重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.项目总监理工程师和项目监理机构

B.监理投标文件中的监理方案

C.经与业主协商确定的监理大纲

D.建设工程监理合同

更多“监理规划是在项目()充分分析和研究建设工程的目标、技术、管理、环境以及参与工程建设的各方面的”相关的问题

更多“监理规划是在项目()充分分析和研究建设工程的目标、技术、管理、环境以及参与工程建设的各方面的”相关的问题

第1题

(ii) State, with reasons, whether Messier Ltd can provide Galileo with accommodation in the UK without

giving rise to a UK income tax liability. (2 marks)

第2题

(ii) State when the inheritance tax (IHT) calculated in (i) would be payable and by whom. (2 marks)

第3题

(d) Explain how Gloria would be taxed in the UK on the dividends paid by Bubble Inc and the capital gains tax

and inheritance tax implications of a future disposal of the shares. Clearly state, giving reasons, whether or

not the payment made to Eric is allowable for capital gains tax purposes. (9 marks)

You should assume that the rates and allowances for the tax year 2005/06 apply throughout this question.

第4题

(ii) Explain why Galileo is able to pay the inheritance tax due in instalments, state when the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

第5题

(ii) The sales director has suggested to Damian, that to encourage the salesmen to accept the new arrangement,

the company should increase the value of the accessories of their own choice that can be fitted to the low

emission cars.

State, giving reasons, whether or not Damian should implement the sales director’s suggestion.

(2 marks)

第6题

(b) (i) Advise Andrew of the income tax (IT) and capital gains tax (CGT) reliefs available on his investment in

the ordinary share capital of Scalar Limited, together with any conditions which need to be satisfied.

Your answer should clearly identify any steps that should be taken by Andrew and the other investors

to obtain the maximum relief. (13 marks)

第7题

(b) Assuming that the income from the sale of the books is not treated as trading income, calculate Bob’s taxable

income and gains for all relevant tax years, using any loss reliefs in the most tax-efficient manner. Your

answer should include an explanation of the loss reliefs available and your reasons for using (or not using)

them. (12 marks)

Assume that the rates and allowances for 2004/05 apply throughout this part of the question.

第8题

(ii) Explain the income tax (IT), national insurance (NIC) and capital gains tax (CGT) implications arising on

the grant to and exercise by an employee of an option to buy shares in an unapproved share option

scheme and on the subsequent sale of these shares. State clearly how these would apply in Henry’s

case. (8 marks)

第9题

(b) Explain the capital gains tax (CGT) and inheritance tax (IHT) implications of Graeme gifting his remaining ‘T’

ordinary shares at their current value either:

(i) to his wife, Catherine; or

(ii) to his son, Barry.

Your answer should be supported by relevant calculations and clearly identify the availability and effect of

any reliefs (other than the CGT annual exemption) that might be used to reduce or defer any tax liabilities

arising. (9 marks)

第10题

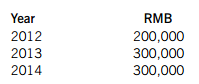

(a) Chris and Wendy graduated from high school in 2012 and set up a hair-dressing shop in the form. of a limited company, Hair Ltd. The total amounts received from the customers of Hair Ltd in each of the last three years has been as follows. The income is evenly spread over the 12 months.

In order to encourage small enterprises, the State Council has granted the following tax reliefs:

– Before 1 August 2014, an entity with a turnover of less than RMB20,000 per month was exempt from business tax (BT).

– For the period from 1 August 2014 to 31 December 2018, the exemption threshold was increased to RMB30,000 per month.

Hair Ltd files business tax on a monthly basis.

Required:

(i) Calculate the business tax payable by Hair Ltd in each of the three years, 2012, 2013 and 2014. (4 marks)

(ii) Calculate the enterprise income tax (EIT) of Hair Ltd of 2014. (2 marks)

(b) With respect to the three turnover taxes in China, namely, value added tax (VAT), business tax (BT) and consumption tax (CT):

(i) State which two of the turnover taxes are mutually exclusive. (1 mark)

(ii) Briefly explain the purpose and effect of levying consumption tax. (3 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!