重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The theme park is expected to attract an average of 15,000 visitors per day for at least four years, after which major new investment would be required in order to maintain demand. The price of admission to the theme park is expected to be £18 per adult and £10 per child. 60% of visitors are forecast to be children. In addition to admission revenues,

it is expected that the average visitor will spend £8 on food and drinks, (of which 30% is profit), and £5 on gifts and souvenirs, (of which 40% is profit). The park would open for 360 days per year.

All costs and receipts (excluding maintenance and construction costs and the realisable value) are shown at current prices; the company expects all costs and receipts to rise by 3% per year from current values.

The theme park would cost a total of £400 million and could be constructed and working in one year’s time. Half of the £400 million would be payable immediately, and half in one year’s time. In addition working capital of £50 million will be required from the end of year one. The after tax realisable value of fixed assets is expected to be between £250 million and £300 million after four years of operation.

Maintenance costs (excluding labour) are expected to be £15 million in the first year of operation, increasing by £4 million per year thereafter. Annual insurance costs are £2 million, and the company would apportion £2·5 million per year to the theme park from existing overheads. The theme park would require 1,500 staff costing a total of £40 million per annum (at current prices). Sleepon will use the existing advertising campaigns for its hotels to also advertise the theme park. This will save approximately £2 million per year in advertising expenses.

As Sleepon has no previous experience of theme park management, it has investigated the current risk and financial structure of the closest UK theme park competitor, Thrillall plc. Details are summarised below.

Thrillall plc, summarised balance sheet

Other information:

(i) Sleepon has access to a £450 million Eurosterling loan at 7·5% fixed rate to provide the necessary finance for the theme park.

(ii) £250 million of the investment will attract 25% per year capital allowances on a reducing balance basis.

(iii) Corporate tax is at a rate of 30%.

(iv) The average stock market return is 10% and the risk free rate 3·5%.

(v) Sleepon’s current weighted average cost of capital is 9%.

(vi) Sleepon’s market weighted gearing if the theme park project is undertaken is estimated to be 61·4% equity,

38·6% debt.

(vii) Sleepon’s equity beta is 0·70.

(viii) The current share price of Sleepon is 148 pence, and of Thrillall 386 pence.

(ix) Thrillall’s medium and long term debt comprises long term bonds with a par value of £100 and current market price of £93.

(x) Thrillall’s equity beta is 1·45.

Required:

Prepare a report analysing whether or not Sleepon should undertake the investment in the theme park. Your report should include a discussion of what other information would be useful to Sleepon in making the investment decision. All relevant calculations must be included in the report or as an appendix to it. State clearly any assumptions that you make.

(Approximately 28 marks are available for calculations and 12 for discussion)

(40 marks)

更多“1 Sleepon Hotels plc owns a successful chain of hotels. The company is considering diversi”相关的问题

更多“1 Sleepon Hotels plc owns a successful chain of hotels. The company is considering diversi”相关的问题

第1题

fficult farming conditions. Furlion Co’s chief executive has been investigating a significant opportunity in the country of Naswa, where Furlion Co has not previously sold any products. The government of Naswa has been undertaking a major land reclamation programme and Furlion Co’s equipment is particularly suitable for use on the reclaimed land. Because of the costs and other problems involved in transporting its products, Furlion Co’s chief executive proposes that Furlion Co should establish a plant for manufacturing machinery in Naswa. He knows that the Naswan government is keen to encourage the development of sustainable businesses within the country.

Initial calculations suggest that the proposed investment in Naswa would have a negative net present value of $1·01 million. However, Furlion Co’s chief executive believes that there may be opportunities for greater cash flows in future if the Naswan government expands its land reclamation programme. The government at present is struggling to fund expansion of the programme out of its own resources and is looking for other funding. If the Naswan government obtains this funding, the chief executive has forecast that the increased demand for Furlion Co’s products would justify $15 million additional expenditure at the site of the factory in three years’ time. The expected net present value for this expansion is currently estimated to be $0.

It can be assumed that all costs and revenues include inflation. The relevant cost of capital is 12% and the risk free rate is 4%. The chief executive has estimated the likely volatility of cash flows at a standard deviation of 30%.

