重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

ended 30 September 2005:

Trading loss

The trading loss is £32,800. This figure is before taking account of capital allowances.

The equipment sold on 1 November 2004 for £12,800 originally cost £27,400. Motor car (2), purchased on

19 May 2005, is a low emission motor car (CO2 emission rate of less than 120 grams per kilometre).

The cost of the new freehold office building purchased on 20 September 2005 included £8,500 for the central

heating system, £7,200 for sprinkler equipment and the fire alarm system, £10,700 for the electrical and lighting

systems, and £7,050 for the ventilation system.

Thai Curry Ltd is a small company as defined by the Companies Acts.

Industrial building

On 1 October 2004 Thai Curry Ltd purchased a second-hand factory for £360,000 (excluding the cost of land). The

factory was originally constructed at a cost of £300,000 (excluding the cost of land), and was first brought into use

for industrial purposes on 1 October 1999. The factory was not used for industrial purposes during the period

1 October 2001 to 31 March 2003, but returned to industrial use from 1 April 2003 until the date of sale. The

previous owner of the factory prepared accounts to 31 March.

Income from property

Thai Curry Ltd lets out two warehouses that are surplus to requirements.

The first warehouse was let from 1 October 2004 until 31 May 2005 at a monthly rent of £2,200. On that date the

tenant left owing two months rent which Thai Curry Ltd was not able to recover. During August 2005 £8,800 was

spent on painting the warehouse. The warehouse was not re-let until 1 October 2005.

The second warehouse was empty from 1 October 2004 until 31 January 2005, but was let from 1 February 2005.

On that date Thai Curry Ltd received a premium of £60,000 for the grant of a four-year lease, and the annual rent of

£18,000 which is payable in advance.

Loan interest received

Loan interest of £8,000 was received on 30 June 2005, and £3,500 was accrued at 30 September 2005. The loan

was made for non-trading purposes.

Dividends received

During the year ended 30 September 2005 Thai Curry Ltd received dividends of £36,000 from African Spice plc, an

unconnected UK company. This figure was the actual cash amount received.

Profit on disposal of shares

On 28 July 2005 Thai Curry Ltd sold 10,000 £1 ordinary shares in African Spice plc, making a capital gain of

£155,300 on the disposal.

Other information

Thai Curry Ltd has three associated companies.

Required:

(a) Calculate Thai Curry Ltd’s tax adjusted trading loss for the year ended 30 September 2005. You should

assume that the company claims the maximum available capital allowances. (14 marks)

更多“1 Thai Curry Ltd is a manufacturer of ready to cook food. The following information is ava”相关的问题

更多“1 Thai Curry Ltd is a manufacturer of ready to cook food. The following information is ava”相关的问题

第1题

(c) (i) State the date by which Thai Curry Ltd’s self-assessment corporation tax return for the year ended

30 September 2005 should be submitted, and advise the company of the penalties that will be due if

the return is not submitted until 31 May 2007. (3 marks)

(ii) State the date by which Thai Curry Ltd’s corporation tax liability for the year ended 30 September 2005

should be paid, and advise the company of the interest that will be due if the liability is not paid until

31 May 2007. (3 marks)

第2题

(b) Assuming that Thai Curry Ltd claims relief for its trading loss against total profits under s.393A ICTA 1988,calculate the company’s corporation tax liability for the year ended 30 September 2005. (10 marks)

第3题

听力原文:M: What is the most popular thing recently in Thailand?

W: Nowadays in Bangkok people are interested in new modern technology like iPod trains anti mobiles.

M: What is the population of Thailand?

W: There are about 65 million in Thailand and most people live in Bangkok because it is the capital city of Thailand.

M: How many different types of Thai curry are there?

W: We have many kind of curry but the most well-known are green curry-like chicken curry and fish ball curry-and red curry, which we call "Pa Neang." And main ingredients are coconut milk, chicken, pork and herb.

M: Do young Thai people know any Japanese musicians?

W: Yes, we know a lot, like Johnny's Junior, Arashi, winds, and Utada Hikaru.

M: Which do young Thai people eat more of, bread, flee, or noodles?

W: Rice is the main food for Thai people. Nowadays we eat more bread and more noodles.

M: What is the most popular sport in Thailand?

W: Thai people like to watch soccer—mostly interested in Premier League, Bundesliga and Calcio Serie A and we like to play badminton too.

M: What do most Thai people eat when they are cold?

