重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

依据《安全生产法》的规定.()是安全生产的主体。

A.施工单位

B.建设单位

C.生产经营单位

D.监理工程师

更多“依据《安全生产法》的规定.()是安全生产的主体。A.施工单位B.建设单位C.生产经营单位D.监理工程师”相关的问题

更多“依据《安全生产法》的规定.()是安全生产的主体。A.施工单位B.建设单位C.生产经营单位D.监理工程师”相关的问题

第1题

whether your firm would be prepared to conduct a joint audit in cooperation with Lead & Co, on the future

financial statements of Maxwell Co if the acquisition goes ahead. Leo Sabat thinks that this would enable your

firm to improve group audit efficiency, without losing the cumulative experience that Lead & Co has built up while

acting as auditor to Maxwell Co.

Required:

Define ‘joint audit’, and assess the advantages and disadvantages of the audit of Maxwell Co being conducted

on a ‘joint basis’. (7 marks)

第2题

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

第3题

The Board of BJM Co has asked your audit firm (YHT & Co) to conduct a review of BJM‘s compliance with hygiene regulations. The partner responsible for the review engagement has asked you to tell him what level of assurance you believe YHT & Co should provide, and also what type of opinion the firm should give. What is the level of assurance and type of opinion that can be provided on this review engagement?

A、Level of assurance Report wording Reasonable Positive

B、Level of assurance Report wording Reasonable Negative

C、Level of assurance Report wording Limited Positive

D、Level of assurance Report wording Limited Negative

第5题

(a) I know that auditors are required to assess risks of material misstatement by developing an understanding of the business risks of an audit client, but I am not clear on the relationship between business risk and risk of material misstatement. Can you explain the two types of risk, and how identifying business risk relates to risk of material misstatement? (4 marks)

(b) I worked on the interim audit of Crow Co, a manufacturing company which outsources its payroll function. I know that for Crow Co payroll is material. How does the outsourcing of payroll affect our audit planning? (4 marks)

(c) Crow Co is tendering for an important contract to supply Hatfield Co. I know that Hatfield Co is also an audit client of our firm, and I have heard that Crow Co’s management has requested our firm to provide advice on the tender it is preparing. What matters should our firm consider in deciding whether to provide advice to Crow Co on the tender? (5 marks)

(d) I also worked on the audit of Campbell Co, where I heard the managing director, Ting Campbell, discussing a potential new business opportunity with the audit engagement partner. Campbell Co is an events organiser, and is planning to run a programme of nationwide events for accountants, at which speakers will discuss technical updates to financial reporting, tax and audit regulations. Ting proposed that our firm could invest some cash in the business opportunity, supply the speakers, market the events to our audit clients, and that any profit made would be shared between Ryder & Co and Campbell Co. What would be the implications of our firm considering this business opportunity? (7 marks)

Required:

For each of the issues raised, respond to the audit junior, explaining the ethical and professional matters arising from the audit junior’s comments.

Note: The split of the mark allocation is shown against each of the issues above.

第6题

recent meeting of the board of directors that: ‘our loss of market share during the last three years might lead to the

end of JOL Co as an organisation and therefore we must address this issue immediately’.

Required:

(b) Discuss the statement of the managing director of JOL Co and discuss six performance indicators, other than

decreasing market share, which might indicate that JOL Co might fail as a corporate entity. (10 marks)

