重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which of the following statements are correct?

(1) Co X is the taxpayer for China enterprise income tax (EIT)

(2) Co Y is the withholding agent for China EIT

(3) Co A is the withholding agent for China EIT

(4) The EIT should be filed at the place where Co

A.is located A 1 and 2

B.1, 3 and 4

C.1 and 4 only

D.3 and 4 only

更多“Co X, a US company, owned 30% of the equity of a Chinese company, Co A. Co X sold all of t”相关的问题

更多“Co X, a US company, owned 30% of the equity of a Chinese company, Co A. Co X sold all of t”相关的问题

第1题

第2题

(a) Defi ne the going concern assumption. (2 marks)

Medimade Co is an established pharmaceutical company that has for many years generated 90% of its revenue through the sale of two specifi c cold and fl u remedies. Medimade has lately seen a real growth in the level of competition that it faces in its market and demand for its products has signifi cantly declined. To make matters worse, in the past the company has not invested suffi ciently in new product development and so has been trying to remedy this by recruiting suitably trained scientifi c staff, but this has proved more diffi cult than anticipated.

In addition to recruiting staff the company also needed to invest $2m in plant and machinery. The company wanted to borrow this sum but was unable to agree suitable terms with the bank; therefore it used its overdraft facility, which carried a higher interest rate. Consequently, some of Medimade’s suppliers have been paid much later than usual and hence some of them have withdrawn credit terms meaning the company must pay cash on delivery. As a result of the above the company’s overdraft balance has grown substantially.

The directors have produced a cash fl ow forecast and this shows a signifi cantly worsening position over the coming 12 months.

The directors have informed you that the bank overdraft facility is due for renewal next month, but they are confi dent that it will be renewed. They also strongly believe that the new products which are being developed will be ready to market soon and hence trading levels will improve and therefore that the company is a going concern. Therefore they do not intend to make any disclosures in the accounts regarding going concern.

Required:

(b) Identify any potential indicators that the company is not a going concern and describe why these could impact upon the ability of the company to continue trading on a going concern basis. (8 marks)

(c) Explain the audit procedures that the auditor of Medimade should perform. in assessing whether or not the company is a going concern. (6 marks)

(d) The auditors have been informed that Medimade’s bankers will not make a decision on the overdraft facility until after the audit report is completed. The directors have now agreed to include going concern disclosures.

Required:

Describe the impact on the audit report of Medimade if the auditor believes the company is a going concern but a material uncertainty exists. (4 marks)

第3题

第4题

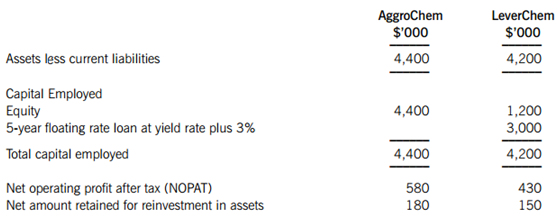

AggroChem is a fully listed company fi nanced wholly by equity. LeverChem is listed on an alternative investment market. Both companies have been trading for over 10 years and have shown strong levels of profi tability recently. However, both companies’ shares are thinly traded. It is thought that the current market value of LeverChem’s shares at higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

higher than the book value is accurate, but it is felt that AggroChem shares are not quoted accurately by the market.

The following information is taken from the fi nancial statements of both companies at the start of the current year:

It can be assumed that the retained earnings for both companies are equal to the net reinvestment in assets.

The assets of both companies are stated at fair value. Discussions with the AtReast Bank have led to an agreement that the fl oating rate loan to LeverChem can be transferred to the combined business on the same terms. The current yield rate is 5% and the current equity risk premium is 6%. It can be assumed that the risk free rate of return is equivalent to the yield rate. AggroChem’s beta has been estimated to be 1·26.

AggroChem Co wants to use the Black-Scholes option pricing (BSOP) model to assess the value of the combined business and the maximum premium payable to LeverChem’s shareholders. AggroChem has conducted a review of the volatility of the NOPAT values of both companies since both were formed and has estimated that the volatility of the combined business assets, if the acquisition were to go ahead, would be 35%. The exercise price should be calculated as the present value of a discount (zero-coupon) bond with an identical yield and term to maturity of the current bond.

