重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Clarinet Co (Clarinet) is a computer hardware specialist and has been trading for over five years. The company is funded partly through overdrafts and loans and also by several large shareholders; the year end is 30 April 2014.

Clarinet has experienced significant growth in previous years; however, in the current year a new competitor, Drums Design Co (Drums), has entered the market and through competitive pricing has gained considerable market share from Clarinet. One of Clarinet’s larger customers has stopped trading with them and has moved its business to Drums. In addition, a number of Clarinet’s specialist developers have left the company and joined Drums. Clarinet has found it difficult to replace these employees due to the level of their skills and knowledge. Clarinet has just received notification that its main supplier who provides the company with specialist electrical equipment has ceased to trade.

Clarinet is looking to develop new products to differentiate itself from the rest of its competitors. It has approached its shareholders to finance this development; however, they declined to invest further in Clarinet. Clarinet’s loan is long term and it has met all repayments on time. The overdraft has increased significantly over the year and the directors have informed you that the overdraft facility is due for renewal next month, and they are confident it will be renewed.

The directors have produced a cash flow forecast which shows a significantly worsening position over the coming 12 months. They are confident with the new products being developed, and in light of their trading history of significant growth, believe it is unnecessary to make any disclosures in the financial statements regarding going concern.

At the year end, Clarinet received notification from one of its customers that the hardware installed by Clarinet for the customers’ online ordering system has not been operating correctly. As a result, the customer has lost significant revenue and has informed Clarinet that they intend to take legal action against them for loss of earnings. Clarinet has investigated the problem post year end and discovered that other work-in-progress is similarly affected and inventory should be written down. The finance director believes that as this misstatement was identified after the year end, it can be amended in the 2015 financial statements.

Required:

(a) Describe the procedures the auditors of Clarinet Co should undertake in relation to the uncorrected inventory misstatement identified above. (4 marks)

(b) Explain SIX potential indicators that Clarinet Co is not a going concern. (6 marks)

(c) Describe the audit procedures which you should perform. in assessing whether or not Clarinet Co is a going concern. (6 marks)

(d) The auditors have been informed that Clarinet’s bankers will not make a decision on the overdraft facility until after the audit report is completed. The directors have now agreed to include some going concern disclosures.

Required:

Describe the impact on the audit report of Clarinet Co if the auditor believes the company is a going concern but that this is subject to a material uncertainty. (4 marks)

更多“Clarinet Co (Clarinet) is a computer hardware specialist and has been trading for over fiv”相关的问题

更多“Clarinet Co (Clarinet) is a computer hardware specialist and has been trading for over fiv”相关的问题

第1题

as recently become a listed company. In accordance with corporate governance principles Saxophone maintains a small internal audit department. The directors feel that the team needs to increase in size and specialist skills are required, but they are unsure whether to recruit more internal auditors, or to outsource the whole function to their external auditors, Cello & Co.

Saxophone is required to comply with corporate governance principles in order to maintain its listed status; hence the finance director has undertaken a review of whether or not the company complies.

Bill Bassoon is the chairman of Saxophone, until last year he was the chief executive. Bill is unsure if Saxophone needs more non-executive directors as there are currently three non-executive directors out of the eight board members. He is considering appointing one of his close friends, who is a retired chief executive of a manufacturing company, as a non-executive director.

The finance director, Jessie Oboe, decides on the amount of remuneration each director is paid. Currently all remuneration is in the form. of an annual bonus based on profits. Jessie is considering setting up an audit committee, but has not undertaken this task yet as she is very busy. A new sales director was appointed nine months ago. He has yet to undertake his board training as this is normally provided by the chief executive and this role is currently vacant.

There are a large number of shareholders and therefore the directors believe that it is impractical and too costly to hold an annual general meeting of shareholders. Instead, the board has suggested sending out the financial statements and any voting resolutions by email; shareholders can then vote on the resolutions via email.

Required:

(a) Explain the advantages and disadvantages for each of Saxophone Enterprises Co AND Cello & Co of outsourcing the internal audit department.