One of Furlion Co’s non-executive directors has read about possible changes in interest rates and wonders how these might affect the investment appraisal.

Required:

(a) Assess, showing all relevant calculations, whether Furlion Co should proceed with the significant opportunity. Discuss the assumptions made and other factors which will affect the decision of whether to establish a plant in Naswa. The Black Scholes pricing model may be used, where appropriate. (16 marks)

(b) Explain what is meant by an option’s rho and discuss the impact of changes in interest rates on the appraisal of the investment. (5 marks)

(c) Discuss the possibility of the Naswan government obtaining funding for further land reclamation from the World Bank, referring specifically to the International Development Association. (4 marks)

第2题

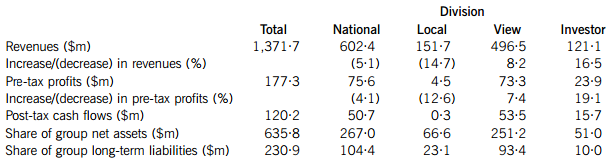

nised as follows:

– Staple National – the national newspaper, the Daily Staple. This division’s revenues and operating profits have decreased for the last two years.

– Staple Local – a portfolio of 18 local and regional newspapers. This division’s operating profits have fallen for the last five years and operating profits and cash flows are forecast to be negative in the next financial year. Other newspaper groups with local titles have also reported significant falls in profitability recently.

– Staple View – a package of digital channels showing sporting events and programmes for a family audience. Staple Group’s board has been pleased with this division’s recent performance, but it believes that the division will only be able to sustain a growth rate of 4% in operating profits and cash flows unless it can buy the rights to show more major sporting events. Over the last year, Staple View’s biggest competitor in this sector has acquired two smaller digital broadcasters.

– Staple Investor – established from a business which was acquired three years ago, this division offers services for investors including research, publications, training events and conferences. The division gained a number of new clients over the last year and has thus shown good growth in revenues and operating profits.

Some of Staple Group’s institutional investors have expressed concern about the fall in profitability of the two newspaper divisions.

The following summarised data relates to the group’s last accounting year. The % changes in pre-tax profits and revenues are changes in the most recent figures compared with the previous year.

Staple Group’s board regards the Daily Staple as a central element of the group’s future. The directors are currently considering a number of investment plans, including the development of digital platforms for the Daily Staple. The finance director has costed the investment programme at $150 million. The board would prefer to fund the investment programme by disposing parts or all of one of the other divisions. The following information is available to help assess the value of each division:

– One of Staple Group’s competitors, Postway Co, has contacted Staple Group’s directors asking if they would be interested in selling 15 of the local and regional newspapers for $60 million. Staple Group’s finance director believes this offer is low and wishes to use the net assets valuation method to evaluate a minimum price for the Staple Local division.

– Staple Group’s finance director believes that a valuation using free cash flows would provide a fair estimate of the value of the Staple View division. Over the last year, investment in additional non-current assets for the Staple View division has been $12·5 million and the incremental working capital investment has been $6·2 million. These investment levels will have to increase at 4% annually in order to support the expected sustainable increases in operating profit and cash flow.

– Staple Group’s finance director believes that the valuation of the Staple Investor division needs to reflect the potential it derives from the expertise and experience of its staff. The finance director has calculated a value of $118·5 million for this division, based on the earnings made last year but also allowing for the additional earnings which he believes that the expert staff in the division will be able to generate in future years.

Assume a risk-adjusted, all-equity financed, cost of capital of 12% and a tax rate of 30%. Goodwill should be ignored in any calculations.

Staple Group’s finance and human resources directors are looking at the staffing of the two newspaper divisions. The finance director proposes dismissing most staff who have worked for the group for less than two years, two years’ employment being when staff would be entitled to enhanced statutory employment protection. The finance director also proposes a redundancy programme for longer-serving staff, selecting for redundancy employees who have complained particularly strongly about recent changes in working conditions. There is a commitment in Staple Group’s annual report to treat employees fairly, communicate with them regularly and enhance employees’ performance by structured development.

