重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section A – BOTH questions are compulsory and MUST be attempted

The Superior Business Consultancy (SBC) which is based in Jayland provides clients with consultancy services in Advertising, Recruitment and IT Support. SBC commenced trading on 1 July 2003 and has grown steadily since then.

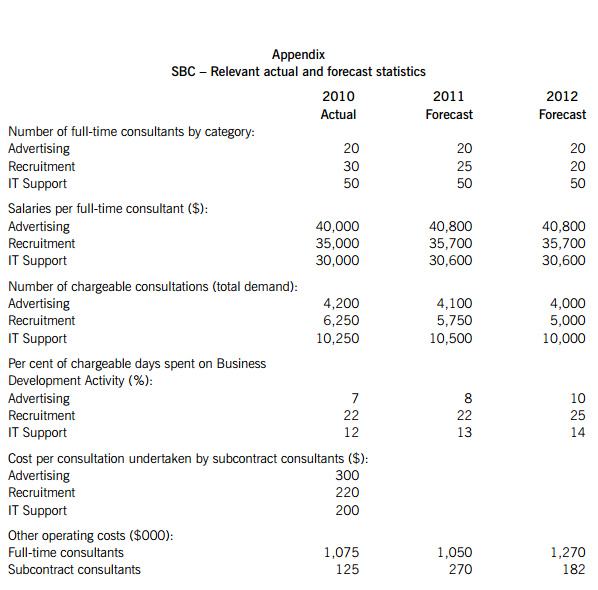

The following information, together with that contained in the appendix, is available:

(1) Three types of consultants are employed by SBC on a full-time basis. These are:

Advertising consultants who provide advice regarding advertising and promotional activities

Recruitment consultants who provide advice regarding recruitment and selection of staff, and

IT consultants who provide advice regarding the selection of business software and technical support.

(2) During the year ended 31 May 2010, each full-time consultant was budgeted to work on 200 days. All consultations undertaken by consultants of SBC had a duration of one day.

(3) During their 200 working days per annum, full-time consultants undertake some consultations on a ‘no-fee’ basis. Such consultations are regarded as Business Development Activity (BDA) by the management of SBC.

(4) SBC also engages the services of subcontract consultants who provide clients with consultancy services in the categories of Advertising, Recruitment and IT Support. All of the subcontract consultants have worked for SBC for at least three years.

(5) During recent years the directors of SBC have become increasingly concerned that SBC’s systems are inadequate for the measurement of performance. This concern was further increased after they each read a book entitled ‘How to improve business performance measurement’.

Required:

Prepare a report for the directors of SBC which:

(i) discusses the importance of non-fi nancial performance indicators (NFPIs) and evaluates, giving examples, how a ‘balanced scorecard’ approach may be used to improve performance within SBC; (13 marks)

(ii) contains a calculation of the actual average cost per chargeable consultation for both full-time consultants and separately for subcontract consultants in respect of each of the three categories of consultancy services during the year ended 31 May 2010; (7 marks)

(iii) suggests reasons for the trends shown by the fi gures contained in the appendix; (5 marks)

(iv) discusses the potential benefi ts and potential problems which might arise as a consequence of employing subcontract consultants within SBC. (6 marks)

Professional marks will be awarded in Question 1 for appropriateness of format, style. and structure of the report. (4 marks)

更多“Section A – BOTH questions are compulsory and MUST be attemptedThe Superior Business Consu”相关的问题

更多“Section A – BOTH questions are compulsory and MUST be attemptedThe Superior Business Consu”相关的问题

第1题

mance of CTC with

effect from 1 May 2009 (where only the products in (a) and (b) above are available for manufacture).

(4 marks)

第2题

phant’ will be

financially viable, assuming that all other data remain unchanged. (4 marks)

第3题

Elephant’ for which the

following estimated information is available:

1. Sales volumes and selling prices per unit

Year ending, 31 May 2009 2010 2011

Sales units (000) 80 180 100

Selling price per unit ($) 50 50 50

2. Nellie will generate a contribution to sales ratio of 50% throughout the three year period.

3. Product specific fixed overheads during the year ending 31 May 2009 are estimated to be $1·6 million. It

is anticipated that these fixed overheads would decrease by 10% per annum during each of the years ending

31 May 2010 and 31 May 2011.

4. Capital investment amounting to $3·9 million would be required in June 2008. The investment would have

no residual value at 31 May 2011.

5. Additional working capital of $500,000 would be required in June 2008. A further $200,000 would be

required on 31 May 2009. These amounts would be recovered in full at the end of the three year period.

6. The cost of capital is expected to be 12% per annum.

Assume all cash flows (other than where stated) arise at the end of the year.