Note: The total marks will be split as follows:

Saxophone Enterprises Co (8 marks)

Cello & Co (2 marks) (10 marks)

(b) In respect of the corporate governance of Saxophone Enterprises Co:

(i) Identify and explain FIVE corporate governance weaknesses; and

(ii) Provide a recommendation to address each weakness.

Note: The total marks will be split equally between each part. (10 marks)

第2题

work of stores in countries across Europe. The company’s year end is 30 June 2014. You are the audit senior of Piano & Co. Recorder is a new client and you are currently planning the audit with the audit manager. You have been provided with the following planning notes from the audit partner following his meeting with the finance director.

Recorder purchases goods from a supplier in South Asia and these goods are shipped to the company’s central warehouse. The goods are usually in transit for two weeks and the company correctly records the goods when received. Recorder does not undertake a year-end inventory count, but carries out monthly continuous (perpetual) inventory counts and any errors identified are adjusted in the inventory system for that month.

During the year the company introduced a bonus based on sales for its sales persons. The bonus target was based on increasing the number of customers signing up for 24-month phone line contracts. This has been successful and revenue has increased by 15%, especially in the last few months of the year. The level of receivables is considerably higher than last year and there are concerns about the creditworthiness of some customers.

Recorder has a policy of revaluing its land and buildings and this year has updated the valuations of all land and buildings.

During the year the directors have each been paid a significant bonus, and they have included this within wages and salaries. Separate disclosure of the bonus is required by local legislation.

Required:

(a) Describe FIVE audit risks, and explain the auditor’s response to each risk, in planning the audit of Recorder Communications Co. (10 marks)

(b) Explain the audit procedures you should perform. in order to place reliance on the continuous (perpetual) counts for year-end inventory. (3 marks)

(c) Describe substantive procedures you should perform. to confirm the directors’ bonus payments included in the financial statements. (3 marks)

The finance director of Recorder informed the audit partner that the reason for appointing Piano & Co as auditors was because they audit other mobile phone companies, including Recorder’s main competitor. The finance director has asked how Piano & Co keeps information obtained during the audit confidential.

Required: (d) Explain the safeguards which your firm should implement to ensure that this conflict of interest is properly managed. (4 marks)

第3题

(a) Define the ‘three Es’ of a value for money audit. (3 marks)

(b) ISA 230 Audit Documentation requires auditors to prepare audit documentation for an audit of financial statements on a timely basis.

Required:

Describe FOUR benefits of documenting audit work. (4 marks)

(c) ISA 530 Audit Sampling applies when the auditor has decided to use sampling to obtain sufficient and appropriate audit evidence.

Required:

Define what is meant by ‘audit sampling’ and explain the need for this. (3 marks)

第4题

excess of 250 permanent employees and its year end is 31 August 2014. You are the audit supervisor of Viola & Co and are currently reviewing the documentation of Trombone’s payroll system, detailed below, in preparation for the interim audit.

Trombone’s payroll system

Permanent employees work a standard number of hours per week as specified in their employment contract. However, when the hotels are busy, staff can be requested by management to work additional shifts as overtime. This can either be paid on a monthly basis or taken as days off.

Employees record any overtime worked and days taken off on weekly overtime sheets which are sent to the payroll department. The standard hours per employee are automatically set up in the system and the overtime sheets are entered by clerks into the payroll package, which automatically calculates the gross and net pay along with relevant deductions. These calculations are not checked at all. Wages are increased by the rate of inflation each year and the clerks are responsible for updating the standing data in the payroll system.

Employees are paid on a monthly basis by bank transfer for their contracted weekly hours and for any overtime worked in the previous month. If employees choose to be paid for overtime, authorisation is required by department heads of any overtime in excess of 30% of standard hours. If employees choose instead to take days off, the payroll clerks should check back to the ‘overtime worked’ report; however, this report is not always checked.