Required:

Prepare a report for the management of AggroChem on the valuation of the combined business following acquisition and the maximum premium payable to the shareholders of LeverChem. Your report should:

(i) Using the free cash fl ow model, estimate the market value of equity for AggroChem Co, explaining any assumptions made. (9 marks)

(ii) Explain the circumstances in which the Black-Scholes option pricing (BSOP) model could be used to assess the value of a company, including the data required for the variables used in the model. (5 marks)

(iii) Using the BSOP methodology, estimate the maximum price and premium AggroChem may pay for LeverChem. (9 marks)

(iv) Discuss the appropriateness of the method used in part (iii) above, by considering whether the BSOP model can provide a meaningful value for a company. (5 marks)

Professional marks will be awarded in question 2 for the clarity and presentation of the report. (4 marks)

第5题

He was offered the opportunity to

A.take over a company called Brinscombe's.

B.invest his own money in a new company.

C.set up a company for someone else.

第6题

Case One

Lignum Co regularly trades with companies based in Zuhait, a small country in South America whose currency is the Zupesos (ZP). It recently sold machinery for ZP140 million, which it is about to deliver to a company based there. It is expecting full payment for the machinery in four months. Although there are no exchange traded derivative products available for the Zupesos, Medes Bank has offered Lignum Co a choice of two over-the-counter derivative products.

The first derivative product is an over-the-counter forward rate determined on the basis of the Zuhait base rate of 8·5% plus 25 basis points and the French base rate of 2·2% less 30 basis points.

Alternatively, with the second derivative product Lignum Co can purchase either Euro call or put options from Medes Bank at an exercise price equivalent to the current spot exchange rate of ZP142 per €1. The option premiums offered are: ZP7 per €1 for the call option or ZP5 per €1 for the put option.

The premium cost is payable in full at the commencement of the option contract. Lignum Co can borrow money at the base rate plus 150 basis points and invest money at the base rate minus 100 basis points in France.

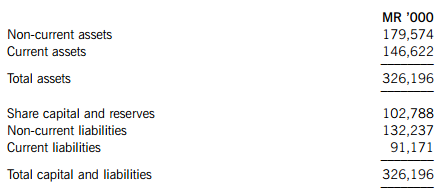

Case Two Namel Co is Lignum Co’s subsidiary company based in Maram, a small country in Asia, whose currency is the Maram Ringit (MR). The current pegged exchange rate between the Maram Ringit and the Euro is MR35 per €1. Due to economic difficulties in Maram over the last couple of years, it is very likely that the Maram Ringit will devalue by 20% imminently. Namel Co is concerned about the impact of the devaluation on its Statement of Financial Position.

Given below is an extract from the current Statement of Financial Position of Namel Co.

The current assets consist of inventories, receivables and cash. Receivables account for 40% of the current assets. All the receivables relate to sales made to Lignum Co in Euro. About 70% of the current liabilities consist of payables relating to raw material inventory purchased from Lignum Co and payable in Euro. 80% of the non-current liabilities consist of a Euro loan and the balance are borrowings sourced from financial institutions in Maram.

Case Three

Lignum Co manufactures a range of farming vehicles in France which it sells within the European Union to countries which use the Euro. Over the previous few years, it has found that its sales revenue from these products has been declining and the sales director is of the opinion that this is entirely due to the strength of the Euro. Lignum Co’s biggest competitor in these products is based in the USA and US$ rate has changed from almost parity with the Euro three years ago, to the current value of US$1·47 for €1. The agreed opinion is that the US$ will probably continue to depreciate against the Euro, but possibly at a slower rate, for the foreseeable future.

Required:

Prepare a report for Lignum Co’s treasury division that:

(i) Briefly explains the type of currency exposure Lignum Co faces for each of the above cases; (3 marks)

(ii) Recommends which of the two derivative products Lignum Co should use to manage its exposure in case one and advises on alternative hedging strategies that could be used. Show all relevant calculations; (9 marks)

(iii) Computes the gain or loss on Namel Co’s Statement of Financial Position, due to the devaluation of the Maram Ringit in case two, and discusses whether and how this exposure should be managed; (8 marks)

(iv) Discusses how the exposure in case three can be managed. (3 marks) Professional marks will be awarded in question 2 for the structure and presentation of the report. (4 marks)

第7题

In April 1986,X,a Chinese Radio Component Factory signed a contract in Beijing withY,(a US company)for a capacitor production line worth 1 7 million Yuan.The equipment was to have been delivered before April 30,1 987.But it did not arrive even by Septembe

Since Y is an absent defendant residing outside the Chinese territory。in view of the principle“the plaintiff follows the forum of the defendant”incorporated in Chinese proce.dure law,does the People’S Court have jurisdiction over such a case?Why?

