重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Required:

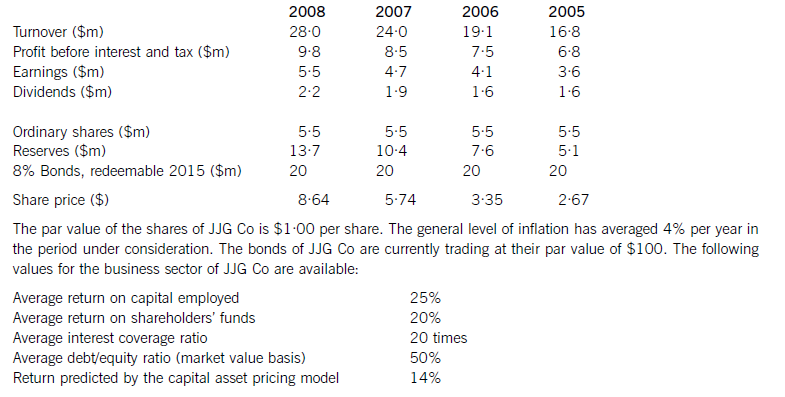

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

更多“JJG Co is planning to raise $15 million of new finance for a major expansion of existing b”相关的问题

更多“JJG Co is planning to raise $15 million of new finance for a major expansion of existing b”相关的问题

第1题

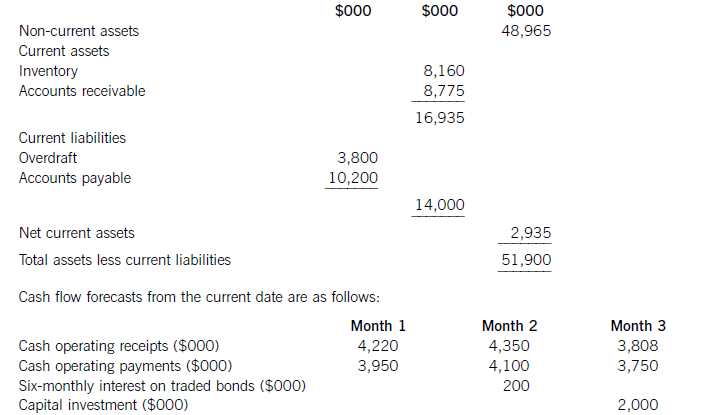

The following financial information relates to HGR Co:

Statement of financial position at the current date (extracts)

The finance director has completed a review of accounts receivable management and has proposed staff training and operating procedure improvements, which he believes will reduce accounts receivable days to the average sector value of 53 days. This reduction would take six months to achieve from the current date, with an equal reduction in each month. He has also proposed changes to inventory management methods, which he hopes will reduce inventory days by two days per month each month over a three-month period from the current date. He does not expect any change in the current level of accounts payable.

HGR Co has an overdraft limit of $4,000,000. Overdraft interest is payable at an annual rate of 6·17% per year, with payments being made each month based on the opening balance at the start of that month. Credit sales for the year to the current date were $49,275,000 and cost of sales was $37,230,000. These levels of credit sales and cost of sales are expected to be maintained in the coming year. Assume that there are 365 working days in each year.

Required:

(a) Discuss the working capital financing strategy of HGR Co. (7 marks)

(b) For HGR Co, calculate:

(i) the bank balance in three months’ time if no action is taken; and

(ii) the bank balance in three months’ time if the finance director’s proposals are implemented.

Comment on the forecast cash flow position of HGR Co and recommend a suitable course of action.

(10 marks)

(c) Discuss how risks arising from granting credit to foreign customers can be managed and reduced.

(8 marks)

第2题

well in test marketing trials conducted recently by the company’s research and development division. The following information relating to this investment proposal has now been prepared.

Initial investment $2 million

Selling price (current price terms) $20 per unit

Expected selling price inflation 3% per year

Variable operating costs (current price terms) $8 per unit

Fixed operating costs (current price terms) $170,000 per year

Expected operating cost inflation 4% per year

The research and development division has prepared the following demand forecast as a result of its test marketing trials. The forecast reflects expected technological change and its effect on the anticipated life-cycle of Product W33.

