重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

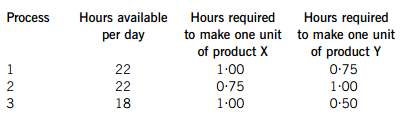

The table below details the process times per product and daily time available:

Daily demand for product X and product Y is 10 units and 16 units respectively.

Which of the following will improve throughput?

A.Increasing the efficiency of the maintenance routine for Process 2

B.Increasing the demand for both products

C.Reducing the time taken for rest breaks on Process 3

D.Reducing the time product X requires for Process 1

更多“A manufacturing company uses three processes to make its two products, X and Y. The time a”相关的问题

更多“A manufacturing company uses three processes to make its two products, X and Y. The time a”相关的问题

第1题

s of $190,000. However, the bookkeeper forgot to account for the following:

A machine with a net book value of $40,000 was sold at the start of the year for $50,000 and replaced with a machine costing $250,000. Both the purchase and sale are cash transactions. No depreciation is charged in the year of purchase or disposal. The investment centre calculates return on investment (ROI) based on closing net assets.

Assuming no other changes to profit or net assets, what is the return on investment (ROI) for the year?

A.18·8%

B.19·8%

C.15·1%

D.15·9%

第2题

actors. One of the chosen methods is the percentage of students passing five exams or more.

Which of the three Es in the value for money framework is being measured here?

A.Economy

B.Efficiency

C.Effectiveness

D.Expertise

第3题

Which of the following is NOT likely to be a potential benefit of introducing this system?

A.Schedules of labour are prepared for manufacturing

B.Inventory records are updated automatically

C.Sales are recorded into the financial ledgers

D.Critical strategic information can be summarised

第4题

works outside of the department. There are many other government departments working within the same building.

Which of the following would NOT be an effective control procedure for the generation and distribution of the information within the government department?

A.If working from home, departmental employees must use a memory stick to transfer data, as laptop computers are not allowed to leave the department

B.All departmental employees must enter non-disclosed and regularly updated passwords to access their computers

C.All authorised employees must swipe an officially issued, personal identity card at the entrance to the department before they can gain access

D.All hard copies of confidential information must be shredded at the end of each day or locked overnight in a safe if needed again

第5题

Which of the following techniques is NOT relevant to target costing?

A.Value analysis

B.Variance analysis

C.Functional analysis

D.Activity analysis

第6题

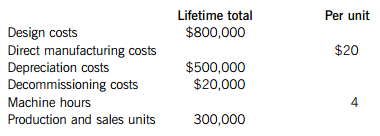

life-cycle of a new product, P. The information in the following table relates exclusively to product P:

The company’s total fixed production overheads are budgeted to be $72 million each year and total machine hours are budgeted to be 96 million hours. The company absorbs overheads on a machine hour basis.

What is the budgeted life-cycle cost per unit for product P?

A.$24·40

B.$25·73

C.$27·40

D.$22·73

第7题

is split into two divisions: Division F and Division N. Each division operates separately as an investment centre, with each one having full control over its non-current assets. In addition, both divisions are responsible for their own current assets, controlling their own levels of inventory and cash and having full responsibility for the credit terms granted to customers and the collection of receivables balances. Similarly, each division has full responsibility for its current liabilities and deals directly with its own suppliers.

Each divisional manager is paid a salary of $120,000 per annum plus an annual performance-related bonus, based on the return on investment (ROI) achieved by their division for the year. Each divisional manager is expected to achieve a minimum ROI for their division of 10% per annum. If a manager only meets the 10% target, they are not awarded a bonus. However, for each whole percentage point above 10% which the division achieves for the year, a bonus equivalent to 2% of annual salary is paid, subject to a maximum bonus equivalent to 30% of annual salary.

The following figures relate to the year ended 31 August 2015:

During the year ending 31 August 2015, Division N invested $6·8m in new equipment including a technologically advanced cutting machine, which is expected to increase productivity by 8% per annum. Division F has made no investment during the year, although its computer system is badly in need of updating. Division F’s manager has said that he has already had to delay payments to suppliers (i.e. accounts payables) because of limited cash and the computer system ‘will just have to wait’, although the cash balance at Division F is still better than that of Division N.