The ‘overtime worked’ report, which details any overtime recorded by employees, is run by the payroll department weekly and emailed to department heads for authorisation. The payroll department asks department heads to only report if there are any errors recorded. Department heads are required to arrange for overtime sheets to be authorised by an alternative responsible official if they are away on annual leave; however, there are instances where this arrangement has not occurred.

The payroll package produces a list of payments per employee; this links into the bank system to produce a list of automatic payments. The finance director reviews the total list of bank transfers and compares this to the total amount to be paid per the payroll records; if any issues arise then the automatic bank transfer can be manually changed by the finance director.

Required:

(a) In respect of the payroll system of Trombone Co:

(i) Identify and explain FIVE deficiencies;

(ii) Recommend a control to address each of these deficiencies; and

(iii) Describe a test of control Viola & Co should perform. to assess if each of these controls is operating effectively.

Note: The total marks will be split equally between each part. (15 marks)

(b) Explain the difference between an interim and a final audit. (5 marks)

(c) Describe substantive procedures you should perform. at the final audit to confirm the completeness and accuracy of Trombone Co’s payroll expense. (6 marks)

Trombone deducts employment taxes from its employees’ wages on a monthly basis and pays these to the local taxation authorities in the following month. At the year end the financial statements will contain an accrual for income tax payable on employment income. You will be in charge of auditing this accrual. Required:

(d) Describe the audit procedures required in respect of the year end accrual for tax payable on employment income. (4 marks)

第5题

s)

(b) The directors of a company have provided the external audit firm with an oral representation confirming that the bank overdraft balances included within current liabilities are complete.

Required:

Describe the relevance and reliability of this oral representation as a source of evidence to confirm the completeness of the bank overdraft balances. (3 marks)

(c) You are the audit manager of Violet & Co and you are currently reviewing the audit files for several of your clients for which the audit fieldwork is complete. The audit seniors have raised the following issues:

Daisy Designs Co (Daisy)

Daisy’s year end is 30 September, however, subsequent to the year end the company’s sales ledger has been corrupted by a computer virus. Daisy’s finance director was able to produce the financial statements prior to this occurring; however, the audit team has been unable to access the sales ledger to undertake detailed testing of revenue or year-end receivables. All other accounting records are unaffected and there are no backups available for the sales ledger. Daisy’s revenue is $15·6m, its receivables are $3·4m and profit before tax is $2m.

Fuchsia Enterprises Co (Fuchsia)

Fuchsia has experienced difficult trading conditions and as a result it has lost significant market share. The cash flow forecast has been reviewed during the audit fieldwork and it shows a significant net cash outflow. Management are confident that further funding can be obtained and so have prepared the financial statements on a going concern basis with no additional disclosures; the audit senior is highly sceptical about this. The prior year financial statements showed a profit before tax of $1·2m; however, the current year loss before tax is $4·4m and the forecast net cash outflow for the next 12 months is $3·2m.

Required:

For each of the two issues:

(i) Discuss the issue, including an assessment of whether it is material;

(ii) Recommend procedures the audit team should undertake at the completion stage to try to resolve the issue; and

(iii) Describe the impact on the audit report if the issue remains unresolved.

Notes: 1 The total marks will be split equally between each issue.

2 Audit report extracts are NOT required. (12 marks)

第6题

ode of Ethics and Conduct.

(b) Rose Leisure Club Co (Rose) operates a chain of health and fitness clubs. Its year end was 31 October 2012. You are the audit manager and the year-end audit is due to commence shortly. The following three matters have been brought to your attention.

(i) Trade payables and accruals

Rose’s finance director has notified you that an error occurred in the closing of the purchase ledger at the year end. Rather than it closing on 1 November, it accidentally closed one week earlier on 25 October. All purchase invoices received between 25 October and the year end have been posted to the 2013 year-end purchase ledger.

(ii) Receivables

Rose’s trade receivables have historically been low as most members pay monthly in advance. However, during the year a number of companies have taken up group memberships at Rose and hence the receivables balance is now material. The audit senior has undertaken a receivables circularisation for the balances at the year end; however, there are a number who have not responded and a number of responses with differences.

