重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

‘I was alerted yesterday to a fraud being conducted by members of our sales team. It appears that several sales representatives have been claiming reimbursement for fictitious travel and client entertaining expenses and inflating actual expenses incurred. Specifically, it has been alleged that the sales representatives have claimed on expenses for items such as gifts for clients and office supplies which were never actually purchased, claimed for business-class airline tickets but in reality had purchased economy tickets, claimed for non-existent business mileage and used the company credit card to purchase items for personal use.

I am very worried about the scale of this fraud, as travel and client entertainment is one of our biggest expenses. All of the alleged fraudsters have been suspended pending an investigation, which I would like your firm to conduct. We will prosecute these employees to attempt to recoup our losses if evidence shows that a fraud has indeed occurred, so your firm would need to provide an expert witness in the event of a court case. Can we meet tomorrow to discuss this potential assignment?’

Chestnut Co has a small internal audit department and in previous years the evidence obtained by Cedar & Co as part of the external audit has indicated that the control environment of the company is generally good. The audit opinion on the financial statements for the year ended 31 March 2011 was unmodified.

Required:

(a) Assess the ethical and professional issues raised by the request for your firm to investigate the alleged fraudulent activity. (6 marks)

(b) Explain the matters that should be discussed in the meeting with Jack Privet in respect of planning the investigation into the alleged fraudulent activity. (6 marks)

(c) Evaluate the arguments for and against the prohibition of auditors providing non-audit services to audit clients. (6 marks)

更多“You are an audit manager in Cedar & Co, responsible for the audit of Chestnut Co, a la”相关的问题

更多“You are an audit manager in Cedar & Co, responsible for the audit of Chestnut Co, a la”相关的问题

第1题

Section B – TWO questions ONLY to be attempted

You are a manager in the audit department of Beech & Co, responsible for the audits of Fir Co, Spruce Co and Pine Co. Each company has a financial year ended 31 July 2011, and the audits of all companies are nearing completion. The following issues have arisen in relation to the audit of accounting estimates and fair values:

(a) Fir Co

Fir Co is a company involved in energy production. It owns several nuclear power stations, which have a remaining estimated useful life of 20 years. Fir Co intends to decommission the power stations at the end of their useful life and the statement of financial position at 31 July 2011 recognises a material provision in respect of decommissioning costs of $97 million (2010 – $110 million). A brief note to the financial statements discloses the opening and closing value of the provision but no other information is provided.

Required: Comment on the matters that should be considered, and explain the audit evidence you should expect to find in your file review in respect of the decommissioning provision. (8 marks)

(b) Spruce Co

Spruce Co is also involved in energy production. It has a trading division which manages a portfolio of complex financial instruments such as derivatives. The portfolio is material to the financial statements. Due to the specialist nature of these financial instruments, an auditor’s expert was engaged to assist in obtaining sufficient appropriate audit evidence relating to the fair value of the financial instruments. The objectivity, capabilities and competence of the expert were confirmed prior to their engagement.

Required:

Explain the procedures that should be performed in evaluating the adequacy of the auditor’s expert’s work. (5 marks)

(c) Pine Co

Pine Co operates a warehousing and distribution service, and owns 120 properties. During the year ended 31 July 2011, management changed its estimate of the useful life of all properties, extending the life on average by 10 years. The financial statements contain a retrospective adjustment, which increases opening non-current assets and equity by a material amount. Information in respect of the change in estimate has not been disclosed in the notes to the financial statements.

Required:

Identify and explain the potential implications for the auditor’s report of the accounting treatment of the change in accounting estimates. (5 marks)

第2题

ls and stationery to order. It specialises in using 100% recycled paper in its printing, a fact which is promoted heavily in its advertising.