第8题

Introduction

The following is an interview with Mick Kazinski, a senior marketing executive with Bridge Co, a Deeland-based construction company. It concerns their purchase of Custcare, a Customer Relationship Management (CRM) software package written by the Custcare Corporation, a software company based in Solland, a country some 4,000 km away from Deeland. The interview was originally published in the Management Experiences magazine.

Interviewer: Thanks for talking to us today Mick. Can you tell us how Bridge Co came to choose the Custcare software package?

Mick: Well, we didn’t choose it really. Teri Porter had just joined the company as sales and marketing director. She had recently implemented the Custcare package at her previous company and she was very enthusiastic about it. When she found out that we did not have a CRM package at Bridge Co, she suggested that we should also buy the Custcare package as she felt that our requirements were very similar to those of her previous company. We told her that any purchase would have to go through our capex (capital expenditure) system as the package cost over $20,000. Here at Bridge Co, all capex applications have to be accompanied by a formal business case and an Invitation to Tender (ITT) has to be sent out to at least three potential suppliers. However, Teri is a very clever lady. She managed to do a deal with Custcare and they agreed to supply the package at a cost of $19,995, just under the capex threshold. Teri had to cut a few things out. For example, we declined the training courses (Teri said the package was an easy one to use and she would show us how to use it) and also we opted for the lowest level of support, something we later came to regret. Overall, we were happy. We knew that Custcare was a popular and successful CRM package.

Interviewer: So, did you have a demonstration of the software before you bought it?

Mick: Oh yes, and everyone was very impressed. It seemed to do all the things we would ever want it to do and, in fact, it gave us some ideas about possibilities that we would never have thought of. Also, by then, it was clear that our internal IT department could not provide us with a bespoke solution. Teri had spoken to them informally and she was told that they could not even look at our requirements for 18 months. In contrast, we could be up and running with the Custcare package within three months. Also, IT quoted an internal transfer cost of $18,000 for just defining our requirements. This was almost as much as we were paying for the whole software solution!

Interviewer: When did things begin to go wrong?

Mick: Well, the implementation was not straightforward. We needed to migrate some data from our current established systems and we had no-one who could do it. We tried to recruit some local technical experts, but Custcare pointed out that we had signed their standard contract which only permitted Custcare consultants to work on such tasks. We had not realised this, as nobody had read the contract carefully. In the end, we had to give in and it cost us $10,000 in fees to migrate the data from some of our internal systems to the new package. Teri managed to get the money out of the operational budget, but we weren’t happy.

We then tried to share data between the Custcare software and our existing order processing system. We thought this would be easy, but apparently the file formats are incompatible. Thus we have to enter customer information into two systems and we are unable to exploit the customer order analysis facility of the Custcare CRM.

Finally, although we were happy with the functionality and reliability of the Custcare software, it works very slowly. This is really very disappointing. Some reports and queries have to be aborted because the software appears to have hung. The software worked very quickly in the demonstration, but it is painfully slow now that it is installed on our IT platform.

Interviewer: What is the current situation?

Mick: Well, we are all a bit deflated and disappointed in the package. The software seems reasonable enough, but its poor performance and our inability to interface it to the order processing system have reduced users’ confidence in the system. Because users have not been adequately trained, we have had to phone Custcare’s support desk more than we should. However, as I said before, we took the cheapest option. This is for a help line to be available from 8.00 hrs to 17.00 hrs Solland time. As you know, Solland is in a completely different time zone and so we have had to stay behind at work and contact them in the late evening. Again, nobody had closely read the terms of the contract. We have taken legal advice, but we have also found that, for dispute resolution, the contract uses the commercial contract laws of Solland. Nobody in Bridge Co knows what these are! Our solicitor said that we should have asked for this specification to be changed when the contract was drawn up. I just wish we had chosen a product produced by a company here in Deeland. It would have made it much easier to resolve issues and disputes.

Interviewer: What does Teri think?

Mick: Not a lot! She has left us to rejoin her old company in a more senior position. The board did ask her to justify her purchase of the Custcare CRM package, but I don’t think she ever did. I am not sure that she could!

Required:

(a) Suggest a process for evaluating, selecting and implementing a software package solution and explain how this process would have prevented the problems experienced at Bridge Co in the Custcare CRM application. (15 marks)

(b) The CEO of Bridge Co now questions whether buying a software package was the wrong approach to meeting the CRM requirements at Bridge Co. He wonders whether they should have commissioned a bespoke software system instead.

