重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section A暂缺

Section B – ALL FIVE questions are compulsory and MUST be attempted

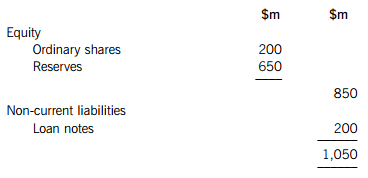

Gemlo Co is a company listed on a large stock market. Extracts from its current statement of financial position are as follows:

Gemlo Co is planning an expansion of existing business operations costing $10 million in the near future and is assessing its current financial position as part of preparing a business case in support of seeking new finance. The business expansion is expected to increase the profit before interest and tax of Gemlo Co by 20% in the first year.

The planned business expansion by Gemlo Co has already been announced to the stock market. Information on the expected increase in profit before interest and tax has not yet been announced and the company has not decided on how the expansion is to be financed.

The ordinary shares of the company are currently trading at $3·75 per share on an ex dividend basis. The irredeemable loan notes have a cost of debt of 7%. The 7% loan notes have a cost of debt of 6% and will be redeemed at a 5% premium to nominal value after seven years. The interest cover of Gemlo Co is 6 times.

Companies operating in the same business sector as Gemlo Co have an average debt/equity ratio of 40% on a market value basis and an average interest cover of 9 times.

Required:

(a) Calculate the debt/equity ratio of Gemlo Co based on market values and comment on your findings. (4 marks)

(b) Gemlo Co agrees with a bank that its business expansion will be financed by a new issue of 8% loan notes. The company then announces to the stock market both this financing decision and the expected increase in profit before interest and tax arising from the business expansion. Required:

Assuming the stock market is semi-strong form. efficient, analyse and discuss the effect of the financing and profitability announcement on the financial risk and share price of Gemlo Co. Note: Up to 2 marks for relevant calculations. (6 marks)

更多“Section A暂缺Section B – ALL FIVE questions are compulsory and MUST be attemptedGemlo Co i”相关的问题

更多“Section A暂缺Section B – ALL FIVE questions are compulsory and MUST be attemptedGemlo Co i”相关的问题

第1题

n preparation for this the company has decided to calculate its weighted average cost of capital. Tinep Co has the following capital structure:

The ordinary shares of Tinep Co have a nominal value of 50 cents per share and are currently trading on the stock market on an ex dividend basis at $5·85 per share. Tinep Co has an equity beta of 1·15.

The loan notes have a nominal value of $100 and are currently trading on the stock market on an ex interest basis at $103·50 per loan note. The interest on the loan notes is 6% per year before tax and they will be redeemed in six years’ time at a 6% premium to their nominal value.

The risk-free rate of return is 4% per year and the equity risk premium is 6% per year. Tinep Co pays corporation tax at an annual rate of 25% per year.

Required:

(a) Calculate the market value weighted average cost of capital and the book value weighted average cost of capital of Tinep Co, and comment briefly on any difference between the two values. (9 marks)

(b) Discuss the factors to be considered by Tinep Co in choosing to raise funds via a rights issue. (6 marks)

第2题

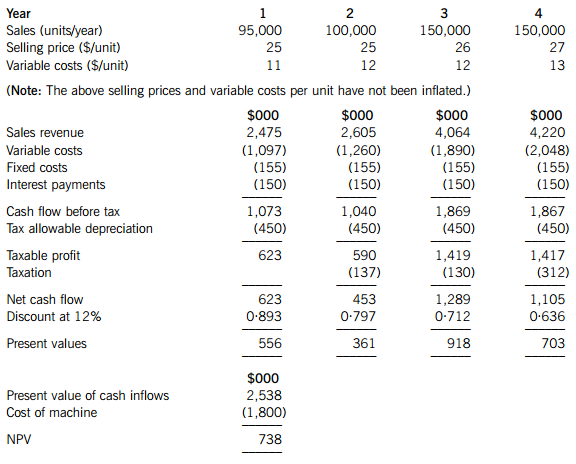

evaluating an investment proposal to manufacture Product K3J. The initial investment of $1,800,000 will be payable at the start of the first year of operation. The following draft evaluation has been prepared by a junior employee.

The junior employee also provided the following information:

1. Relevant fixed costs are forecast to be $150,000 per year.

2. Sales and production volumes are the same and no finished goods inventory is held.

3. The corporation tax rate is 22% per year and tax liabilities are payable one year in arrears.

4. Uftin Co can claim tax allowable depreciation of 25% per year on a reducing balance basis on the initial investment.

5. A balancing charge or allowance can be claimed at the end of the fourth year.

6. It is expected that selling price inflation will be 4·2% per year, variable cost inflation will be 5% per year and fixed cost inflation will be 3% per year.