(iii) Reorganisation

The company recently announced its plans to reorganise its health and fitness clubs. This will involve closing some clubs for refurbishment, retraining some existing staff and disposing of some surplus assets. These plans were agreed at a board meeting in October and announced to their shareholders on 29 October. Rose is proposing to make a reorganisation provision in the financial statements.

Required:

Describe substantive procedures you would perform. to obtain sufficient and appropriate audit evidence in relation to the above three matters.

Note: The mark allocation is shown against each of the three matters above.

第7题

1 December 2012. The audit manager and partner recently attended a planning meeting with the finance director and have provided you with the planning notes below.

You are the audit senior, and this is your first year on this audit. In order to familiarise yourself with Sunflower, the audit manager has asked you to undertake some research in order to gain an understanding of Sunflower, so that you are able to assist in the planning process. He has then asked that you identify relevant audit risks from the notes below and also consider how the team should respond to these risks.

Sunflower has spent $1·6 million in refurbishing all of its supermarkets; as part of this refurbishment programme their central warehouse has been extended and a smaller warehouse, which was only occasionally used, has been disposed of at a profit. In order to finance this refurbishment, a sum of $1·5 million was borrowed from the bank. This is due to be repaid over five years.

The company will be performing a year-end inventory count at the central warehouse as well as at all 25 supermarkets on 31 December. Inventory is valued at selling price less an average profit margin as the finance director believes that this is a close approximation to cost.

Prior to 2012, each of the supermarkets maintained their own financial records and submitted returns monthly to head office. During 2012 all accounting records have been centralised within head office. Therefore at the beginning of the year, each supermarket’s opening balances were transferred into head office’s accounting records. The increased workload at head office has led to some changes in the finance department and in November 2012 the financial controller left. His replacement will start in late December.

Required:

(a) List FIVE sources of information that would be of use in gaining an understanding of Sunflower Stores Co, and for each source describe what you would expect to obtain. (5 marks)

(b) Using the information provided, describe FIVE audit risks and explain the auditor’s response to each risk in planning the audit of Sunflower Stores Co. (10 marks)

(c) The finance director of Sunflower Stores Co is considering establishing an internal audit department. Required: Describe the factors the finance director should consider before establishing an internal audit department. (5 marks)

第8题

financial statements, they are given certain rights.

Required:

State THREE rights of an auditor, excluding those related to resignation and removal. (3 marks)

(b) ISA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment requires auditors to obtain an understanding of control activities relevant to the audit.

Control activities are the policies and procedures that help ensure that management directives are carried out; and which are designed to prevent and detect fraud and error occurring. An example of a control activity is the maintenance of a control account.

Required:

Apart from maintenance of a control account, explain FOUR control activities a company may undertake to prevent and detect fraud and error. (4 marks)

(c) Describe THREE limitations of external audits. (3 marks)

第9题

n facility, where it undertakes continuous production 24 hours a day, seven days a week. Also on this site are two warehouses, where the company’s raw materials and finished goods are stored. Lily’s year end is 31 December.

Lily is finalising the arrangements for the year-end inventory count, which is to be undertaken on 31 December 2012. The finished windows are stored within 20 aisles of the first warehouse. The second warehouse is for large piles of raw materials, such as sand, used in the manufacture of glass. The following arrangements have been made for the inventory count:

The warehouse manager will supervise the count as he is most familiar with the inventory. There will be ten teams of counters and each team will contain two members of staff, one from the finance and one from the manufacturing department. None of the warehouse staff, other than the manager, will be involved in the count.

Each team will count an aisle of finished goods by counting up and then down each aisle. As this process is systematic, it is not felt that the team will need to flag areas once counted. Once the team has finished counting an aisle, they will hand in their sheets and be given a set for another aisle of the warehouse. In addition to the above, to assist with the inventory counting, there will be two teams of counters from the internal audit department and they will perform. inventory counts.