Required:

(a) Evaluate the options for disposing of parts of Staple Group, using the financial information to assess possible disposal prices. The evaluation should include a discussion of the benefits and drawbacks to Staple Group from disposing of parts of the Staple Group. (19 marks)

(b) Discuss the significance of the finance director’s proposals for reduction in staff costs for Staple Group’s relationships with its shareholders and employees and discuss the ethical implications of the proposals. (6 marks)

第3题

Section B – TWO questions ONLY to be attempted

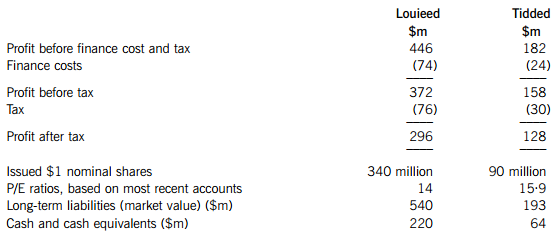

Louieed Co

Louieed Co, a listed company, is a major supplier of educational material, selling its products in many countries. It supplies schools and colleges and also produces learning material for business and professional exams. Louieed Co has exclusive contracts to produce material for some examining bodies. Louieed Co has a well-defined management structure with formal processes for making major decisions.

Although Louieed Co produces online learning material, most of its profits are still derived from sales of traditional textbooks. Louieed Co’s growth in profits over the last few years has been slow and its directors are currently reviewing its long-term strategy. One area in which they feel that Louieed Co must become much more involved is the production of online testing materials for exams and to validate course and textbook learning.

Bid for Tidded Co

Louieed Co has recently made a bid for Tidded Co, a smaller listed company. Tidded Co also supplies a range of educational material, but has been one of the leaders in the development of online testing and has shown strong profit growth over recent years. All of Tidded Co’s initial five founders remain on its board and still hold 45% of its issued share capital between them. From the start, Tidded Co’s directors have been used to making quick decisions in their areas of responsibility. Although listing has imposed some formalities, Tidded Co has remained focused on acting quickly to gain competitive advantage, with the five founders continuing to give strong leadership.

Louieed Co’s initial bid of five shares in Louieed Co for three shares in Tidded Co was rejected by Tidded Co’s board. There has been further discussion between the two boards since the initial offer was rejected and Louieed Co’s board is now considering a proposal to offer Tidded Co’s shareholders two shares in Louieed Co for one share in Tidded Co or a cash alternative of $22·75 per Tidded Co share. It is expected that Tidded Co&39;s shareholders will choose one of the following options:

(i) To accept the two-shares-for-one-share offer for all the Tidded Co shares; or,

(ii) To accept the cash offer for all the Tidded Co shares; or,

(iii) 60% of the shareholders will take up the two-shares-for-one-share offer and the remaining 40% will take the cash offer.

In case of the third option being accepted, it is thought that three of the company&39;s founders, holding 20% of the share capital in total, will take the cash offer and not join the combined company. The remaining two founders will probably continue to be involved in the business and be members of the combined company&39;s board.

Louieed Co’s finance director has estimated that the merger will produce annual post-tax synergies of $20 million. He expects Louieed Co’s current price-earnings (P/E) ratio to remain unchanged after the acquisition.

Extracts from the two companies’ most recent accounts are shown below:

The tax rate applicable to both companies is 20%.

Assume that Louieed Co can obtain further debt funding at a pre-tax cost of 7·5% and that the return on cash surpluses is 5% pre-tax.

Assume also that any debt funding needed to complete the acquisition will be reduced instantly by the balances of cash and cash equivalents held by Louieed Co and Tidded Co.

Required:

(a) Discuss the advantages and disadvantages of the acquisition of Tidded Co from the viewpoint of Louieed Co. (6 marks)

(b) Calculate the P/E ratios of Tidded Co implied by the terms of Louieed Co’s initial and proposed offers, for all three of the above options. (5 marks)

(c) Calculate, and comment on, the funding required for the acquisition of Tidded Co and the impact on Louieed Co’s earnings per share and gearing, for each of the three options given above.

