重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.进度控制工作流程

B.材料进场及检验安排

C.业主提供施工条件的进度协调程序

D.工程进度款的支付时间与方式

E.进度控制的方法和具体措施

更多“在建设工程监理规划指导下编制的施工进度控制工作细则,其主要内容有()。 A.进度控制工作流程 B.”相关的问题

更多“在建设工程监理规划指导下编制的施工进度控制工作细则,其主要内容有()。 A.进度控制工作流程 B.”相关的问题

第1题

A.2.35%

B.2.73%

C.5.08%

D.4.10%

第2题

A、4%

B、24%

C、3.2%

D、4.1%

第3题

A.$3·20

B.$4·41

C.$2·59

D.$4·20

第4题

A.13.75%

B.15%

C.10%

D.20%

第5题

Required:

(a) Justifying any assumptions which you make, calculate the current market value of the loan notes of Darlga Co, using future share price increases of:

(i) 4% per year;

(ii) 6% per year. (6 marks)

(b) Discuss the limitations of the dividend growth model as a way of valuing the ordinary shares of a company. (4 marks)

第6题

MOON Company has 200,000 common shares outstanding, and the par value is $2 per share. MOON has thought it is necessary to reinvest most of its earnings, so as to maintain the growth rate of 12%. Because of the founder's death, it is expected a low growth rate. The realistic growth rate is 5%, and the dividend distribution will increase. The required return rate of the shreholders is 14%. It is expected an earnings of $2 millions in 20X9, and the investment requirement in 20X9 is $0.8 millions. Required: (1)If all the required capital for the investment is from the earning, and MOON uses a residual dividend approach, please calculate the dividend per share in Year 20X9. (2)Please calculate the dividend payout ratio if Year 20X9; (3)If the dividend payout ratio grows by 5% each year, calculate the intrisic value of the share based on the result of (1);

第7题

A、Cash dividends

B、Stock repurchases

C、Stock splits

D、Stock dividends

第8题

A、Issue price of the stock.

B、Value assigned per share of stock by the corporate charter.

C、Market value of the stock on the date of the financial statements.

D、Maximum selling price of the stock.

E、Dividend value of the stock.

第9题

Dinla Co has the following capital structure.

The ordinary shares of Dinla Co are currently trading at $4·26 per share on an ex dividend basis and have a nominal value of $0·25 per share. Ordinary dividends are expected to grow in the future by 4% per year and a dividend of $0·25 per share has just been paid.

The 5% preference shares have an ex dividend market value of $0·56 per share and a nominal value of $1·00 per share. These shares are irredeemable.

The 6% loan notes of Dinla Co are currently trading at $95·45 per loan note on an ex interest basis and will be redeemed at their nominal value of $100 per loan note in five years’ time.

The bank loan has a fixed interest rate of 7% per year.

Dinla Co pays corporation tax at a rate of 25%.

Required:

(a) Calculate the after-tax weighted average cost of capital of Dinla Co on a market value basis. (8 marks)

(b) Discuss the connection between the relative costs of sources of finance and the creditor hierarchy. (3 marks)

(c) Explain the differences between Islamic finance and other conventional finance. (4 marks)

第10题

One of the items discussed at a recent board meeting of QSX Co was the dividend payment for 2010. The fi nance director proposed that, in order to conserve cash within the company, no dividend would be paid in 2010, 2011 and 2012. It was expected that improved economic conditions at the end of this three-year period would make it possible to pay a dividend of 70c per share in 2013. The fi nance director expects that an annual dividend increase of 3% per year in subsequent years could be maintained.

The current cost of equity of QSX Co is 10% per year.

Assume that dividends are paid at the end of each year.

Required:

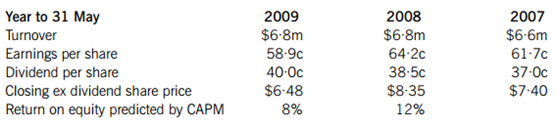

(a) Calculate the dividend yield, capital gain and total shareholder return for 2008 and 2009, and briefl y discuss your fi ndings with respect to:

(i) the returns predicted by the capital asset pricing model (CAPM);

(ii) the other fi nancial information provided. (10 marks)

(b) Calculate and comment on the share price of QSX Co using the dividend growth model in the following circumstances:

(i) based on the historical information provided;

(ii) if the proposed change in dividend policy is implemented. (7 marks)

(c) Discuss the relationship between investment decisions, dividend decisions and fi nancing decisions in the context of fi nancial management, illustrating your discussion with examples where appropriate. (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!