W: Thank you for your question. In Thailand it's not too cold in winter but some people love eating Tom Yam Kung in December and January.

M: Do most Thai people like to take photos? Why or why not?

W: Most Thai people like to take photos because Thailand has many beautiful places and beautiful people—so that's why we love to take photos.

(20)

A.They prefer sour food.

B.They prefer sweet food.

C.They prefer salty food.

D.They prefer spicy food.

第4题

Did you know that London is one of the most multicultural cities in the world? Here, there are about 300 different cultures living side by side. Forget tea and sandwiches, now it is more common for a Londoner to drink cappuccino for breakfast, and eat Thai food for lunch in the local pub. Let’s see how life has changed in Britain’s capital.

A India

Most people from India arrived in London in the 1950s and 60s. Now there is a strong Asian presence here – in the shops, markets and, of course, the restaurants. In fact, curry is Britain’s favorite takeaway meal. A typical family has a curry every two weeks, either delivered or bought ready-made from the supermarket. Indian people live all over London. Southall, in the far west of the city, is one of many places well known for its Indian culture.

B Poland

This community represents more than 1% of the UK’s total population and is growing rapidly. In London, many Polish people live in the Hammersmith area, in the west of the city. Here, there are several Catholic churches, and delicatessens which sell the country’s specialities such as beetroot soup (barszcz) or Polish cakes and snacks. Were they right to come? Young Poles say they can easily earn three times as much money here as at home, where unemployment remains high.

C West Africa

West Africans – mainly from Ghana and Nigeria – have brought a wealth of languages, music and culture to the British capital. Many London markets sell their traditional foods like yams and different types of rice. A lot of Nigerians live in the south-east London area, in suburbs like Deptford.

1、When did most people from India arrive in London?

A、The 1950s and 60s.

B、The 1950s.

C、The 1960s.

2、How often does a typical family have a curry?

A、Two times.

B、Every two weeks.

C、Two weeks.

3、Where do many Polish people live?

A、The east of the city.

B、Catholic churches.

C、The Hammersmith area.

4、Why do Polish people come to London?

A、They can earn three times as much money in the UK.

B、Unemployment remains high in the UK.

C、They are growing rapidly.

5、What kind of traditional West Africa foods do markets sell?

A、Ghana and Nigeria.

B、Languages,music and culture.

C、Yams and different types of rice.

第5题

5 Assume today’s date is 1 May 2005.

On 1 April 1999, Alan set up his own company, Alantech Ltd to design and produce technology components in mobile

phones. He personally owns 100% of the share capital. Accounts are drawn up to 31 December each year.

The company was successful, and the profits made allowed Alantech to buy 7.5% of the ordinary shares in another

technology company, Mobile Ltd, on 1 July 2001. The price paid for the shares was £75,000. At this time, the

remaining ordinary shares in Mobile were held by Boron Ltd (7.5%), Carbon plc (40%) and Diamond Ltd (45%).

Technology companies faced difficult trading during this time, and although Alantech Ltd continued to make profits,

other companies suffered. This allowed Alantech Ltd to buy 100% of the shares of Boron Ltd (together with its 100%

subsidiary, Bubble Ltd) at a low price as both companies were performing poorly. The acquisition took place on 1

July 2004, and was funded by the sale of a building used in Alantech Ltd’s trade. The building had cost £150,000

on 1 September 1999, and was sold for £250,000 on 1 May 2004.

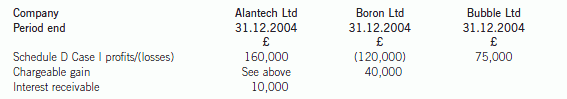

Trading results for the companies are as follows:

Additional information:

– Boron Ltd’s chargeable gain took place prior to its acquisition by Alantech Ltd.

– Bubble Ltd has brought forward Schedule D Case I losses of £25,000 as at 1 January 2004.

– It is anticipated that Boron Ltd will make a small Schedule D Case I loss in 2005.

– Mobile Ltd is profit making.

Alan believes that to improve the Boron Ltd business, the company needs to invest in new high-tech fixed machinery

within the next year. The projected cost of the fixed machinery is £200,000. In order to raise funds, Alantech Ltd and

Boron Ltd will have to sell the shares in Mobile Ltd. From an examination of Boron Ltd’s accounting records, Alan

understands that Boron Ltd’s holding of shares in Mobile Ltd was bought on 1 November 2000 for £55,000.