The count sheets are sequentially numbered, and the product codes and descriptions are printed on them but no quantities. If the counters identify any inventory which is not on their sheets, then they are to enter the item on a separate sheet, which is not numbered. Once all counting is complete, the sequence of the sheets is checked and any additional sheets are also handed in at this stage. All sheets are completed in ink.

Any damaged goods identified by the counters will be too heavy to move to a central location, hence they are to be left where they are but the counter is to make a note on the inventory sheets detailing the level of damage.

As Lily undertakes continuous production, there will continue to be movements of raw materials and finished goods in and out of the warehouse during the count. These will be kept to a minimum where possible.

The level of work-in-progress in the manufacturing plant is to be assessed by the warehouse manager. It is likely that this will be an immaterial balance. In addition, the raw materials quantities are to be approximated by measuring the height and width of the raw material piles. In the past this task has been undertaken by a specialist; however, the warehouse manager feels confident that he can perform. this task.

Required:

(a) For the inventory count arrangements of Lily Window Glass Co:

(i) Identify and explain SIX deficiencies; and

(ii) Provide a recommendation to address each deficiency.

The total marks will be split equally between each part (12 marks)

You are the audit senior of Daffodil & Co and are responsible for the audit of inventory for Lily. You will be attending the year-end inventory count on 31 December 2012.

In addition, your manager wishes to utilise computer-assisted audit techniques for the first time for controls and substantive testing in auditing Lily Window Glass Co’s inventory.

Required:

(b) Describe the procedures to be undertaken by the auditor DURING the inventory count of Lily Window Glass Co in order to gain sufficient appropriate audit evidence. (6 marks)

(c) For the audit of the inventory cycle and year-end inventory balance of Lily Window Glass Co:

(i) Describe FOUR audit procedures that could be carried out using computer-assisted audit techniques (CAATS);

(ii) Explain the potential advantages of using CAATs; and

(iii) Explain the potential disadvantages of using CAATs.

The total marks will be split equally between each part (12 marks)

第10题

itor. (3 marks)

You are the audit manager of Kiwi & Co and you have been provided with financial statements extracts and the following information about your client, Strawberry Kitchen Designs Co (Strawberry), who is a kitchen manufacturer. The company’s year end is 30 April 2012.

Strawberry has recently been experiencing trading difficulties, as its major customer who owes $0·6m to Strawberry has ceased trading, and it is unlikely any of this will be received. However the balance is included within the financial statements extracts below. The sales director has recently left Strawberry and has yet to be replaced.

The monthly cash flow has shown a net cash outflow for the last two months of the financial year and is forecast as negative for the forthcoming financial year. As a result of this, the company has been slow in paying its suppliers and some are threatening legal action to recover the sums owing.

Due to its financial difficulties, Strawberry missed a loan repayment and, as a result of this breach in the loan covenants, the bank has asked that the loan of $4·8m be repaid in full within six months. The directors have decided that in order to conserve cash, no final dividend will be paid in 2012.

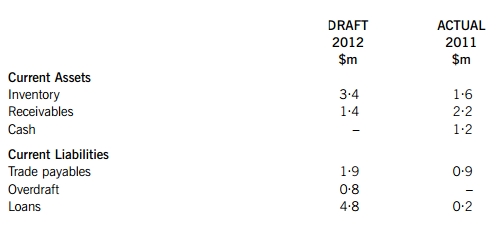

Financial statements extracts for year ended 30 April:

Required:

(b) Explain the potential indicators that Strawberry Kitchen Designs Co is not a going concern. (6 marks)

(c) Describe the audit procedures that you should perform. in assessing whether or not the company is a going concern. (6 marks)

(d) Having performed the going concern audit procedures, you have serious concerns in relation to the going concern status of Strawberry. The finance director has informed you that as the cash flow issues are short term he does not propose to make any amendments to the financial statements.

Required:

(i) State Kiwi & Co’s responsibility for reporting on going concern to the directors of Strawberry Kitchen Designs Co; and (2 marks)

(ii) If the directors refuse to amend the financial statements, describe the impact on the audit report. (3 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!