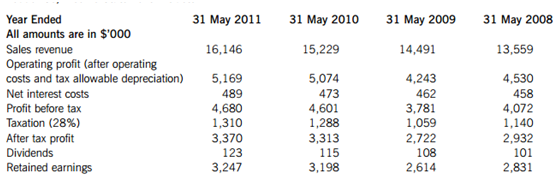

Fodder Co, Income Statement Extracts

Fodder Co has a market debt to equity ratio of 10:90 and an estimated equity beta of 1·53. It can be assumed that its tax allowable depreciation is equivalent to the amount of investment needed to maintain current operational levels. However, Fodder Co will require an additional investment in assets of 22c per $1 increase in sales revenue, for the next four years. It is anticipated that Fodder Co will pay interest at 9% on its future borrowings.

For the next four years, Fodder Co’s sales revenue will grow at the same average rate as the previous years. After the forecasted four-year period, the growth rate of its free cash flows will be half the initial forecast sales revenue growth rate for the foreseeable future.

Information about the combined company

Following the acquisition, it is expected that the combined company’s sales revenue will be $51,952,000 in the first year, and its profit margin on sales will be 30% for the foreseeable futue. After the first year the growth rate in sales revenue will be 5·8% per year for the following three years. Following the acquisition, it is expected that the combined company will pay annual interest at 6·4% on future borrowings.

The combined company will require additional investment in assets of $513,000 in the first year and then 18c per $1 increase in sales revenue for the next three years. It is anticipated that after the forecasted four-year period, its free cash flow growth rate will be half the sales revenue growth rate.

It can be assumed that the asset beta of the combined company is the weighted average of the individual companies’ asset betas, weighted in proportion of the individual companies’ market value.

Other information

The current annual government base rate is 4·5% and the market risk premium is estimated at 6% per year. The relevant annual tax rate applicable to all the companies is 28%.

SGF Co’s interest in Pursuit Co

There have been rumours of a potential bid by SGF Co to acquire Pursuit Co. Some financial press reports have suggested that this is because Pursuit Co’s share price has fallen recently. SGF Co is in a similar line of business as Pursuit Co and until a couple of years ago, SGF Co was the smaller company. However, a successful performance has resulted in its share price rising, and SGF Co is now the larger company.

The rumours of SGF Co’s interest have raised doubts about Pursuit Co’s ability to acquire Fodder Co. Although SGF Co has made no formal bid yet, Pursuit Co’s board is keen to reduce the possibility of such a bid. The Chief Financial Officer has suggested that the most effective way to reduce the possibility of a takeover would be to distribute the $20 million in its cash reserves to its shareholders in the form. of a special dividend. Fodder Co would then be purchased using debt finance. He conceded that this would increase Pursuit Co’s gearing level but suggested it may increase the company’s share price and make Pursuit Co less appealing to SGF Co.

Required:

Prepare a report to the Board of Directors of Pursuit Co that

(i) Evaluates whether the acquisition of Fodder Co would be beneficial to Pursuit Co and its shareholders. The free cash flow to firm method should be used to estimate the values of Fodder Co and the combined company assuming that the combined company’s capital structure stays the same as that of Pursuit Co’s current capital structure. Include all relevant calculations; (16 marks)

(ii) Discusses the limitations of the estimated valuations in part (i) above; (4 marks)

(iii) Estimates the amount of debt finance needed, in addition to the cash reserves, to acquire Fodder Co and concludes whether Pursuit Co’s current capital structure can be maintained; (3 marks)

(iv) Explains the implications of a change in the capital structure of the combined company, to the valuation method used in part (i) and how the issue can be resolved; (4 marks)

(v) Assesses whether the Chief Financial Officer’s recommendation would provide a suitable defence against a bid from SGF Co and would be a viable option for Pursuit Co. (5 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the report. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!