重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Secure Net (SN) manufacture security cards that restrict access to government owned buildings around the world.

The standard cost for the plastic that goes into making a card is $4 per kg and each card uses 40g of plastic after an allowance for waste. In November 100,000 cards were produced and sold by SN and this was well above the budgeted sales of 60,000 cards.

The actual cost of the plastic was $5·25 per kg and the production manager (who is responsible for all buying and production issues) was asked to explain the increase. He said ‘World oil price increases pushed up plastic prices by 20% compared to our budget and I also decided to use a different supplier who promised better quality and increased reliability for a slightly higher price. I know we have overspent but not all the increase in plastic prices is my fault’ The actual usage of plastic per card was 35g per card and again the production manager had an explanation. He said ‘The world-wide standard size for security cards increased by 5% due to a change in the card reader technology, however, our new supplier provided much better quality of plastic and this helped to cut down on the waste.’

SN operates a just in time (JIT) system and hence carries very little inventory.Required:

(a) Calculate the total material price and total material usage variances ignoring any possible planning error in the figures. (4 marks)

(b) Analyse the above total variances into component parts for planning and operational variances in as much detail as the information allows. (8 marks)

(c) Assess the performance of the production manager. (8 marks)

更多“Secure Net (SN) manufacture security cards that restrict access to government owned buildi”相关的问题

更多“Secure Net (SN) manufacture security cards that restrict access to government owned buildi”相关的问题

第1题

t on temporary workers, whom it hires on three-month contracts whenever production requirements increase. All buying of materials is the responsibility of the company’s purchasing department and the company’s policy is to hold low levels of raw materials in order to minimise inventory holding costs. Bokco uses cost plus pricing to set the selling prices for its products once an initial cost card has been drawn up. Prices are then reviewed on a quarterly basis. Detailed variance reports are produced each month for sales, material costs and labour costs. Departmental managers are then paid a monthly bonus depending on the performance of their department.

One month ago, Bokco began production of a new product. The standard cost card for one unit was drawn up to include a cost of $84 for labour, based on seven hours of labour at $12 per hour. Actual output of the product during the first month of production was 460 units and the actual time taken to manufacture the product totalled 1,860 hours at a total cost of $26,040.

After being presented with some initial variance calculations, the production manager has realised that the standard time per unit of seven hours was the time taken to produce the first unit and that a learning rate of 90% should have been anticipated for the first 1,000 units of production. He has consequently been criticised by other departmental managers who have said that, ‘He has no idea of all the problems this has caused.’

Required:

(a) Calculate the labour efficiency planning variance and the labour efficiency operational variance AFTER taking account of the learning effect. Note: The learning index for a 90% learning curve is –0·1520 (5 marks)

(b) Discuss the likely consequences arising from the production manager’s failure to take into account the learning effect before production commenced. (5 marks)

第2题

elds before paying. F Co is concerned that a large number of customers are eating some of the fruit whilst picking it and are therefore not paying for all of it. As a result, it has to decide whether to hire staff to pick and package the fruit instead. The following values and costs have been identified:

(i) The total sales value of the fruit currently picked and paid for by customers

(ii) The cost of growing the fruit

(iii) The cost of hiring staff to pick and package the fruit

(iv) The total sales value of the fruit if it is picked and packaged by staff instead

Which of the above are relevant to the decision?

A.All of the above

B.(ii), (iii) and (iv) only

C.(i), (ii) and (iv) only

D.(i), (iii) and (iv) only

第3题

c life of the equipment is expected to be 50 years, with no resale value at the end of the period. The forecast return on the initial investment is 15% per annum before depreciation. The division’s cost of capital is 7%.

What is the expected annual residual income of the initial investment?

A.$0

B.($270,000)

C.$162,000

D.$216,000

第4题

ing a new design of massaging chair to launch into the competitive market in which they operate.

They have carried out an investigation in the market and using a target costing system have targeted a competitive selling price of $120 for the chair. BCC wants a margin on selling price of 20% (ignoring any overheads).

The frame. and massage mechanism will be bought in for $51 per chair and BCC will upholster it in leather and assemble it ready for despatch.

Leather costs $10 per metre and two metres are needed for a complete chair although 20% of all leather is wasted in the upholstery process.

The upholstery and assembly process will be subject to a learning effect as the workers get used to the new design.

BCC estimates that the first chair will take two hours to prepare but this will be subject to a learning rate (LR) of 95%.

The learning improvement will stop once 128 chairs have been made and the time for the 128th chair will be the time for all subsequent chairs. The cost of labour is $15 per hour.

The learning formula is shown on the formula sheet and at the 95% learning rate the value of b is -0·074000581.

