重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The following scenario relates to questions 6–10

You are an audit manager at Blenkin & Co and are approaching the end of the audit of Sampson Co, which is a large listed retailer. The draft financial statements currently show a profit before tax of $6·5m and revenue of $66m for the financial year ended 30 June 20X6. You have been informed that the finance director left Sampson Co on 31 May 20X6.

As part of the subsequent events audit procedures, you reviewed post year-end board meeting minutes and discovered that a legal case for unfair dismissal has been brought against Sampson Co by the finance director. During a discussion with the Human Resources (HR) director of Sampson Co, you established that the company received notice of the proposed legal claim on 10 July 20X6.

The HR director told you that Sampson Co’s lawyers believe that the finance director’s claim is likely to be successful, but estimate that $150,000 is the maximum amount of compensation which would be paid. However, management does not intend to make any adjustments or disclosures in the financial statements.

Blenkin & Co has a responsibility to perform. procedures to obtain sufficient, appropriate evidence that subsequent events are appropriately reflected in the financial statements of Sampson Co.

Subsequent events procedures should be performed between the date of the financial statements and WHICH DATE?

A.The date the subsequent events review is performed

B.The date of approval of the financial statements

C.The date of the auditor’s report

D.The date the financial statements are issued

If, after the financial statements have been issued, Blenkin & Co becomes aware of a fact which may have caused its report to be amended, the firm should consider several possible actions.

Which of the following are appropriate actions for Blenkin & Co to take?

(1) Discuss the matter with management and, where appropriate, those charged with governance

(2) Obtain a written representation from management

(3) Consider whether the firm should resign from the engagement

(4) Enquire how management intends to address the matter in the financial statements where appropriate

A.1 and 2

B.1 and 4

C.2 and 3

D.3 and 4

Which of the following audit procedures should be performed to form. a conclusion as to whether the financial statements require amendment in relation to the unfair dismissal claim?

(1) Inspect relevant correspondence with Sampson Co’s lawyers

(2) Write to the finance director to confirm the claim and level of damages

(3) Review the post year-end cash book for evidence of payments to the finance director

(4) Request that management confirm their views in a written representation

A.1, 2 and 3

B.1, 2 and 4

C.1, 3 and 4

D.2, 3 and 4

You are drafting the auditor’s report for Sampson Co and the audit engagement partner has reminded you that the report will need to reflect the requirements of ISA 701 Communicating Key Audit Matters in the Independent Auditor’s Report.

According to ISA 701, which of the following should be included in the ‘Key Audit Matters’ paragraph in the auditor’s report?

A.Matters which required significant auditor attention

B.Matters which result in a modification to the audit opinion

C.All matters which were communicated to those charged with governance

D.All matters which are considered to be material to the financial statements

Which of the following audit opinions will be issued if the unfair dismissal case is NOT adjusted for or disclosed within the financial statements?

A.A qualified audit opinion as the financial statements are materially misstated

B.A qualified audit opinion as the auditor is unable to obtain sufficient appropriate evidence

C.An unmodified opinion with an emphasis of matter paragraph

D.An unmodified audit opinion

请帮忙给出每个问题的正确答案和分析,谢谢!

更多“The following scenario relates to questions 6–10You are an audit manager at Blenkin &”相关的问题

更多“The following scenario relates to questions 6–10You are an audit manager at Blenkin &”相关的问题

第1题

The following scenario relates to questions 1–5

You are an audit senior of Viola & Co and are currently conducting the audit of Poppy Co for the year ended 30 June 20X6.

Materiality has been set at $50,000, and you are carrying out the detailed substantive testing on the year-end payables balance. The audit manager has emphasised that understatement of the trade payables balance is a significant audit risk.

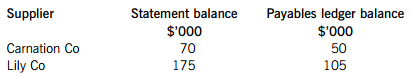

Below is an extract from the list of supplier statements as at 30 June 20X6 held by the company and corresponding payables ledger balances at the same date along with some commentary on the noted differences:

Carnation Co

The difference in the balance is due to an invoice which is under dispute due to faulty goods which were returned on 29 June 20X6.