第7题

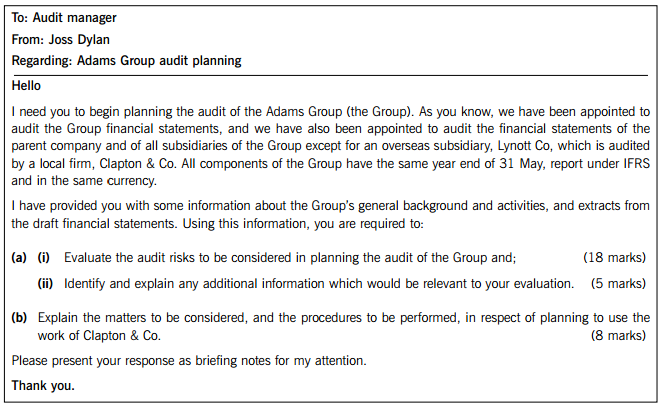

Section A – BOTH questions are compulsory and MUST be attempted

You are a manager in Dando & Co, a firm of Chartered Certified Accountants responsible for the audit of the Adams Group. Your firm was appointed as auditor in January 2014, and the audit engagement partner, Joss Dylan, has sent you the following email:

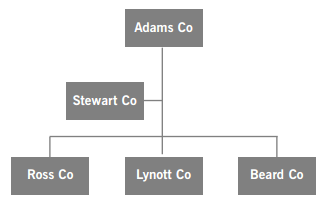

Attachment: Background and structure of the Adams Group

The Group operates in the textile industry, buying cotton, silk and other raw materials to manufacture a range of goods including clothing, linen and soft furnishings. Goods are sold under the Adams brand name, which was acquired by Adams Co many years ago and is held at its original cost in the Group statement of financial position. The Group structure and information about each of the components of the Group is shown below:

Ross Co, Lynott Co and Beard Co are all wholly owned, acquired subsidiaries which manufacture different textiles. Adams Co also owns 25% of Stewart Co, a company which is classified as an associate in the Group statement of financial position at a value of $12 million at 31 May 2014. The shares in Stewart Co were acquired in January 2014 for consideration of $11·5 million. Other than this recent investment in Stewart Co, the Group structure has remained unchanged for many years.

Information relevant to each of the subsidiaries

Ross Co manufactures luxury silk clothing, with almost all of its output sold through approximately 200 department stores. Ross Co’s draft statement of financial position recognises assets of $21·5 million at 31 May 2014. Any silk clothing which has not been sold within 12 months is transferred to Lynott Co, where the silk material is recycled in its manufacturing process.

Lynott Co is located overseas, where it can benefit from low cost labour in its factories. It produces low price fashion clothing for the mass market. A new inventory system was introduced in December 2013 in order to introduce stronger controls over the movement of inventory between factories and stores. Lynott Co is audited by Clapton & Co, and its audit reports in all previous years have been unmodified. Clapton & Co is a small accounting and audit firm, but is a member of an international network of firms. Lynott Co’s draft statement of financial position recognises assets of $24 million at 31 May 2014.

Beard Co manufactures soft furnishings. The company is cash-rich, and surplus cash is invested in a large portfolio of investment properties, which generate rental income. The Group’s accounting policy is to measure investment properties at fair value. Beard Co’s draft statement of financial position recognises assets of $28 million at 31 May 2014, of which investment properties represent $10 million.

Other information

As part of management’s strategy to increase market share, a bonus scheme has been put in place across the Group under which senior managers will receive a bonus based on an increase in revenue.

Adams Co imposes an annual management charge of $800,000 on each of its subsidiaries, with the charge for each financial year payable in the subsequent August.

