重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

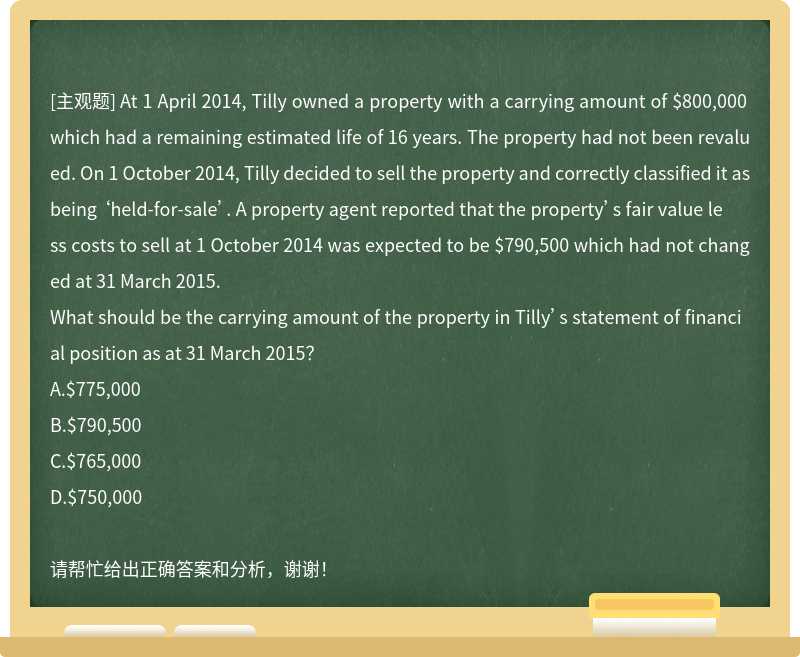

What should be the carrying amount of the property in Tilly’s statement of financial position as at 31 March 2015?

A.$775,000

B.$790,500

C.$765,000

D.$750,000

更多“At 1 April 2014, Tilly owned a property with a carrying amount of $800,000 which had a rem”相关的问题

更多“At 1 April 2014, Tilly owned a property with a carrying amount of $800,000 which had a rem”相关的问题

第1题

rnings were $200,000. During the year ended 31 March 2015, Zeta purchased goods from Wilmslow totalling $320,000. At 31 March 2015, one quarter of these goods were still in the inventory of Zeta. Wilmslow applies a mark-up on cost of 25% to all of its sales.

At 31 March 2015, the retained earnings of Wilmslow and Zeta were $450,000 and $340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A.$706,000

B.$542,000

C.$498,000

D.$546,000

第2题

to be eliminated from the consolidated financial statements under IFRS.

Which of the following statements about intra-group profits in consolidated financial statements is/are correct?

(i) The profit made by a parent on the sale of goods to a subsidiary is only realised when the subsidiary sells the goods to a third party

(ii) Eliminating intra-group unrealised profits never affects non-controlling interests

(iii) The profit element of goods supplied by the parent to an associate and held in year-end inventory must be eliminated in full

A.(i) only

B.(i) and (ii)

C.(ii) and (iii)

D.(iii) only

第3题

ing terms:

The selling price of the car was $25,300. Latterly paid $12,650 (half of the cost) on 1 April 2014 and would pay the remaining $12,650 on 31 March 2016 (two years after the sale). Hindberg’s cost of capital is 10% per annum.

What is the total amount which Hindberg should credit to profit or loss in respect of this transaction in the year ended 31 March 2015?

A.$23,105

B.$23,000

C.$20,909

D.$24,150

第4题

ASB’s Conceptual framework for financial reporting.

Which of the following accounting treatments correctly applies the principle of faithful representation?

A.Reporting a transaction based on its legal status rather than its economic substance

B.Excluding a subsidiary from consolidation because its activities are not compatible with those of the rest of the group

C.Recording the whole of the net proceeds from the issue of a loan note which is potentially convertible to equity shares as debt (liability)

D.Allocating part of the sales proceeds of a motor vehicle to interest received even though it was sold with 0% (interest free) finance

第5题

e the financial statements were authorised for issue.

Which would be treated as a NON-adjusting event under IAS 10 Events After the Reporting Period?

A.A public announcement in April 2015 of a formal plan to discontinue an operation which had been approved by the board in February 2015

B.The settlement of an insurance claim for a loss sustained in December 2014

C.Evidence that $20,000 of goods which were listed as part of the inventory in the statement of financial position as at 31 March 2015 had been stolen

D.A sale of goods in April 2015 which had been held in inventory at 31 March 2015. The sale was made at a price below its carrying amount at 31 March 2015

第6题

Which of the following statements relating to intangible assets is true?

A.All intangible assets must be carried at amortised cost or at an impaired amount; they cannot be revalued upwards

B.The development of a new process which is not expected to increase sales revenues may still be recognised as an intangible asset

C.Expenditure on the prototype of a new engine cannot be classified as an intangible asset because the prototype has been assembled and has physical substance

D.Impairment losses for a cash generating unit are first applied to goodwill and then to other intangible assets before being applied to tangible assets

第7题

rofit margin compared to the previous year?

A.An increase in gearing leading to higher interest costs

B.A reduction in the allowance for uncollectible receivables

C.A decision to value inventory on the average cost basis from the first in first out (FIFO) basis. Unit prices of inventory had risen during the current year

D.A change from the amortisation of development costs being included in cost of sales to being included in administrative expenses

第8题

Germane has a number of relationships with other companies.

In which of the following relationships is Germane necessarily the parent company?

(i) Foll has 50,000 non-voting and 100,000 voting equity shares in issue with each share receiving the same dividend. Germane owns all of Foll’s non-voting shares and 40,000 of its voting shares

(ii) Kipp has 1 million equity shares in issue of which Germane owns 40%. Germane also owns $800,000 out of $1 million 8% convertible loan notes issued by Kipp. These loan notes may be converted on the basis of 40 equity shares for each $100 of loan note, or they may be redeemed in cash at the option of the holder

(iii) Germane owns 49% of the equity shares in Polly and 52% of its non-redeemable preference shares. As a result of these investments, Germane receives variable returns from Polly and has the ability to affect these returns through its power over Polly

A.(i) only

B.(i) and (ii) only

C.(ii) and (iii) only

D.All three

第9题

Which of the following transactions would increase Jasim’s gearing compared to what it would have been had the transaction NOT taken place?

Gearing should be taken as debt/(debt + equity). Each transaction should be considered separately.

A.During the year a property was revalued upwards by $20,000

B.A bonus issue of equity shares of 1 for 4 was made during the year using other components of equity

C.A provision for estimated damages was reduced during the year from $21,000 to $15,000 based on the most recent legal advice

D.An asset with a fair value of $25,000 was acquired under a finance lease on 31 March 2015

第10题

Johnson paid $1·2 million for a 30% investment in Treem’s equity shares on 1 August 2014.

Treem’s profit after tax for the year ended 31 March 2015 was $750,000. On 31 March 2015, Treem had $300,000 goods in its inventory which it had bought from Johnson in March 2015. These had been sold by Johnson at a mark-up on cost of 20%. Treem has not paid any dividends.

On the assumption that Treem is an associate of Johnson, what would be the carrying amount of the investment in Treem in the consolidated statement of financial position of Johnson as at 31 March 2015?

A.$1,335,000

B.$1,332,000

C.$1,300,000

D.$1,410,000

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!