Explain, with reference to the CRM project at Bridge Co, the advantages of adopting a software package approach to fulfilling business system requirements compared with a bespoke software solution. (10 marks)

第9题

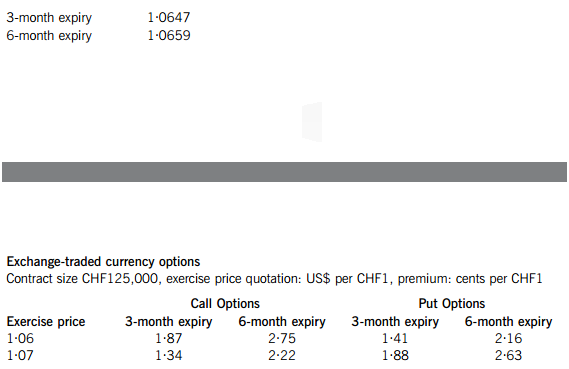

Section A – This ONE question is compulsory and MUST be attempted

Cocoa-Mocha-Chai (CMC) Co is a large listed company based in Switzerland and uses Swiss Francs as its currency. It imports tea, coffee and cocoa from countries around the world, and sells its blended products to supermarkets and large retailers worldwide. The company has production facilities located in two European ports where raw materials are brought for processing, and from where finished products are shipped out. All raw material purchases are paid for in US dollars (US$), while all sales are invoiced in Swiss Francs (CHF).

Until recently CMC Co had no intention of hedging its foreign currency exposures, interest rate exposures or commodity price fluctuations, and stated this intent in its annual report. However, after consultations with senior and middle managers, the company’s new Board of Directors (BoD) has been reviewing its risk management and operations strategies.

The following two proposals have been put forward by the BoD for further consideration:

Proposal one

Setting up a treasury function to manage the foreign currency and interest rate exposures (but not commodity price fluctuations) using derivative products. The treasury function would be headed by the finance director. The purchasing director, who initiated the idea of having a treasury function, was of the opinion that this would enable her management team to make better decisions. The finance director also supported the idea as he felt this would increase his influence on the BoD and strengthen his case for an increase in his remuneration.

In order to assist in the further consideration of this proposal, the BoD wants you to use the following upcoming foreign currency and interest rate exposures to demonstrate how they would be managed by the treasury function:

(i) a payment of US$5,060,000 which is due in four months’ time; and

(ii) a four-year CHF60,000,000 loan taken out to part-fund the setting up of four branches (see proposal two below). Interest will be payable on the loan at a fixed annual rate of 2·2% or a floating annual rate based on the yield curve rate plus 0·40%. The loan’s principal amount will be repayable in full at the end of the fourth year.

Proposal two

This proposal suggested setting up four new branches in four different countries. Each branch would have its own production facilities and sales teams. As a consequence of this, one of the two European-based production facilities will be closed. Initial cost-benefit analysis indicated that this would reduce costs related to production, distribution and logistics, as these branches would be closer to the sources of raw materials and also to the customers. The operations and sales directors supported the proposal, as in addition to above, this would enable sales and marketing teams in the branches to respond to any changes in nearby markets more quickly. The branches would be controlled and staffed by the local population in those countries. However, some members of the BoD expressed concern that such a move would create agency issues between CMC Co’s central management and the management controlling the branches. They suggested mitigation strategies would need to be established to minimise these issues.

Response from the non-executive directors

When the proposals were put to the non-executive directors, they indicated that they were broadly supportive of the second proposal if the financial benefits outweigh the costs of setting up and running the four branches. However, they felt that they could not support the first proposal, as this would reduce shareholder value because the costs related to undertaking the proposal are likely to outweigh the benefits.

Additional information relating to proposal one

The current spot rate is US$1·0635 per CHF1. The current annual inflation rate in the USA is three times higher than Switzerland.

The following derivative products are available to CMC Co to manage the exposures of the US$ payment and the interest on the loan:

Exchange-traded currency futures

Contract size CHF125,000 price quotation: US$ per CHF1

It can be assumed that futures and option contracts expire at the end of the month and transaction costs related to these can be ignored.

Over-the-counter products

In addition to the exchange-traded products, Pecunia Bank is willing to offer the following over-the-counter derivative products to CMC Co:

(i) A forward rate between the US$ and the CHF of US$ 1·0677 per CHF1.