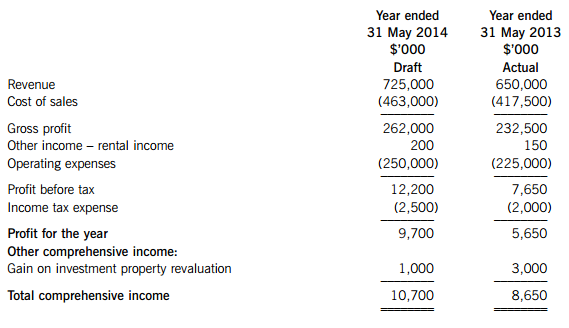

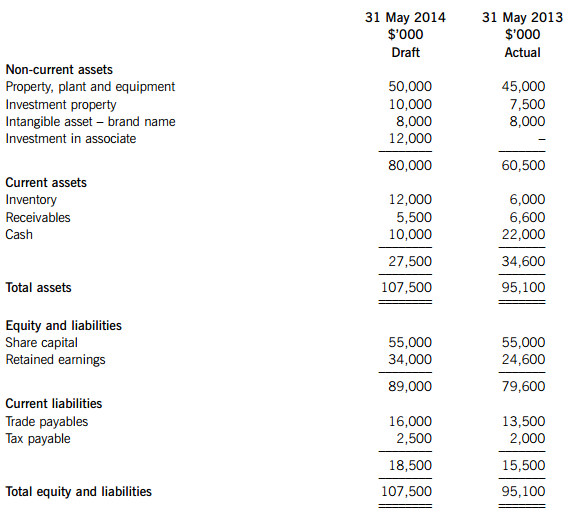

Extracts from draft Group consolidated financial statements

Draft consolidated statement of profit or loss and other comprehensive income

Draft consolidated statement of financial position

Required:

Respond to the email from the audit partner. (31 marks)

Note: The split of the mark allocation is shown within the partner’s email. Professional marks will be awarded for the presentation, logical flow and clarity of explanation of the briefing notes. (4 marks)

第8题

services mainly to large, privately owned companies. The firm has suffered from increased competition, due to two

new firms of accountants setting up in the same town. Several audit clients have moved to the new firms, leading to

loss of revenue, and an over staffed audit department. Bob McEnroe, one of the partners of Becker & Co, has asked

you to consider how the firm could react to this situation. Several possibilities have been raised for your consideration:

1. Murray Co, a manufacturer of electronic equipment, is one of Becker & Co’s audit clients. You are aware that the

company has recently designed a new product, which market research indicates is likely to be very successful.

The development of the product has been a huge drain on cash resources. The managing director of Murray Co

has written to the audit engagement partner to see if Becker & Co would be interested in making an investment

in the new product. It has been suggested that Becker & Co could provide finance for the completion of the

development and the marketing of the product. The finance would be in the form. of convertible debentures.

Alternatively, a joint venture company in which control is shared between Murray Co and Becker & Co could be

established to manufacture, market and distribute the new product.

2. Becker & Co is considering expanding the provision of non-audit services. Ingrid Sharapova, a senior manager in

Becker & Co, has suggested that the firm could offer a recruitment advisory service to clients, specialising in the

recruitment of finance professionals. Becker & Co would charge a fee for this service based on the salary of the

employee recruited. Ingrid Sharapova worked as a recruitment consultant for a year before deciding to train as

an accountant.

3. Several audit clients are experiencing staff shortages, and it has been suggested that temporary staff assignments

could be offered. It is envisaged that a number of audit managers or seniors could be seconded to clients for

periods not exceeding six months, after which time they would return to Becker & Co.

Required:

Identify and explain the ethical and practice management implications in respect of:

(a) A business arrangement with Murray Co. (7 marks)

第10题

to the following three audits of financial statements for the year ending 31 December 2006:

(a) Blythe Co is a new audit client. This private company is a local manufacturer and distributor of sportswear. The

company’s finance director, Peter, sees little value in the audit and put it out to tender last year as a cost-cutting

exercise. In accordance with the requirements of the invitation to tender your firm indicated that there would not

be an interim audit.

(b) Huggins Co, a long-standing client, operates a national supermarket chain. Your firm provided Huggins Co with

corporate financial advice on obtaining a listing on a recognised stock exchange in 2005. Senior management

expects a thorough examination of the company’s computerised systems, and are also seeking assurance that

the annual report will not attract adverse criticism.

(c) Gray Co has been an audit client since 1999 after your firm advised management on a successful buyout. Gray

provides communication services and software solutions. Your firm provides Gray with technical advice on

financial reporting and tax services. Most recently you have been asked to conduct due diligence reviews on

potential acquisitions.

Required:

For these assignments, compare and contrast:

(i) the threats to independence;

(ii) the other professional and practical matters that arise; and

(iii) the implications for allocating staff.

(15 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!