7. The investment has no scrap value.

8. The investment will be partly financed by a $1,500,000 loan at 10% per year.

9. Uftin Co has a weighted average cost of capital of 12% per year.

Required:

(a) Prepare a revised draft evaluation of the investment proposal and comment on its financial acceptability. (11 marks)

(b) Explain any TWO revisions you have made to the draft evaluation in part (a) above. (4 marks)

第3题

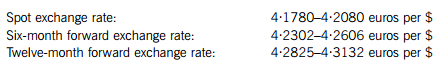

different countries. The company expects to receive €1,200,000 in six months’ time from a foreign customer. Current exchange rates in the home country of PZK Co are as follows:

Required:

(a) Calculate the loss or gain compared to its current dollar value which PZK Co will incur by taking out a forward exchange contract on the future euro receipt, and explain why taking out a forward exchange contract may be preferred by PZK Co to not hedging the future euro receipt. (4 marks)

(b) If the interest rate in the home country of PZK Co is 4% per year, calculate the annual interest rate in the foreign customer’s country implied by the spot exchange rate and the twelve-month forward exchange rate. (2 marks)

(c) Discuss whether PZK Co should avoid exchange rate risk by invoicing foreign customers in dollars. (4 marks)

第4题

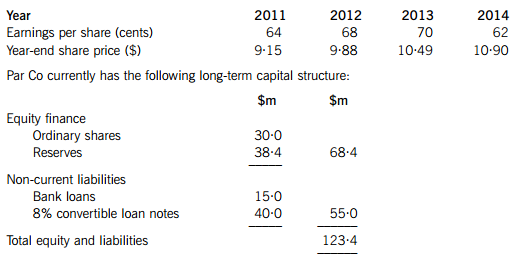

Recent information on the earnings per share and share price of Par Co is as follows:

The 8% loan notes are convertible into eight ordinary shares per loan note in seven years’ time. If not converted, the loan notes can be redeemed on the same future date at their nominal value of $100. Par Co has a cost of debt of 9% per year.

The ordinary shares of Par Co have a nominal value of $1 per share and have been traded on a large stock exchange for many years. Listed companies similar to Par Co have been recently reported to have an average price/earnings ratio of 12 times.

Required:

(a) Calculate the market price of the convertible loan notes of Par Co, commenting on whether conversion is likely. (5 marks)

(b) Calculate the share price of Par Co using the price/earnings ratio method and discuss the problems in using this method of valuing the shares of a company. (5 marks)

第5题

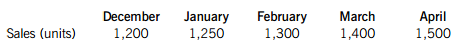

Flit Co is preparing a cash flow forecast for the three-month period from January to the end of March. The following sales volumes have been forecast:

Notes:

1. The selling price per unit is $800 and a selling price increase of 5% will occur in February. Sales are all on one month’s credit.

2. Production of goods for sale takes place one month before sales.

3. Each unit produced requires two units of raw materials, costing $200 per unit. No raw materials inventory is held. Raw material purchases are on one months’ credit.

4. Variable overheads and wages equal to $100 per unit are incurred during production, and paid in the month of production.

5. The opening cash balance at 1 January is expected to be $40,000.

6. A long-term loan of $300,000 will be received at the beginning of March.

7. A machine costing $400,000 will be purchased for cash in March.

Required:

(a) Calculate the cash balance at the end of each month in the three-month period. (5 marks)

(b) Calculate the forecast current ratio at the end of the three-month period. (2 marks)

(c) Assuming that Flit Co expects to have a short-term cash surplus during the three-month period, discuss whether this should be invested in shares listed on a large stock market. (3 marks)

第6题

Which of the following is LEAST likely to fall within financial management?

A.The dividend payment to shareholders is increased

B.Funds are raised to finance an investment project

C.Surplus assets are sold off

D.Non-executive directors are appointed to the remuneration committee

第7题

ments. In terms of capital market efficiency, to which of the following does the investor’s belief relate?

A.Fundamental analysis

B.Operational efficiency

C.Technical analysis

D.Semi-strong form efficiency

第8题

The company has the following targets for the next year:

What is the net investment in working capital required for the next year?

A.$8,125,000

B.$4,375,000

C.$2,875,000

D.$6,375,000

第9题

king capital should increase as sales increase 2 An increase in the cash operating cycle will decrease profitability 3 Overtrading is also known as under-capitalisation

A.1 and 2 only

B.1 and 3 only

C.2 and 3 only

D.1, 2 and 3

第10题

be a solution? 1 Imperfect competition 2 Social costs or externalities 3 Imperfect information

A.1 only

B.1 and 2 only

C.2 and 3 only

D.1, 2 and 3

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!