重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Eva’s income tax liability and class 4 national insurance contributions (NIC) for the tax year 2015–16 are £4,840. Her income tax liability and class 4 NICs for the tax year 2014–15 were £6,360.

What is the lowest amount to which Eva could make a claim to reduce each of her payments on account for the tax year 2015–16 without being charged interest?

A.£4,840

B.£0

C.£3,180

D.£2,420

更多“Eva’s income tax liability and class 4 national insurance contributions (NIC) for the tax”相关的问题

更多“Eva’s income tax liability and class 4 national insurance contributions (NIC) for the tax”相关的问题

第2题

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

第3题

第4题

Young people from poorer families needn't file their income tax forms

A.Right

B.Wrong

C.Not mentioned

第5题

A.The amount of money citizens spend on products subject to the state tax tends to be equal across income levels.

B.The federal income tax favors citizens with high incomes, whereas the state sales tax favors citizens with low incomes.

C.Citizens with low annual incomes can afford to pay a relatively higher percentage of their incomes in state sales tax, since their federal income tax is relatively low.

D.The lower a state"s sales tax, the more it will tend to redistribute income from the more affluent citizens to the rest of society.

E.Citizens who fail to earn federally taxable income are also exempt from the state sales tax.

第7题

A.A.Right

B.B.Wrong

C.C.Not mentioned

第8题

?Look at the statements below and at the five extracts about taxes.

?Which extract(A,B,C,D or E)does each statement(1-8)refer to?

?For each statement(1-8),mark one letter(A,B,C,D or E)on your Answer Sheet.

?You Will need to use some of these letters more than once.

A.Flat Tax

Income tax is a direct tax which is levied on the income of private individuals.There are various income tax systems that exist.ranging frOm a flat tax to an extensive progressive tax systern.

A flat tax,also cal led a proportional tax,is a system that taxes.Usual ly the flat tax is proposed to k ick in at a certain income level,or to exempt income below that level,so that the lowest-income members of society don't need to pay income tax.

Proposed flat taxes usually allow little or no exemption of earned income besides the bottom-level exemption.

Advocates of a flat tax claim that it will end unfair discrimination.They also argue that flat taxes are easier(and cheaper)to administer and comply with than complex,graduated taxes.Most political parties that advocate the introduction of a flat tax are on the right of the pol itical spectrum.

B.Progressive Tax

A progressive tax,or graduated tax,is a tax that is larger as a percentage of income for those with larger incomes.It is usually applied in reference to income taxes,where people with more income pay a higher percentage of it in taxes.The term progressive refers to the way the rate progresses from low to high.

C.Regressive Tax

A regressive tax is a tax which takes a larger percentage of income from people whose income is low. A tax which places placesonately more of a burden on those with lower incomes.

Regressive taxes,as opposed to progressive taxes,are more burdensome on lower-income individuals than on higher-income individuals and corporations.

D.Tax Deduction

Within the United States'income tax system,a tax deduction,or" tax-deductible expense" ,is an item which is subtracted from gross income in order to arrive at the taxable income.

Effectively,the taxpayer pays no income tax on the amount of money he spent on tax-deductible expenses.For example.if an individual earns$50,000 in a year and gives $5,000 to tax-deductible charities,he will end up paying income tax as though he had earned only$45,000 that year.In this way,the federal and state governments encourage certain types of spending.

E.Tax Avoidance and Tax Evasion

Tax avoidance is the legal exploitation of the tax regime to one's own advantage,to attempt to reduce the amount of tax that is payable by means that are within the law whilst making a full disclosure of the materialinformation to the tax authorities.

Tax evasion,on the other hand,is a crime.Tax evasion usually entails taxpayers deliberately misrepresenting or concealing the true state of their affairs to the tax authorities to reduce their tax liability,and includes,in particular,dishonest tax reporting,such as under-declared income,profits or gains;or overstated deductions.

In the U.S.if you donate 10,000 dollars to some charity organization,you can take that sum away from your total income when you pay income tax.

第9题

A、reducing savings.

B、increasing deductions on their income tax

C、reducing cash holdings.

D、None of the above is correct

第10题

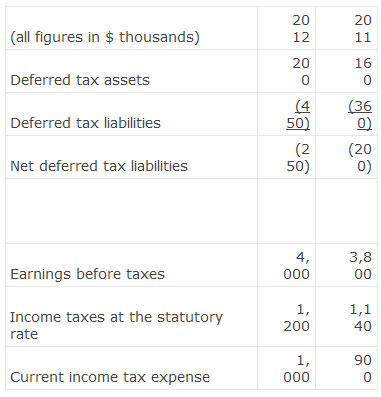

The following information is available about a company:

The company’s 2012 income tax expense (in thousands) is closest to:

A. $1,000.

B. $1,050.

C. $1,250.

第11题

The federal government gets most of their income from______.

A.property tax

B.income tax

C.sales tax

D.estate tax

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!