Lily Co

The difference in the balance is due to the supplier statement showing an invoice dated 28 June 20X6 for $70,000 which was not recorded in the financial statements until after the year end. The payables clerk has advised the audit team that the invoice was not received until 2 July 20X6.

The audit manager has asked you to review the full list of trade payables and select balances on which supplier statement reconciliations will be performed.

Which of the following items should you select for testing?

(1) Suppliers with material balances at the year end

(2) Suppliers which have a high volume of business with Poppy Co

(3) Major suppliers with nil balances at the year end

(4) Major suppliers where the statement agrees to the ledger

A.1 only

B.1, 2 and 3 only

C.2 and 4 only

D.1, 2, 3 and 4

Which of the following audit procedures should be performed in relation to the balance with Lily Co to determine if the payables balance is understated?

A.Inspect the goods received note to determine when the goods were received

B.Inspect the purchase order to confirm it is dated before the year end

C.Review the post year-end cashbook for evidence of payment of the invoice

D.Send a confirmation request to Lily Co to confirm the outstanding balance

Which of the following audit procedures should be carried out to confirm the balance owing to Carnation Co?

(1) Review post year-end credit notes for evidence of acceptance of return

(2) Inspect pre year-end goods returned note in respect of the items sent back to the supplier

(3) Inspect post year-end cash book for evidence that the amount has been settled

A.1, 2 and 3

B.1 and 3 only

C.1 and 2 only

D.2 and 3 only

The audit manager has asked you to review the results of some statistical sampling testing, which resulted in 20% of the payables balance being tested.

The testing results indicate that there is a $45,000 error in the sample: $20,000 which is due to invoices not being recorded in the correct period as a result of weak controls and additionally there is a one-off error of $25,000 which was made by a temporary clerk.

What would be an appropriate course of action on the basis of these results?

A.The error is immaterial and therefore no further work is required

B.The effect of the control error should be projected across the whole population

C.Poppy Co should be asked to adjust the payables figure by $45,000

D.A different sample should be selected as these results are not reflective of the population

To help improve audit efficiency, Viola & Co is considering introducing the use of computer assisted audit techniques (CAATs) for some audits. You have been asked to consider how CAATs could be used during the audit of Poppy Co.

Which of the following is an example of using test data for trade payables testing?

A.Selecting a sample of supplier balances for testing using monetary unit sampling

B.Recalculating the ageing of trade payables to identify balances which may be in dispute

C.Calculation of trade payables days to use in analytical procedures

D.Inputting dummy purchase invoices into the client system to see if processed correctly

请帮忙给出每个问题的正确答案和分析,谢谢!

第2题

(a) Define audit risk and the components of audit risk. (5 marks)

You are an audit supervisor of Amethyst & Co and are currently planning the audit of your client, Aquamarine Co (Aquamarine) which manufactures elevators. Its year end is 31 July 2016 and the forecast profit before tax is $15·2 million.

The company undertakes continuous production in its factory, therefore at the year end it is anticipated that work in progress will be approximately $950,000. In order to improve the manufacturing process, Aquamarine placed an order in April for $720,000 of new plant and machinery; one third of this order was received in May with the remainder expected to be delivered by the supplier in late July or early August.

At the beginning of the year, Aquamarine purchased a patent for $1·3 million which gives them the exclusive right to manufacture specialised elevator equipment for five years. In order to finance this purchase, Aquamarine borrowed $1·2 million from the bank which is repayable over five years.

In January 2016 Aquamarine outsourced its payroll processing to an external service organisation, Coral Payrolls Co (Coral). Coral handles all elements of the payroll cycle and sends monthly reports to Aquamarine detailing the payroll costs. Aquamarine ran its own payroll until 31 December 2015, at which point the records were transferred over to Coral.