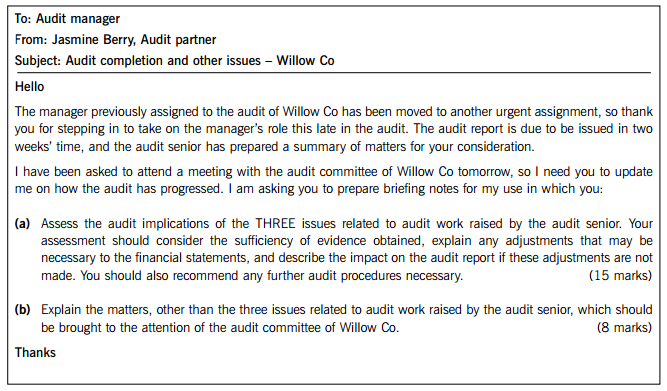

You are a senior audit manager in Bark & Co, and you have just been placed in charge of the audit of Willow Co. The audit for the year ended 31 August 2011 is nearing completion, and the audit engagement partner, Jasmine Berry, has sent you an email:

Summary of issues for manager’s attention, prepared by audit senior

Materiality has been determined as follows:

$800,000 for assets and liabilities

$250,000 for income and expenses

Issues related to audit work performed:

(i) Audit work on inventory

Audit procedures performed at the inventory count indicated that printed inventory items with a value of $130,000 were potentially obsolete. These items were mainly out of date training manuals. The finance director, Cherry Laurel, has not written off this inventory as she argues that the paper on which the items are printed can be recycled and used again in future printing orders. However, the items appear not to be recyclable as they are coated in plastic. The junior who performed the audit work on inventory has requested a written representation from management to confirm that the items can be recycled and no further procedures relevant to these items have been performed.

(ii) Audit work on provisions

Willow Co is involved in a court case with a competitor, Aspen Co, which alleges that a design used in Willow Co’s printed material copies one of Aspen Co’s designs which are protected under copyright. Our evidence obtained is a verbal confirmation from Willow Co’s lawyers that a claim of $125,000 has been made against Willow Co, which is probable to be paid. Cherry Laurel has not made a provision, arguing that it is immaterial. Cherry refused our request to ask the lawyers to confirm their opinion on the matter in writing, saying it is not worth bothering the lawyers again on such a trivial matter.

(iii) Audit work on current assets

Willow Co made a loan of $6,000 to Cherry Laurel, the finance director, on 30 June 2011. The amount is recognised as a current asset. The loan carries an interest rate of 4% which we have confirmed to be the market rate for short-term loans and we have concluded that the loan is an arm’s length transaction. Cherry has provided written confirmation that she intends to repay the loan by 31 March 2012. The only other audit work performed was to agree the cash payment to the cash book. Details of the loan made to Cherry have not been separately disclosed in the financial statements.

Other issues for your attention:

Property revaluations

Willow Co currently adopts an accounting policy of recognising properties at cost. During the audit of non-current assets Willow Co’s property manager said that the company is considering a change of accounting policy so that properties would be recognised at fair value from 1 January 2012.

Non-current asset register

The audit of non-current assets was delayed by a week. We had asked for the non-current asset register reconciliation to be completed by the client prior to commencement of our audit procedures on non-current assets, but it seems that the person responsible for the reconciliation went on holiday having forgotten to prepare the reconciliation. This happened on last year’s audit as well, and the issue was discussed with the audit committee at that time.

Procurement procedures

We found during our testing of trade payables that an approved supplier list is not maintained, and invoices received are not always matched back to goods received notes. This was mentioned to the procurement manager, who said that suppliers are switched fairly often, depending on which supplier is the cheapest, so it would be difficult to maintain an up-to-date approved supplier list.

Financial controller

Mia Fern, Willow Co’s financial controller, owns a holiday home overseas. It appears that she offered the audit team free use of the holiday home for three weeks after the audit, as a reward for the team’s hard work. She also bought lunch for the audit team on most days.

Required:

Respond to the partner’s email. (23 marks)

Note: the split of the mark allocation is shown within the email.