Required:

(a) Calculate the average cost for the first 128 chairs made and identify any cost gap that may be present at

that stage. (8 marks)

(b) Assuming that a cost gap for the chair exists suggest four ways in which it could be closed. (6 marks)

The production manager denies any claims that a cost gap exists and has stated that the cost of the 128th chair will be low enough to yield the required margin.

(c) Calculate the cost of the 128th chair made and state whether the target cost is being achieved on the 128th chair. (6 marks)

第5题

ar market. The store has previously only opened for six days per week for the 50 working weeks in the year, but B&P is now considering also opening on Sundays.

The sales of the business on Monday through to Saturday averages at $10,000 per day with average gross profit of 70% earned.B&P expects that the gross profit % earned on a Sunday will be 20 percentage points lower than the average earned on the other days in the week. This is because they plan to offer substantial discounts and promotions on a Sunday to attract customers. Given the price reduction, Sunday sales revenues are expected to be 60% more than the average daily sales revenues for the other days. These Sunday sales estimates are for new customers only, with no allowance being made for those customers that may transfer from other days.

B&P buys all its goods from one supplier. This supplier gives a 5% discount on all purchases if annual spend exceeds $1,000,000. It has been agreed to pay time and a half to sales assistants that work on Sundays. The normal hourly rate is $20 per hour. In total five sales assistants will be needed for the six hours that the store will be open on a Sunday. They will also be able to take a half-day off (four hours) during the week. Staffing levels will be allowed to reduce slightly during the week to avoid extra costs being incurred.

The staff will have to be supervised by a manager, currently employed by the company and paid an annual salary of $80,000. If he works on a Sunday he will take the equivalent time off during the week when the assistant manager is available to cover for him at no extra cost to B&P. He will also be paid a bonus of 1% of the extra sales generated on the Sunday project.

The store will have to be lit at a cost of $30 per hour and heated at a cost of $45 per hour. The heating will come on two hours before the store opens in the 25 ‘winter’ weeks to make sure it is warm enough for customers to come in at opening time. The store is not heated in the other weeks

The rent of the store amounts to $420,000 per annum.

Required:

(a) Calculate whether the Sunday opening incremental revenue exceeds the incremental costs over a year (ignore inventory movements) and on this basis reach a conclusion as to whether Sunday opening is financially justifiable. (12 marks)

(b) Discuss whether the manager’s pay deal (time off and bonus) is likely to motivate him. (4 marks)

(c) Briefly discuss whether offering substantial price discounts and promotions on Sunday is a good suggestion.(4 marks)

第6题

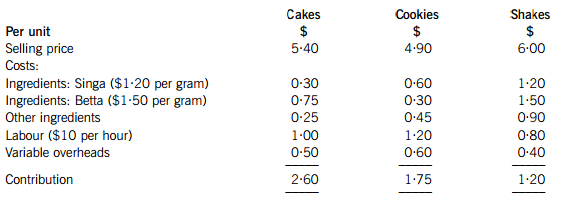

CSC Co is a health food company producing and selling three types of high-energy products: cakes, shakes and cookies, to gyms and health food shops. Shakes are the newest of the three products and were first launched three months ago. Each of the three products has two special ingredients, sourced from a remote part the world. The first of these, Singa, is a super-energising rare type of caffeine. The second, Betta, is derived from an unusual plant believed to have miraculous health benefits.

CSC Co’s projected manufacture costs and selling prices for the three products are as follows:

For each of the three products, the expected demand for the next month is 11,200 cakes, 9,800 cookies and 2,500 shakes.

The total fixed costs for the next month are $3,000.

CSC Co has just found out that the supply of Betta is going to be limited to 12,000 grams next month. Prior to this, CSC Co had signed a contract with a leading chain of gyms, Encompass Health, to supply it with 5,000 shakes each month, at a discounted price of $5·80 per shake, starting immediately. The order for the 5,000 shakes is not included in the expected demand levels above.

Required:

(a) Assuming that CSC Co keeps to its agreement with Encompass Health, calculate the shortage of Betta, the resulting optimum production plan and the total profit for next month. (6 marks)

One month later, the supply of Betta is still limited and CSC Co is considering whether it should breach its contract with Encompass Health so that it can optimise its profits.

Required:

(b) Discuss whether CSC Co should breach the agreement with Encompass Health.