The company has a policy of revaluing land and buildings and the finance director has announced that all land and buildings will be revalued at the year end. During a review of the management accounts for the month of May 2016, you have noticed that receivables have increased significantly on the previous year end and against May 2015.

The finance director has informed you that the company is planning to make approximately 65 employees redundant after the year end. No decision has been made as to when this will be announced, but it is likely to be prior to the year end.

Required:

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Aquamarine Co. (12 marks)

(c) Explain the additional factors Amethyst & Co should consider during the audit in relation to Aquamarine Co’s use of the payroll service organisation. (3 marks)

第3题

ntory system documentation for your audit client, Lemon Quartz Co (Quartz) which manufactures computer equipment. The company’s factory and warehouse are based on one large site, and their year end is 30 June 2016. Quartz is planning to undertake a full inventory count at the year end of its raw materials, work in progress and finished goods and you will be attending this count. In preparation you have been reviewing the inventory count instructions for finished goods provided by Quartz.

The count will be undertaken by 15 teams of two counters from the warehouse department with Quartz’s financial controller providing overall supervision. Each team of two is allocated a number of bays within the warehouse to count and they are provided with sequentially numbered inventory sheets which contain product codes and quantities extracted from the inventory records. The counters move through each allocated bay counting the inventory and confirming that it agrees with the inventory sheets. Where a discrepancy is found, they note this on the sheet.

The warehouse is large and approximately 10% of the bays have been rented out to third parties with similar operations; these are scattered throughout the warehouse. For completeness, the counters have been asked to count the inventory for all bays noting the third party inventories on separate blank inventory sheets, and the finance department will make any necessary adjustments.

Some of Quartz’s finished goods are high in value and are stored in a locked area of the warehouse and all the counting teams will be given the code to access this area. There will be no despatches of inventory during the count and it is not anticipated that there will be any deliveries from suppliers.

Each area is counted once by the allocated team; the sheets are completed in ink, signed by the team and returned after each bay is counted. As no two teams are allocated the same bays, there will be no need to flag that an area has been counted. On completion of the count, the financial controller will confirm with each team that they have returned their inventory sheets.

Required:

(a) In respect of the inventory count procedures for Lemon Quartz Co:

(i) Identify and explain FIVE deficiencies;

(ii) Recommend a control to address each of these deficiencies; and

(iii) Describe a TEST OF CONTROL the external auditors would perform. to assess if each of these controls, if implemented, is operating effectively.

Note: The total marks will be split equally between each part. (15 marks)

(b) Quartz’s finance director has asked your firm to undertake a non-audit assurance engagement later in the year. The audit junior has not been involved in such an assignment before and has asked you to explain what an assurance engagement involves.

Required:

Explain the five elements of an assurance engagement. (5 marks)

第4题

dit supervisor of Jasper & Co and are currently preparing the audit programmes for the audit of Kyanite’s financial statements for the year ended 31 March 2016. You are reviewing the notes of last week’s meeting between the audit manager and finance director where two material issues were discussed.

(i) Property, plant and equipment

In the past Kyanite has received negative press reports over the condition of its fast food restaurants, with comments suggesting they are old fashioned and tired looking. Therefore during the year the company undertook a full review of all its assets and carried out extensive refurbishments to the majority of its restaurants. This review resulted in a significant amount of ageing fixtures and fittings being disposed of and a significant amount of capital expenditure was invested in all remaining restaurants. (6 marks)

(ii) Equity The refurbishment was financed via a share issue in April 2015 at a premium of $1·6 million. (4 marks)

Required:

Describe substantive procedures you should perform. to obtain sufficient and appropriate audit evidence in relation to the above two matters.

Note: The mark allocation is shown against each of the two matters above.

第5题

ses and three distribution depots spread across North America. The audit for the year ended 31 December 2015 is almost complete and the financial statements and audit report are due to be signed shortly. Profit before taxation is $7·9 million. The following events have occurred subsequent to the year end and no amendments or disclosures have been made in the financial statements.