(ii) An interest rate swap contract with a counterparty, where the counterparty can borrow at an annual floating rate based on the yield curve rate plus 0·8% or an annual fixed rate of 3·8%. Pecunia Bank would charge a fee of 20 basis points each to act as the intermediary of the swap. Both parties will benefit equally from the swap contract.

Required:

(a) Advise CMC Co on an appropriate hedging strategy to manage the foreign exchange exposure of the US$ payment in four months’ time. Show all relevant calculations, including the number of contracts bought or sold in the exchange-traded derivative markets. (15 marks)

(b) Demonstrate how CMC Co could benefit from the swap offered by Pecunia Bank. (6 marks)

(c) As an alternative to paying the principal on the loan as one lump sum at the end of the fourth year, CMC Co could pay off the loan in equal annual amounts over the four years similar to an annuity. In this case, an annual interest rate of 2% would be payable, which is the same as the loan’s gross redemption yield (yield to maturity).

Required: Calculate the modified duration of the loan if it is repaid in equal amounts and explain how duration can be used to measure the sensitivity of the loan to changes in interest rates. (7 marks)

(d) Prepare a memorandum for the Board of Directors (BoD) of CMC Co which:

(i) Discusses proposal one in light of the concerns raised by the non-executive directors; and (9 marks)

(ii) Discusses the agency issues related to proposal two and how these can be mitigated. (9 marks)

Professional marks will be awarded in part (d) for the presentation, structure, logical flow and clarity of the memorandum. (4 marks)

第10题

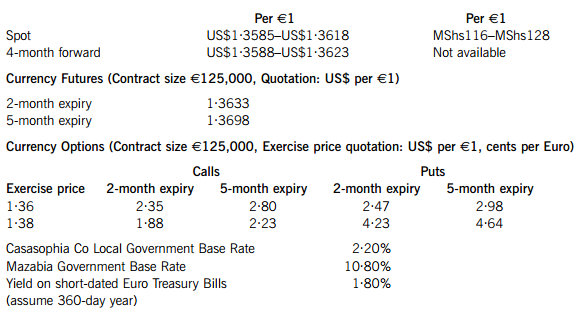

Casasophia Co, based in a European country that uses the Euro (€), constructs and maintains advanced energy efficient commercial properties around the world. It has just completed a major project in the USA and is due to receive the final payment of US$20 million in four months.

Casasophia Co is planning to commence a major construction and maintenance project in Mazabia, a small African country, in six months’ time. This government-owned project is expected to last for three years during which time Casasophia Co will complete the construction of state-of-the-art energy efficient properties and provide training to a local Mazabian company in maintaining the properties. The carbon-neutral status of the building project has attracted some grant funding from the European Union and these funds will be provided to the Mazabian government in Mazabian Shillings (MShs).

Casasophia Co intends to finance the project using the US$20 million it is due to receive and borrow the rest through a € loan. It is intended that the US$ receipts will be converted into € and invested in short-dated treasury bills until they are required. These funds plus the loan will be converted into MShs on the date required, at the spot rate at that time.

Mazabia’s government requires Casasophia Co to deposit the MShs2·64 billion it needs for the project, with Mazabia’s central bank, at the commencement of the project. In return, Casasophia Co will receive a fixed sum of MShs1·5 billion after tax, at the end of each year for a period of three years. Neither of these amounts is subject to inflationary increases. The relevant risk adjusted discount rate for the project is assumed to be 12%.

Financial Information

Exchange Rates available to Casasophia

Mazabia’s current annual inflation rate is 9·7% and is expected to remain at this level for the next six months. However, after that, there is considerable uncertainty about the future and the annual level of inflation could be anywhere between 5% and 15% for the next few years. The country where Casasophia Co is based is expected to have a stable level of inflation at 1·2% per year for the foreseeable future. A local bank in Mazabia has offered Casasophia Co the opportunity to swap the annual income of MShs1.5 billion receivable in each of the next three years for Euros, at the estimated annual MShs/€ forward rates based on the current government base rates.

Required:

(a) Advise Casasophia Co on, and recommend, an appropriate hedging strategy for the US$ income it is due to receive in four months. Include all relevant calculations. (15 marks)

(b) Provide a reasoned estimate of the additional amount of loan finance Casasophia Co needs to obtain to undertake the project in Mazabia in six months. (5 marks)

(c) Given that Casasophia Co agrees to the local bank’s offer of the swap, calculate the net present value of the project, in six months’ time, in €. Discuss whether the swap would be beneficial to Casasophia Co. (10 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!