Note: Up to 10 marks are available for the calculations. (14 marks)

第4题

Section A – This ONE question is compulsory and MUST be attempted

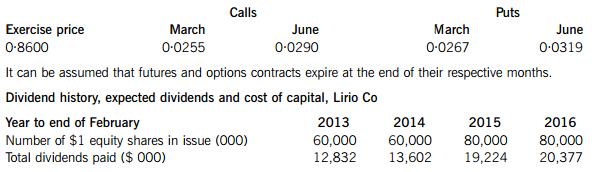

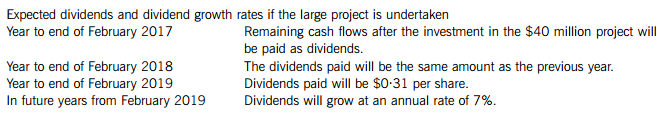

Lirio Co is an engineering company which is involved in projects around the world. It has been growing steadily for several years and has maintained a stable dividend growth policy for a number of years now. The board of directors (BoD) is considering bidding for a large project which requires a substantial investment of $40 million. It can be assumed that the date today is 1 March 2016.

The BoD is proposing that Lirio Co should not raise the finance for the project through additional debt or equity. Instead, it proposes that the required finance is obtained from a combination of funds received from the sale of its equity investment in a European company and from cash flows generated from its normal business activity in the coming two years. As a result, Lirio Co’s current capital structure of 80 million $1 equity shares and $70 million 5% bonds is not expected to change in the foreseeable future.

The BoD has asked the company’s treasury department to prepare a discussion paper on the implications of this proposal. The following information on Lirio Co has been provided to assist in the preparation of the discussion paper.

Expected income and cash flow commitments prior to undertaking the large project for the year to the end of February 2017

Lirio Co’s sales revenue is forecast to grow by 8% next year from its current level of $300 million, and the operating profit margin on this is expected to be 15%. It is expected that Lirio Co will have the following capital investment requirements for the coming year, before the impact of the large project is considered:

1. A $0·10 investment in working capital for every $1 increase in sales revenue;

2. An investment equivalent to the amount of depreciation to keep its non-current asset base at the present productive capacity. The current depreciation charge already included in the operating profit margin is 25% of the non-current assets of $50 million;

3. A $0·20 investment in additional non-current assets for every $1 increase in sales revenue;

4. $8 million additional investment in other small projects.

In addition to the above sales revenue and profits, Lirio Co has one overseas subsidiary – Pontac Co, from which it receives dividends of 80% on profits. Pontac Co produces a specialist tool which it sells locally for $60 each. It is expected that it will produce and sell 400,000 units of this specialist tool next year. Each tool will incur variable costs of $36 per unit and total annual fixed costs of $4 million to produce and sell.

Lirio Co pays corporation tax at 25% and Pontac Co pays corporation tax at 20%. In addition to this, a withholding tax of 8% is deducted from any dividends remitted from Pontac Co. A bi-lateral tax treaty exists between the countries where Lirio Co is based and where Pontac Co is based. Therefore corporation tax is payable on profits made by subsidiary companies, but full credit is given for corporation tax already paid.

It can be assumed that receipts from Pontac Co are in $ equivalent amounts and exchange rate fluctuations on these can be ignored.

Sale of equity investment in the European country

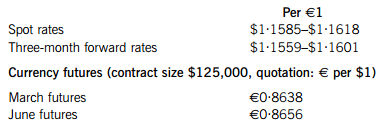

It is expected that Lirio Co will receive Euro (€) 20 million in three months’ time from the sale of its investment. The € has continued to remain weak, while the $ has continued to remain strong through 2015 and the start of 2016. The financial press has also reported that there may be a permanent shift in the €/$ exchange rate, with firms facing economic exposure. Lirio Co has decided to hedge the € receipt using one of currency forward contracts, currency futures contracts or currency options contracts.

The following exchange contracts and rates are available to Lirio Co.

Currency options (contract size $125,000, exercise price quotation € per $1, premium € per $1)

It is expected that dividends will grow at the historic rate, if the large project is not undertaken.

Lirio Co’s cost of equity capital is estimated to be 12%.