Event 1 – Fire

On 15 February 2016, a fire occurred at the largest of the distribution depots. The fire resulted in extensive damage to 40% of the company’s vehicles used for dispatching goods to customers; however, there have been no significant delays to customer deliveries. The company estimates the level of damage to the vehicles to be in excess of $650,000. Only a minimal level of inventory, approximately $25,000, was damaged. Grain’s insurance company has started to investigate the fire to assess the likelihood and level of payment, however, there are concerns the fire was started deliberately, and if true, would invalidate any insurance cover.

Event 2 – Inventory

On 18 February 2016, it was discovered that a large batch of Grain’s new cereal brand ‘Loopy Green Loops’ held in inventory at the year end was defective, as the cereal contained too much green food colouring. To date no sales of this new cereal have been made. The cost of the defective batch of inventory is $915,000 and the defects cannot be corrected. However, the scrapped cereal can be utilised as a raw material for an alternative cereal brand at a value of $50,000.

Required:

For each of the two subsequent events described above:

(i) Based on the information provided, explain whether the financial statements require amendment; and

(ii) Describe audit procedures which should now be performed in order to form. a conclusion on any required amendment.

Note: The total marks will be split equally between each event.

第6题

(i) Describe FIVE types of procedures for obtaining audit evidence; and

(ii) For each type of procedure, describe an example relevant to the audit of BANK balances.

Note: The total marks will be split equally between each part. (10 marks)

第7题

(a) Explain FOUR factors which influence the reliability of audit evidence. (4 marks)

Andromeda Industries Co (Andromeda) develops and manufactures a wide range of fast moving consumer goods. The company’s year end is 31 December 2015 and the forecast profit before tax is $8·3 million. You are the audit manager of Neptune & Co and the year-end audit is due to commence in January. The following information has been gathered during the planning process:

Inventory count

Andromeda’s raw materials and finished goods inventory are stored in 12 warehouses across the country. Each of these warehouses is expected to contain material levels of inventory at the year end. It is expected that there will be no significant work in progress held at any of the sites. Each count will be supervised by a member of Andromeda’s internal audit department and the counts will all take place on 31 December, when all movements of goods in and out of the warehouses will cease.

Research and development

Andromeda spends over $2 million annually on developing new product lines. This year it incurred expenditure on five projects, all of which are at different stages of development. Once they meet the recognition criteria under IAS 38 Intangible Assets for development expenditure, Andromeda includes the costs incurred within intangible assets. Once production commences, the intangible assets are amortised on a straight line basis over five years.

Required:

(b) Describe audit procedures you would perform. during the audit of Andromeda Industries Co:

(i) BEFORE and DURING the inventory counts; and (8 marks)

(ii) In relation to research and development expenditure. (4 marks)

(c) During the audit, the team discovers that one of the five development projects, valued at $980,000 and included within intangible assets, does not meet the criteria for capitalisation. The finance director does not intend to change the accounting treatment adopted as she considers this an immaterial amount.

Required:

Discuss the issue and describe the impact on the audit report, if any, if the issue remains unresolved. (4 marks)

第8题

s testing completed on the payroll cycle of Bronze Industries Co (Bronze), as well as preparing the audit programmes for the final audit.

Bronze operate several chemical processing factories across the country, it manufactures 24 hours a day, seven days a week and employees work a standard shift of eight hours and are paid for hours worked at an hourly rate. Factory employees are paid weekly, with approximately 80% being paid by bank transfer and 20% in cash; the different payment methods are due to employee preferences and Bronze has no plans to change these methods. The administration and sales teams are paid monthly by bank transfer.

Factory staff are each issued a sequentially numbered clock card which details their employee number and name. Employees swipe their cards at the beginning and end of the eight-hour shift and this process is not supervised. During the shift employees are entitled to a 30-minute paid break and employees do not need to clock out to access the dining area. Clock card data links into the payroll system, which automatically calculates gross and net pay along with any statutory deductions. The payroll supervisor for each payment run checks on a sample basis some of these calculations to ensure the system is operating effectively.