Professional marks will be awarded for the format and clarity of your answer. (2 marks)

第3题

Section A – BOTH questions are compulsory and MUST be attempted

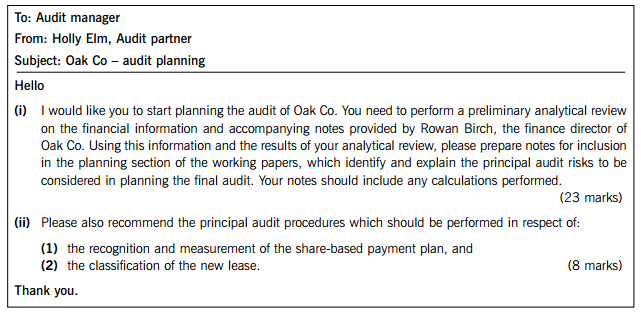

(a) You are a manager in Maple & Co, responsible for the audit of Oak Co, a listed company. Oak Co manufactures electrical appliances such as televisions and radios, which are then sold to retail outlets. You are aware that during the last year, Oak Co lost several customer contracts to overseas competitors. However, a new division has been created to sell its products directly to individual customers via a new website, which was launched on 1 November 2011.

You are about to commence planning the audit for the year ending 31 December 2011, and you have received an email from Holly Elm, the audit engagement partner.

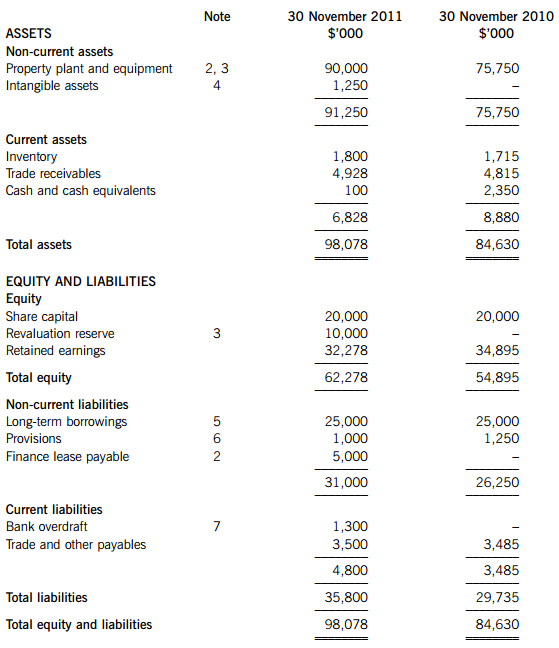

Financial information provided by Rowan Birch:

Statement of comprehensive income (extract from management accounts)

Statement of financial position

Notes:

1. Oak Co established an equity-settled share-based payment plan for its executives on 1 January 2011. 250 executives and senior managers have received 100 share options each, which vest on 31 December 2013 if the executive remains in employment at that date, and if Oak Co’s share price increases by 10% per annum. No expense has been recognised this year as Oak Co’s share price has fallen by 5% in the last six months, and so it is felt that the condition relating to the share price will not be met this year end.

2. On 1 July 2011, Oak Co entered into a lease which has been accounted for as a finance lease and capitalised at $5 million. The leased property is used as the head office for Oak Co’s new website development and sales division. The lease term is for five years and the fair value of the property at the inception of the lease was $20 million.

3. On 30 June 2011 Oak Co’s properties were revalued by an independent expert.

4. A significant amount has been invested in the new website, which is seen as a major strategic development for the company. The website has generated minimal sales since its launch last month, and advertising campaigns are currently being conducted to promote the site.

5. The long-term borrowings are due to be repaid in two equal instalments on 30 September 2012 and 2013. Oak Co is in the process of renegotiating the loan, to extend the repayment dates, and to increase the amount of the loan.

6. The provision relates to product warranties offered by the company.

7. The overdraft limit agreed with Oak Co’s bank is $1·5 million.

Required:

Respond to the email from the audit partner. (31 marks)

Note: the split of the mark allocation is shown within the partner’s email.

Professional marks will be awarded for the presentation and clarity of your answer. (2 marks)

(b) Maple & Co is suffering from declining revenue, and as a result of this, another audit manager has been asked to consider how to improve the firm’s profitability. In a conversation with you this morning he mentioned the following:

‘We really need to make our audits more efficient. I think we should fix materiality at the planning stage at the maximum possible materiality level for all audits, as this would reduce the work we need to do.

I also think we can cut the firm’s overheads by reducing our spending on training. We spend a lot on expensive training courses for junior members of the audit team, and on Continuing Professional Development for our qualified members of staff.

We could also guarantee our clients that all audits will be completed quicker than last year. Reducing the time spent on each assignment will improve the firm’s efficiency and enable us to take on more audit clients.’

