重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

根据《安全生产法》的规定,生产经营单位()工程项目的安全设施,必须与主体工程同时设计、同时施工、同时投入生产和使用。

A.扩建、改建、翻新

B.新建、改建、扩建

C.新建、扩建、引进

D.新建、改建、装修

更多“根据《安全生产法》的规定,生产经营单位()工程项目的安全设施,必须与主体工程同时设计、同时施工、”相关的问题

更多“根据《安全生产法》的规定,生产经营单位()工程项目的安全设施,必须与主体工程同时设计、同时施工、”相关的问题

第1题

(a) State the FIVE threats contained within ACCA’s Code of Ethics and Conduct and for each threat list ONE example of a circumstance that may create the threat. (5 marks)

(b) You are the audit manager of Jones & Co and you are planning the audit of LV Fones Co, which has been an audit client for four years and specialises in manufacturing luxury mobile phones.

During the planning stage of the audit you have obtained the following information. The employees of LV Fones Co are entitled to purchase mobile phones at a discount of 10%. The audit team has in previous years been offered the same level of staff discount.

During the year the fi nancial controller of LV Fones was ill and hence unable to work. The company had no spare staff able to fulfi l the role and hence a qualifi ed audit senior of Jones & Co was seconded to the client for three months. The audit partner has recommended that the audit senior work on the audit as he has good knowledge of the client. The fee income derived from LV Fones was boosted by this engagement and along with the audit and tax fee, now accounts for 16% of the fi rm’s total fees.

From a review of the correspondence fi les you note that the partner and the fi nance director have known each other socially for many years and in fact went on holiday together last summer with their families. As a result of this friendship the partner has not yet spoken to the client about the fee for last year’s audit, 20% of which is still outstanding.

Required:

(i) Explain the ethical threats which may affect the independence of Jones & Co’s audit of LV Fones Co; and (5 marks)

(ii) For each threat explain how it might be avoided. (5 marks)

(c) Describe the steps an audit fi rm should perform. prior to accepting a new audit engagement. (5 marks)

第2题

A、A. (1) and (2)

B、B. (1) and (4)

C、C. (2) and (3)

D、D. (3) and (4)

第3题

which were recently discussed at the monthly audit managers’ meeting:

(1) Nate & Co has recently been approached by a potential new audit client, Fisher Co. Your firm is keen to take the

appointment and is currently carrying out client acceptance procedures. Fisher Co was recently incorporated by

Marcellus Fisher, with its main trade being the retailing of wooden storage boxes.

(2) Nate & Co provides the audit service to CF Co, a national financial services organisation. Due to a number of

errors in the recording of cash deposits from new customers that have been discovered by CF Co’s internal audit

team, the directors of CF Co have requested that your firm carry out a review of the financial information

technology systems. It has come to your attention that while working on the audit planning of CF Co, Jin Sayed,

one of the juniors on the audit team, who is a recent information technology graduate, spent three hours

providing advice to the internal audit team about how to improve the system. As far as you know, this advice has

not been used by the internal audit team.

(3) LA Shots Co is a manufacturer of bottled drinks, and has been an audit client of Nate & Co for five years. Two

audit juniors attended the annual inventory count last Monday. They reported that Brenda Mangle, the new

production manager of LA Shots Co, wanted the inventory count and audit procedures performed as quickly as

possible. As an incentive she offered the two juniors ten free bottles of ‘Super Juice’ from the end of the

production line. Brenda also invited them to join the LA Shots Co office party, which commenced at the end of

the inventory count. The inventory count and audit procedures were completed within two hours (the previous

year’s procedures lasted a full day), and the juniors then spent four hours at the office party.

Required:

(a) Define ‘money laundering’ and state the procedures specific to money laundering that should be considered

before, and on the acceptance of, the audit appointment of Fisher Co. (5 marks)

第4题

Tirrol Co provides repair services to motor vehicles from 25 different locations. All inventory, sales and purchasing systems are computerised, with each location maintaining its own computer system. The software in each location is

the same because the programs were written specifically for Tirrol Co by a reputable software house. Data from each location is amalgamated on a monthly basis at Tirrol Co’s head office to produce management and financial accounts.

You are currently planning your audit approach for Tirrol Co. One option being considered is to re-write Cal & Co’s audit software to interrogate the computerised inventory systems in each location of Tirrol Co (except for head office)

as part of inventory valuation testing. However, you have also been informed that any computer testing will have to be on a live basis and you are aware that July is a major holiday period for your audit firm.

Required:

(a) (i) Explain the benefits of using audit software in the audit of Tirrol Co; (4 marks)

(ii) Explain the problems that may be encountered in the audit of Tirrol Co and for each problem, explain

how that problem could be overcome. (10 marks)

(b) Following a discussion with the management at Tirrol Co you now understand that the internal audit department are prepared to assist with the statutory audit. Specifically, the chief internal auditor is prepared to provide you with documentation on the computerised inventory systems at Tirrol Co. The documentation provides details of the software and shows diagrammatically how transactions are processed through the inventory system. This documentation can be used to significantly decrease the time needed to understand the computer systems and enable audit software to be written for this year’s audit.