Required:

(i) Determine whether the new product is viable purely on financial grounds. (4 marks)

第5题

rs of GHG are again

considering employing a local workforce not only to build the hotel but also to operate it on a daily basis.

Required:

Explain TWO ways in which the possibility of cultural differences might impact on the performance of a local

workforce in building and operating a hotel in Tomorrowland. (6 marks)

第6题

ut the world. The directors

of GHG are committed to a policy of achieving ‘growth’ in terms of geographical coverage and are now considering

building and operating another hotel in Tomorrowland. Tomorrowland is a developing country which is situated 3,000

kilometres from the country in which GHG’s nearest hotel is located.

The managing director of GHG recently attended a seminar on ‘the use of strategic and economic information in

planning organisational performance’.

He has called a board meeting to discuss the strategic and economic factors which should be considered before a

decision is made to build the hotel in Tomorrowland.

Required:

(a) Discuss the strategic and economic factors which should be considered before a decision is made to build

the hotel. (14 marks)

第7题

marks)

第8题

ivision/TRG scenario;

and (6 marks)

第9题

ategic focus is channelled

through profit centres which sell products transferred from production divisions that are operated as cost centres. The

profit centres are the primary value-adding part of the business, where commercial profit centre managers are

responsible for the generation of a contribution margin sufficient to earn the target return of TRG. The target return is

calculated after allowing for the sum of the agreed budgeted cost of production at production divisions, plus the cost

of marketing, selling and distribution costs and central services costs.

The Bettamould Division is part of TRG and manufactures moulded products that it transfers to profit centres at an

agreed cost per tonne. The agreed cost per tonne is set following discussion between management of the Bettamould

Division and senior management of TRG.

The following information relates to the agreed budget for the Bettamould Division for the year ending 30 June 2009:

(1) The budgeted output of moulded products to be transferred to profit centres is 100,000 tonnes. The budgeted

transfer cost has been agreed on a two-part basis as follows:

(i) A standard variable cost of $200 per tonne of moulded products;

(ii) A lump sum annual charge of $50,000,000 in respect of fixed costs, which is charged to profit centres, at

$500 per tonne of moulded products.

(2) Budgeted standard variable costs (as quoted in 1 above) have been set after incorporating each of the following:

(i) A provision in respect of processing losses amounting to 15% of material inputs. Materials are sourced on

a JIT basis from chosen suppliers who have been used for some years. It is felt that the 15% level of losses

is necessary because the ageing of the machinery will lead to a reduction in the efficiency of output levels.

(ii) A provision in respect of machine idle time amounting to 5%. This is incorporated into variable machine

costs. The idle time allowance is held at the 5% level partly through elements of ‘real-time’ maintenance

undertaken by the machine operating teams as part of their job specification.

(3) Quality checks are carried out on a daily basis on 25% of throughput tonnes of moulded products.

(4) All employees and management have contracts based on fixed annual salary agreements. In addition, a bonus

of 5% of salary is payable as long as the budgeted output of 100,000 tonnes has been achieved;

(5) Additional information relating to the points in (2) above (but NOT included in the budget for the year ending

30 June 2009) is as follows:

(i) There is evidence that materials of an equivalent specification could be sourced for 40% of the annual

requirement at the Bettamould Division, from another division within TRG which has spare capacity.

(ii) There is evidence that a move to machine maintenance being outsourced from a specialist company could

help reduce machine idle time and hence allow the possibility of annual output in excess of 100,000 tonnes

of moulded products.

(iii) It is thought that the current level of quality checks (25% of throughput on a daily basis) is vital, although

current evidence shows that some competitor companies are able to achieve consistent acceptable quality

with a quality check level of only 10% of throughput on a daily basis.

The directors of TRG have decided to investigate claims relating to the use of budgeting within organisations which

have featured in recent literature. A summary of relevant points from the literature is contained in the following

statement:

‘The use of budgets as part of a ‘performance contract’ between an organisation and its managers may be seen as a

practice that causes management action which might lead to the following problems:

(a) Meeting only the lowest targets

(b) Using more resources than necessary

(c) Making the bonus – whatever it takes

(d) Competing against other divisions, business units and departments

(e) Ensuring that what is in the budget is spent

(f) Providing inaccurate forecasts

(g) Meeting the target, but not beating it

(h) Avoiding risks.’

Required:

(a) Explain the nature of any SIX of the eight problems listed above relating to the use of budgeting;

(12 marks)

第10题

tres. Each of SFC’s

centres is similar in size to those of HFG. SFC also provides dietary plans and fitness programmes to its clients.

The directors of HFG have decided that they wish to benchmark the performance of HFG with that of SFC.

Required:

Discuss the problems that the directors of HFG might experience in their wish to benchmark the performance

of HFG with the performance of SFC, and recommend how such problems might be successfully addressed.

(7 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!