Alan has identified a possible sale of the group’s entire shareholdings (15%) in Mobile Ltd for £300,000 to Carbon

plc, as this will give Carbon plc a controlling shareholding in Mobile Ltd. He plans to sell the shares at the beginning

of June 2005. Alan has heard that there is a form. of tax relief available to companies selling shares and would like

advice on whether or not it applies to his situation.

In addition, Alan has struggled to deal with the VAT returns for each company in the group, in particular the intragroup

transactions, and wonders if there is any way in which the VAT accounting for the group can be simplified.

Required:

(a) Calculate the chargeable gain arising on Alantech Ltd’s disposal of the building in May 2004. State clearly

any reliefs available, and the conditions to be satisfied to obtain such reliefs. (6 marks)

第6题

“收货单位”栏应填()。

A.TER AUCHI METALS C0.,LTD

B.上海吴淞海关

C.中国五金矿产进出1:2总公司

D.上海亿阳国际贸易有限公司

第7题

A、pay Smith co. Ltd Only,属于限制性抬头,不可转让

B、pay to the order of Smith co. Ltd,属于指示性抬头,需经持票人背书后才可以转让

C、pay bearer,属于持票人抬头或来人抬头,需要背书后才可以转让

D、pay to the order of Smith co. Ltd,属于指示性抬头,不需持票人背书就可以转让

第8题

Alpha Trading Ltd (Alpha) is a value added tax (VAT) general taxpayer. On 1 January 2014, Alpha lent RMB200,000 to Beta Ltd at an interest rate of 10% per annum.

What is the type and amount of turnover tax which Alpha Trading Ltd will pay on the interest income received for the year 2014?

A.Business tax of RMB1,053

B.Business tax of RMB1,000

C.Value added tax of RMB3,400

D.Value added tax of RMB1,200

第9题

Tenth Ltd

(1) For the final four-month period of trading ended 31 July 2015, Tenth Ltd had a tax adjusted trading profit of £52,400. This figure is before taking account of capital allowances.

(2) On 1 April 2015, the tax written down value of the company’s main pool was £12,400. On 3 June 2015, Tenth Ltd purchased a laptop computer for £1,800.

On 31 July 2015, the company sold all of the items included in the main pool at the start of the period for £28,200 and the laptop computer for £1,300. None of the items included in the main pool was sold for more than its original cost.

(3) On 31 July 2015, Tenth Ltd sold the company’s freehold office building for £180,300. The building was purchased on 3 May 2011 for £150,100, and its indexed cost on 31 July 2015 was £164,500.

(4) During the four-month period ended 31 July 2015, Tenth Ltd let out one floor of its freehold office building which was always surplus to requirements. The floor was rented at £1,200 per month, but the tenant left owing the rent for July 2015 which Tenth Ltd was unable to recover. The total running costs of the office building for the four-month period ended 31 July 2015 were £6,300, of which one-third related to the let floor. The other two-thirds of the running costs have been deducted in calculating Tenth Ltd’s tax-adjusted trading profit of £52,400.

(5) During the four-month period ended 31 July 2015, Tenth Ltd made qualifying charitable donations of £800.

Eleventh Ltd

(1) Eleventh Ltd’s operating profit for the six-month period ended 31 March 2016 is £122,900. Depreciation of £2,580 and amortisation of leasehold property of £2,000 (see note (2) below) have been deducted in arriving at this figure.

(2) On 1 October 2015, Eleventh Ltd acquired a leasehold office building, paying a premium of £60,000 for the grant of a 15-year lease. The office building was used for business purposes by Eleventh Ltd throughout the six-month period ended 31 March 2016.

(3) On 1 October 2015, Eleventh Ltd purchased two motor cars. The first motor car cost £12,600, and has a emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a

emission rate of 110 grams per kilometre. This motor car is used as a pool car by the company’s employees. The second motor car cost £13,200, and has a emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

emission rate of 60 grams per kilometre. This motor car is used by Mable, and 45% of the mileage is for private journeys.

(4) On 1 October 2015, Mable made a loan of £100,000 to Eleventh Ltd at an annual interest rate of 5%. This is a commercial rate of interest, and no loan repayments were made during the period ended 31 March 2016. The loan was used to finance the company’s trading activities.

Required:

(a) Calculate Tenth Ltd’s taxable total profits for the four-month period ended 31 July 2015. (7 marks)

(b) Calculate Eleventh Ltd’s tax adjusted trading profit for the six-month period ended 31 March 2016. (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!