Note: No further calculations are required. (4 marks)

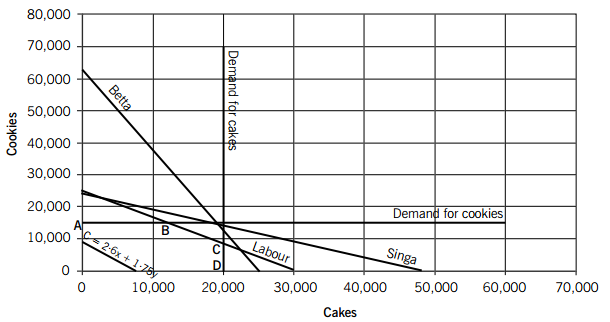

Several months later, the demand for both cakes and cookies has increased significantly to 20,000 and 15,000 units per month respectively. However, CSC Co has lost the contract with Encompass Health and, after suffering from further shortages of supply of Betta, Singa and of its labour force, CSC Co has decided to stop making shakes at all. CSC Co now needs to use linear programming to work out the optimum production plan for cakes and cookies for the coming month. The variable ‘x’ is being used to represent cakes and the variable ‘y’ to represent cookies.

The following constraints have been formulated and a graph representing the new production problem has been drawn:

Singa: 0·25x + 0·5y ≤ 12,000

Betta: 0·5x + 0·2y ≤ 12,500

Labour: 0·1x + 0·12y ≤ 3,000

x ≤ 20,000

y ≤ 15,000

x, y ≥ 0

Required:

(c) (i) Explain what the line labelled ‘C = 2·6x + 1·75y’ on the graph is and what the area represented by the points 0ABCD means. (4 marks)

(ii) Explain how the optimum production plan will be found using the line labelled ‘C = 2·6x + 1·75y’ and identify the optimum point from the graph. (2 marks)

(iii) Explain what a slack value is and identify, from the graph, where slack will occur as a result of the optimum production plan. (4 marks)

Note: No calculations are needed for part (c).

第7题

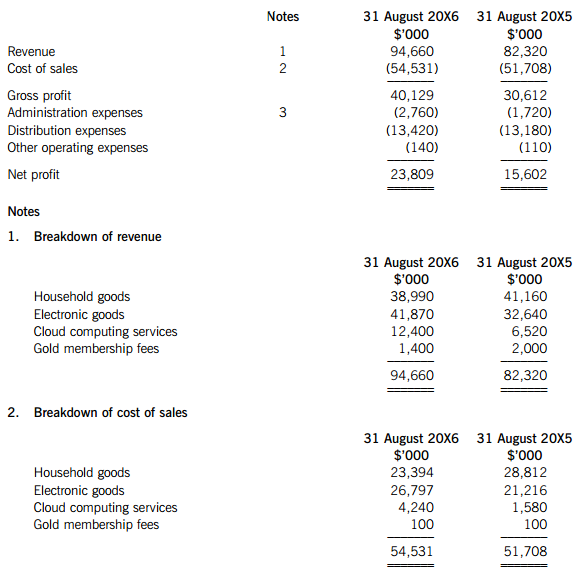

ange of household and electronic goods for some years. One year ago, it began using new suppliers from the country of Slabak, where labour is very cheap, for many of its household goods. In 20X4, Jungle Co also became a major provider of ‘cloud computing’ services, investing heavily in cloud technology. These services provide customers with a way of storing and accessing data and programs over the internet rather than on their computers’ hard drives.

All Jungle Co customers have the option to sign up for the company’s ‘Gold’ membership service, which provides next day delivery on all orders, in return for an annual service fee of $40. In September 20X5, Jungle Co formed its own logistics company and took over the delivery of all of its parcels, instead of using the services of international delivery companies.

Over the last year, there has been worldwide growth in the electronic goods market of 20%. Average growth rates and gross profit margins for cloud computing service providers have been 50% and 80% respectively in the last year. Jungle Co’s prices have remained stable year on year for all sectors of its business, with price competitiveness being crucial to its continuing success as the leading global electronic retailer.

The following information is available for Jungle Co for the last two financial years:

3. Administration expenses

Included in these costs are the costs of running the customer service department ($860,000 in 20X5; $1,900,000 in 20X6.) This department deals with customer complaints.

4. Non-financial data

Required:

Discuss the financial and non-financial performance of Jungle Co for the year ending 31 August 20X6.

Note: There are 7 marks available for calculations and 13 marks available for discussion.

第8题

ertaken to close a cost gap on its computer games.

Which of the following would be appropriate ways for Helot Co to close a cost gap?

(1) Buy cheaper, lower grade plastic for the game discs and cases

(2) Using standard components wherever possible in production

(3) Employ more trainee game designers on lower salaries

(4) Use the company’s own online gaming websites for marketing

A.1, 2 and 3

B.1, 3 and 4

C.2 and 4

D.2 and 3 only

第9题

What is the forecast cost gap for the new game?

A.$2·05

B.$0·00

C.$13·70

D.$29·25

第10题

the finance director has realised that a 95% learning rate should be applied.

Which of the following statements is true?

A.The target cost will decrease and the cost gap will increase

B.The target cost will increase and the cost gap will decrease

C.The target cost will remain the same and the cost gap will increase

D.The target cost will remain the same and the cost gap will decrease

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!