Required:

(a) With reference to purchasing power parity, explain how exchange rate fluctuations may lead to economic exposure. (6 marks)

(b) Prepare a discussion paper, including all relevant calculations, for the board of directors (BoD) of Lirio Co which:

(i) Estimates Lirio Co’s dividend capacity as at 28 February 2017, prior to investing in the large project; (9 marks)

(ii) Advises Lirio Co on, and recommends, an appropriate hedging strategy for the Euro (€) receipt it is due to receive in three months’ time from the sale of the equity investment; (14 marks)

(iii) Using the information on dividends provided in the question, and from (b) (i) and (b) (ii) above, assesses whether or not the project would add value to Lirio Co; (8 marks)

(iv) Discusses the issues of proposed methods of financing the project which need to be considered further. (9 marks)

Professional marks will be awarded in part (b) for the format, structure and presentation of the discussion paper. (4 marks)

第5题

leading university on the ‘application of options to investment decisions and corporate value’. She wants to understand how some of the ideas which were discussed can be applied to decisions made at Faoilean Co. She is still a little unclear about some of the discussion on options and their application, and wants further clarification on the following:

(i) Faoilean Co is involved in the exploration and extraction of oil and gas. Recently there have been indications that there could be significant deposits of oil and gas just off the shores of Ireland. The government of Ireland has invited companies to submit bids for the rights to commence the initial exploration of the area to assess the likelihood and amount of oil and gas deposits, with further extraction rights to follow. Faoilean Co is considering putting in a bid for the rights. The speaker leading the discussion suggested that using options as an investment assessment tool would be particularly useful to Faoilean Co in this respect.

(ii) The speaker further suggested that options were useful in determining the value of equity and default risk, and suggested that this was why companies facing severe financial distress could still have a positive equity value.

(iii) Towards the end of the discussion, the speaker suggested that changes in the values of options can be measured in terms of a number of risk factors known as the ‘greeks’, such as the ‘vega’. The CEO is unclear why option values are affected by so many different risk factors.

Required:

(a) With regard to (i) above, discuss how Faoilean Co may use the idea of options to help with the investment decision in bidding for the exploration rights, and explain the assumptions made when using the idea of options in making investment decisions. (11 marks)

(b) With regard to (ii) above, discuss how options could be useful in determining the value of equity and default risk, and why companies facing severe financial distress still have positive equity values. (9 marks)

(c) With regard to (iii) above, explain why changes in option values are determined by numerous different risk factors and what ‘vega’ determines. (5 marks)

第6题

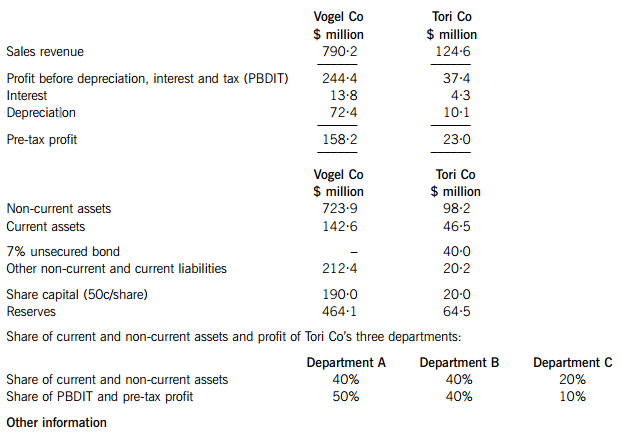

ndustrial companies. Until ten years ago, Vogel Co pursued a strategy of organic growth. Since then, it has followed an aggressive policy of acquiring smaller engineering companies, which it feels have developed new technologies and methods, which could be used in its manufacturing processes. However, it is estimated that only between 30% and 40% of the acquisitions made in the last ten years have successfully increased the company’s shareholder value.

Vogel Co is currently considering acquiring Tori Co, an unlisted company, which has three departments. Department A manufactures machinery for industrial companies, Department B produces electrical goods for the retail market, and the smaller Department C operates in the construction industry. Upon acquisition, Department A will become part of Vogel Co, as it contains the new technologies which Vogel Co is seeking, but Departments B and C will be unbundled, with the assets attached to Department C sold and Department B being spun off into a new company called Ndege Co.

Given below are extracts of financial information for the two companies for the year ended 30 April 2014.