Required:

(a) For each division, for the year ended 31 August 2015, calculate the appropriate closing return on investment (ROI) on which the payment of management bonuses will be based. Briefly justify the figures used in your calculations. Note: There are 3 marks available for calculations and 2 marks available for discussion. (5 marks)

(b) Based on your calculations in part (a), calculate each manager’s bonus for the year ended 31 August 2015. (3 marks)

(c) Discuss whether ROI is providing a fair basis for calculating the managers’ bonuses and the problems arising from its use at CIM Co for the year ended 31 August 2015. (7 marks)

第8题

) and rowing machines (R). The budgeted sales prices and volumes for the next year are as follows:

Labour costs are 60% fixed and 40% variable. General fixed overheads excluding any fixed labour costs are expected to be $55,000 for the next year.

Required:

(a) Calculate the weighted average contribution to sales ratio for Cardio Co. (4 marks)

(b) Calculate the margin of safety in $ revenue for Cardio Co. (3 marks)

(c) Using the graph paper provided and assuming that the products are sold in a CONSTANT MIX, draw a multi-product breakeven chart for Cardio Co. Label fully both axes, any lines drawn on the graph and the breakeven point. (6 marks)

(d) Explain what would happen to the breakeven point if the products were sold in order of the most profitable products first.

Note: You are NOT required to demonstrate this on the graph drawn in part (c). (2 marks)

第9题

production process begins with workers weighing out ingredients on electronic scales and then placing them in a machine for mixing. A worker then manually removes the mix from the machine and shapes it into loaves by hand, after which the bread is then placed into the oven for baking.

All baked loaves are then inspected by OBC’s quality inspector before they are packaged up and made ready for sale. Any loaves which fail the inspection are donated to a local food bank.

The standard cost card for OBC’s ‘Mixed Bloomer’, one of its most popular loaves, is as follows:

Budgeted production of Mixed Bloomers was 1,000 units for the quarter, although actual production was only 950 units. The total actual quantities used and their actual costs were:

Required:

(a) Calculate the total material mix variance and the total material yield variance for OBC for the last quarter. (7 marks)

(b) Using the information in the question, suggest THREE possible reasons why an ADVERSE MATERIAL YIELD variance could arise at OBC. (3 marks)

第10题

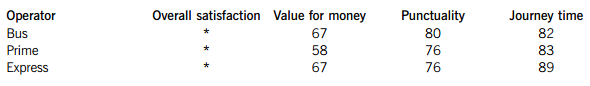

Bus Co is a large bus operator, operating long-distance bus services across the country. There are two other national operators in the country. Bus Co’s mission is to ‘be the market leader in long-distance transport providing a greener, cleaner service for passengers nationwide’. Last month, an independent survey of 40,000 passengers was carried out, the results of which are shown in the table below:

Table: Bus passenger satisfaction % by national operator

* denotes that the percentage has not yet been calculated.

The ‘overall satisfaction’ percentages, which have not yet been inserted into the table, are calculated using a weighted average which reflects the importance customers place on each of the other three criteria above. The weightings used are as follows:

The managing director (MD) of Bus Co has said: ‘Independent research has shown that our customers are the most satisfied of any national bus operator. We are now leading the way on what matters most to customers – value for money and punctuality.’

Required:

(a) Calculate the ‘overall satisfaction’ percentage for each operator. (2 marks)

(b) Taking into account all the data in the table and your calculations from part (a), discuss whether the managing director’s statement is true. (4 marks)

(c) When measuring performance using a ‘value for money’ approach, the criteria of economy, efficiency and effectiveness can be used.

Required:

Briefly define ‘efficiency’ and ‘effectiveness’ and suggest one performance measure for EACH, which would help Bus Co assess the efficiency and effectiveness of the service it provides. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!