Required:

Explain how you will evaluate the computer systems documentation produced by the internal audit

department in order to place reliance on it during your audit. (6 marks)

第5题

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

第6题

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

第7题

(a) You are the manager responsible for the audit of Dylan Co, a listed company, and you are reviewing the working papers of the audit file for the year ended 30 September 2012. The audit senior has left a note for your attention:

‘Dylan Co outsources its entire payroll, invoicing and credit control functions to Hendrix Co. In August 2012, Hendrix Co suffered a computer virus attack on its operating system, resulting in the destruction of its accounting records, including those relating to Dylan Co. We have therefore been unable to perform. the planned audit procedures on payroll, revenue and receivables, all of which are material to the financial statements. Hendrix Co has manually reconstructed the relevant figures as far as possible, and has supplied a written statement to confirm that they are as accurate as possible, given the loss of accounting records.’

Required:

(i) Comment on the actions that should be taken by the auditor, and the implications for the auditor’s report; and (7 marks)

(ii) Discuss the quality control procedures that should be carried out by the audit firm prior to the audit report being issued. (3 marks)

(b) You are also responsible for the audit of Squire Co, a listed company, and you are completing the review of its interim financial statements for the six months ended 31 October 2012. Squire Co is a car manufacturer, and historically has offered a three-year warranty on cars sold. The financial statements for the year ended 30 April 2012 included a warranty provision of $1·5 million and recognised total assets of $27·5 million. You are aware that on 1 July 2012, due to cost cutting measures, Squire Co stopped offering warranties on cars sold. The interim financial statements for the six months ended 31 October 2012 do not recognise any warranty provision. Total assets are $30 million at 31 October 2012.

Required:

Assess the matters that should be considered in forming a conclusion on Squire Co’s interim financial statements, and the implications for the review report. (6 marks)

第8题

The following scenario relates to questions 11–15

Sycamore & Co is the auditor of Fir Co, a listed computer software company. The audit team comprises an engagement partner, a recently appointed audit manager, an audit senior and a number of audit assistants. The audit engagement partner has only been appointed this year due to the rotation of the previous partner who had been involved in the audit for seven years. Only the audit senior has experience of auditing a company in this specialised industry. The previous audit manager, who is a close friend of the new audit manager, left the firm before the completion of the prior year audit and is now the finance director of Fir Co.

The board of Fir Co has asked if Sycamore & Co can take on some additional work and have asked if the following additional non-audit services can be provided:

(1) Routine maintenance of payroll records

(2) Assistance with the selection of a new financial controller including the checking of references

(3) Tax services whereby Sycamore & Co would liaise with the tax authority on Fir Co’s behalf

Sycamore & Co has identified that the current year fees to be received from Fir Co for audit and other services will represent 16% of the firm’s total fee income and totalled 15·5% in the prior year. The audit engagement partner has asked you to consider what can be done in relation to this self-interest threat.

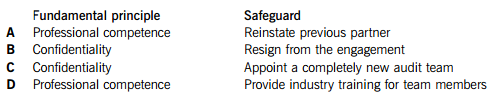

In relation to the composition of the current audit team, which of the following correctly identifies the fundamental principle which is at risk and provides an appropriate safeguard?

A.A

B.B

C.C

D.D

Which of the following identifies the threat which could arise as a result of the finance director’s previous employment at Sycamore & Co and recommends an appropriate safeguard?

A.A self-review threat; review the work performed by the previous audit manager

B.A familiarity threat; a different audit manager should be appointed

C.A self-review threat; change the existing audit plan

D.A familiarity threat; the firm should resign from the engagement

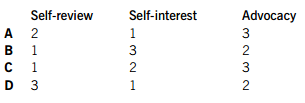

Ignoring the potential effect on total fee levels, which of the following options correctly identifies the threats to independence from providing the above non-audit services?

A.A

B.B

C.C

D.D

Which of the following safeguards would NOT be relevant in mitigating the threat identified in relation to fees?

A.Disclosure to those charged with governance that fees from Fir Co represent more than 15% of Sycamore & Co’s total fee income

B.A pre-issuance review to be conducted by an external accountant

C.The use of separate teams to provide the audit and non-audit services

D.A post-issuance review to be conducted by an external accountant or regulatory body

During the course of the audit of Fir Co, a suspicious cash transfer has been identified. The audit team has reported this to the relevant firm representative as a potential money-laundering transaction.

Which of the following statements is true regarding the confidentiality of this information?

A.Details of the transaction can only be disclosed with the permission of Fir Co

B.If there is a legal requirement to report money-laundering, this overrides the principle of confidentiality

C.Sycamore & Co is not permitted to disclose details of the suspicious transaction as the information has been obtained during the course of the audit

D.In order to maintain confidentiality, Sycamore & Co should report their concerns anonymously

请帮忙给出每个问题的正确答案和分析,谢谢!

第9题

(b) You are the audit manager of Jinack Co, a private limited liability company. You are currently reviewing two

matters that have been left for your attention on the audit working paper file for the year ended 30 September

2005:

(i) Jinack holds an extensive range of inventory and keeps perpetual inventory records. There was no full

physical inventory count at 30 September 2005 as a system of continuous stock checking is operated by

warehouse personnel under the supervision of an internal audit department.

A major systems failure in October 2005 caused the perpetual inventory records to be corrupted before the

year-end inventory position was determined. As data recovery procedures were found to be inadequate,

Jinack is reconstructing the year-end quantities through a physical count and ‘rollback’. The reconstruction

exercise is expected to be completed in January 2006. (6 marks)

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Jinack Co for the year ended 30 September 2005 and, where appropriate, the year ending

30 September 2006.

NOTE: The mark allocation is shown against each of the matters.

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!