Bronze has a human resources department which is responsible for setting up new permanent employees and leavers. Appointments of temporary staff are made by factory production supervisors. Occasionally overtime is required of factory staff, usually to fill gaps caused by staff holidays. Overtime reports which detail the amount of overtime worked are sent out quarterly by the payroll department to production supervisors for their review.

To encourage staff to attend work on time for all shifts Bronze pays a discretionary bonus every six months to factory staff; the production supervisors determine the amounts to be paid. This is communicated in writing by the production supervisors to the payroll department and the bonus is input by a clerk into the system.

For employees paid by bank transfer, the payroll manager reviews the list of the payments and agrees to the payroll records prior to authorising the bank payment. If any changes are required, the payroll manager amends the records. For employees paid in cash, the pay packets are prepared in the payroll department and a clerk distributes them to employees; as she knows most of these individuals she does not require proof of identity.

Required:

(a) Identify and explain FIVE internal control STRENGTHS in Bronze Industries Co’s payroll system. (5 marks)

(b) Identify and explain SIX internal control DEFICIENCIES in Bronze Industries Co’s payroll system and provide a RECOMMENDATION to address each of these deficiencies. (12 marks)

(c) Describe substantive ANALYTICAL PROCEDURES you should perform. to confirm Bronze Industries Co’s payroll expense. (3 marks)

第9题

client, Venus Magnets Co (Venus) which manufactures decorative magnets. Its year end is 31 December 2015 and the forecast profit before tax is $9·6 million.

During the year, the directors reviewed the useful lives and depreciation rates of all classes of plant and machinery. This resulted in an overall increase in the asset lives and a reduction in the depreciation charge for the year.

Inventory is held in five warehouses and on 28 and 29 December a full inventory count will be held with adjustments for movements to the year end. This is due to a lack of available staff on 31 December. In October, there was a fire in one of the warehouses; inventory of $0·9 million was damaged and this has been written down to its scrap value of $0·2 million. An insurance claim has been submitted for the difference of $0·7 million. Venus is still waiting to hear from the insurance company with regards to this claim, but has included the insurance proceeds within the statement of profit or loss and the statement of financial position.

The finance director has informed the audit manager that the October and November bank reconciliations each contained unreconciled differences; however, he considers the overall differences involved to be immaterial.

A directors’ bonus scheme was introduced during the year which is based on achieving a target profit before tax. In order to finalise the bonus figures, the finance director of Venus would like the audit to commence earlier so that the final results are available earlier this year.

Required:

Describe FIVE audit risks, and explain the auditor’s response to each risk, in planning the audit of Venus Magnets Co.

第10题

the company has a diverse customer base but seven significant customers. The company’s year end was 30 September 2015.

During the year, a number of the company’s significant customers have experienced a fall in sales, and consequently they have purchased fewer items from Mercury. As a result, Mercury has paid a number of its suppliers later than usual and some of them have withdrawn credit terms meaning the company must pay cash on delivery. One of Mercury’s main suppliers is threatening legal action to recover the sums owing. As a result of the increased level of payables, the company’s current ratio has fallen below 1 to 0·9 for the first time.

Mercury has produced a cash flow forecast to 30 June 2016 and this shows net cash outflows until May 2016. Mercury has a loan of $2·3 million which is due for repayment in full by 30 September 2016.

The finance director has just informed the audit manager that there is a possible change in legislation which will result in one of Mercury’s top product lines becoming obsolete as it will not comply with the proposed law. The prepared cash flow forecasts do not reflect this possible event.

Required:

(a) Explain FIVE potential indicators that Mercury Motoring Co is NOT a going concern. (5 marks)

(b) Describe the audit procedures which you should perform. in assessing whether or not Mercury Motoring Co is a going concern. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!