Required:

Comment on the practice management and quality control issues raised by the audit manager’s suggestions to improve the audit firm’s profitability. (6 marks)

第4题

ity disclaimer paragraph,

and discuss the main arguments for and against the use of a liability disclaimer paragraph. (5 marks)

第5题

ial statements in the form

to be presented to shareholders at the forthcoming company general meeting. Uma has also commented that the

previous auditors did not use a liability disclaimer in their audit report, and would like more information about the use

of liability disclaimer paragraphs.

Required:

(b) Discuss the ethical issues raised by the request for your firm to type the financial statements of Blod Co.

(3 marks)

第6题

s ‘findings

from the audit’ in your report to those charged with governance, and explain the reason for their

inclusion. (7 marks)

第7题

ended 31 March 2008. Your

firm was appointed as auditors of Blod Co in September 2007. The audit work has been completed, and you are

reviewing the working papers in order to draft a report to those charged with governance. The statement of financial

position (balance sheet) shows total assets of $78 million (2007 – $66 million). The main business activity of Blod

Co is the manufacture of farm machinery.

During the audit of property, plant and equipment it was discovered that controls over capital expenditure transactions

had deteriorated during the year. Authorisation had not been gained for the purchase of office equipment with a cost

of $225,000. No material errors in the financial statements were revealed by audit procedures performed on property,

plant and equipment.

An internally generated brand name has been included in the statement of financial position (balance sheet) at a fair

value of $10 million. Audit working papers show that the matter was discussed with the financial controller, who

stated that the $10 million represents the present value of future cash flows estimated to be generated by the brand

name. The member of the audit team who completed the work programme on intangible assets has noted that this

treatment appears to be in breach of IAS 38 Intangible Assets, and that the management refuses to derecognise the

asset.

Problems were experienced in the audit of inventories. Due to an oversight by the internal auditors of Blod Co, the

external audit team did not receive a copy of inventory counting procedures prior to attending the count. This caused

a delay at the beginning of the inventory count, when the audit team had to quickly familiarise themselves with the

procedures. In addition, on the final audit, when the audit senior requested documentation to support the final

inventory valuation, it took two weeks for the information to be received because the accountant who had prepared

the schedules had mislaid them.

Required:

(a) (i) Identify the main purpose of including ‘findings from the audit’ (management letter points) in a report

to those charged with governance. (2 marks)

第10题

ou have recently been made

responsible for reviewing invoices raised to clients and for monitoring your firm’s credit control procedures. Several

matters came to light during your most recent review of client invoice files:

Norman Co, a large private company, has not paid an invoice from Smith & Co dated 5 June 2007 for work in respect

of the financial statement audit for the year ended 28 February 2007. A file note dated 30 November 2007 states

that Norman Co is suffering poor cash flows and is unable to pay the balance. This is the only piece of information

in the file you are reviewing relating to the invoice. You are aware that the final audit work for the year ended

28 February 2008, which has not yet been invoiced, is nearly complete and the audit report is due to be issued

imminently.

Wallace Co, a private company whose business is the manufacture of industrial machinery, has paid all invoices

relating to the recently completed audit planning for the year ended 31 May 2008. However, in the invoice file you

notice an invoice received by your firm from Wallace Co. The invoice is addressed to Valerie Hobson, the manager

responsible for the audit of Wallace Co. The invoice relates to the rental of an area in Wallace Co’s empty warehouse,

with the following comment handwritten on the invoice: ‘rental space being used for storage of Ms Hobson’s

speedboat for six months – she is our auditor, so only charge a nominal sum of $100’. When asked about the invoice,

Valerie Hobson said that the invoice should have been sent to her private address. You are aware that Wallace Co

sometimes uses the empty warehouse for rental income, though this is not the main trading income of the company.

In the ‘miscellaneous invoices raised’ file, an invoice dated last week has been raised to Software Supply Co, not a

client of your firm. The comment box on the invoice contains the note ‘referral fee for recommending Software Supply

Co to several audit clients regarding the supply of bespoke accounting software’.

Required:

Identify and discuss the ethical and other professional issues raised by the invoice file review, and recommend

what action, if any, Smith & Co should now take in respect of:

(a) Norman Co; (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!