It is expected that all units of Product W33 produced will be sold, in line with the company’s policy of keeping no inventory of finished goods. No terminal value or machinery scrap value is expected at the end of four years, when production of Product W33 is planned to end. For investment appraisal purposes, PV Co uses a nominal (money) discount rate of 10% per year and a target return on capital employed of 30% per year. Ignore taxation.

Required:

(a) Identify and explain the key stages in the capital investment decision-making process, and the role of

investment appraisal in this process. (7 marks)

(b) Calculate the following values for the investment proposal:

(i) net present value;

(ii) internal rate of return;

(iii) return on capital employed (accounting rate of return) based on average investment; and

(iv) discounted payback period. (13 marks)

(c) Discuss your findings in each section of (b) above and advise whether the investment proposal is financially acceptable. (5 marks)

第3题

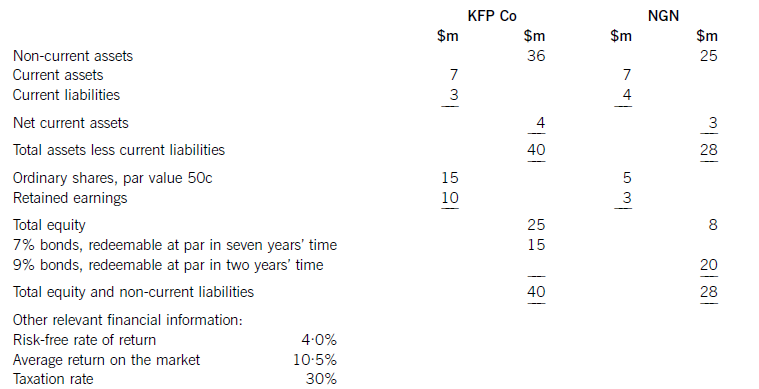

prepares to make a bid to buy a rival unlisted company, NGN. Both companies are in the same business sector. Financial information on KFP Co and NGN is as follows:

NGN has a cost of equity of 12% per year and has maintained a dividend payout ratio of 45% for several years. The current earnings per share of the company is 80c per share and its earnings have grown at an average rate of 4·5% per year in recent years.

The ex div share price of KFP Co is $4·20 per share and it has an equity beta of 1·2. The 7% bonds of the company are trading on an ex interest basis at $94·74 per $100 bond. The price/earnings ratio of KFP Co is eight times.

The directors of KFP Co believe a cash offer for the shares of NGN would have the best chance of success. It has been suggested that a cash offer could be financed by debt.

Required:

(a) Calculate the weighted average cost of capital of KFP Co on a market value weighted basis. (10 marks)

(b) Calculate the total value of the target company, NGN, using the following valuation methods:

(i) Price/earnings ratio method, using the price/earnings ratio of KFP Co; and

(ii) Dividend growth model. (6 marks)

(c) Discuss the relationship between capital structure and weighted average cost of capital, and comment on

the suggestion that debt could be used to finance a cash offer for NGN. (9 marks)

第4题

【题目描述】

有一块布,第一次用去全长的30%,第二次用去全长的1/3,第一次用去的比第二次少2米,这块布全长多少米?( )A.60

B.80

C.100

D.120

| 【我提交的答案】: C |

| 【参考答案与解析】: 正确答案:A |

解析:由题意可知:2÷(1/3-3/10)=60。故选A。

【我的疑问】

为什么用2除以(3分之1-10分之3)

第5题

to other investment

appraisal methods such as payback, return on capital employed and internal rate of return. (9 marks)

第6题

indings. (5 marks)

第7题

nagers to

endeavour to meet the objectives of the company. Your answer should refer to:

(i) setting targets for financial performance;

(ii) participation in the budget-setting process. (12 marks)

第8题

nth period, and the value

of cost of sales for the period. (3 marks)

第9题

(b) Discuss how the operating statement you have produced can assist managers in:

(i) controlling variable costs;

(ii) controlling fixed production overhead costs. (8 marks)

第10题

o obtain additional

funding to finance an expansion of business operations. (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!