Other information

(i) It is estimated that for Department C, the realisable value of its non-current assets is 100% of their book value, but its current assets’ realisable value is only 90% of their book value. The costs related to closing Department C are estimated to be $3 million.

(ii) The funds raised from the disposal of Department C will be used to pay off Tori Co’s other non-current and current liabilities.

(iii) The 7% unsecured bond will be taken over by Ndege Co. It can be assumed that the current market value of the bond is equal to its book value.

(iv) At present, around 10% of Department B’s PBDIT come from sales made to Department C.

(v) Ndege Co’s cost of capital is estimated to be 10%. It is estimated that in the first year of operation Ndege Co’s free cash flows to firm will grow by 20%, and then by 5·2% annually thereafter.

(vi) The tax rate applicable to all the companies is 20%, and Ndege Co can claim 10% tax allowable depreciation on its non-current assets. It can be assumed that the amount of tax allowable depreciation is the same as the investment needed to maintain Ndege Co’s operations.

(vii) Vogel Co’s current share price is $3 per share and it is estimated that Tori Co’s price-to-earnings (PE) ratio is 25% higher than Vogel Co’s PE ratio. After the acquisition, when Department A becomes part of Vogel Co, it is estimated that Vogel Co’s PE ratio will increase by 15%.

(viii) It is estimated that the combined company’s annual after-tax earnings will increase by $7 million due to the synergy benefits resulting from combining Vogel Co and Department A.

Required:

(a) Discuss the possible reasons why Vogel Co may have switched its strategy of organic growth to one of growing by acquiring companies. (4 marks)

(b) Discuss the possible actions Vogel Co could take to reduce the risk that the acquisition of Tori Co fails to increase shareholder value. (7 marks)

(c) Estimate, showing all relevant calculations, the maximum premium Vogel Co could pay to acquire Tori Co, explaining the approach taken and any assumptions made. (14 marks)

第7题

Section B – TWO questions ONLY to be attempted

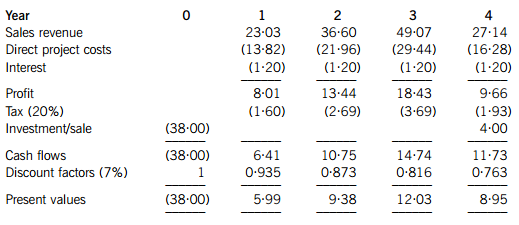

You have recently commenced working for Burung Co and are reviewing a four-year project which the company is considering for investment. The project is in a business activity which is very different from Burung Co’s current line of business.

The following net present value estimate has been made for the project:

All figures are in $ million

Net present value is negative $1·65 million, and therefore the recommendation is that the project should not be accepted.

In calculating the net present value of the project, the following notes were made:

(i) Since the real cost of capital is used to discount cash flows, neither the sales revenue nor the direct project costs have been inflated. It is estimated that the inflation rate applicable to sales revenue is 8% per year and to the direct project costs is 4% per year.

(ii) The project will require an initial investment of $38 million. Of this, $16 million relates to plant and machinery, which is expected to be sold for $4 million when the project ceases, after taking any taxation and inflation impact into account.

(iii) Tax allowable depreciation is available on the plant and machinery at 50% in the first year, followed by 25% per year thereafter on a reducing balance basis. A balancing adjustment is available in the year the plant and machinery is sold. Burung Co pays 20% tax on its annual taxable profits. No tax allowable depreciation is available on the remaining investment assets and they will have a nil value at the end of the project.

(iv) Burung Co uses either a nominal cost of capital of 11% or a real cost of capital of 7% to discount all projects, given that the rate of inflation has been stable at 4% for a number of years.

(v) Interest is based on Burung Co’s normal borrowing rate of 150 basis points over the 10-year government yield rate.

(vi) At the beginning of each year, Burung Co will need to provide working capital of 20% of the anticipated sales revenue for the year. Any remaining working capital will be released at the end of the project.

(vii) Working capital and depreciation have not been taken into account in the net present value calculation above, since depreciation is not a cash flow and all the working capital is returned at the end of the project.

It is anticipated that the project will be financed entirely by debt, 60% of which will be obtained from a subsidised loan scheme run by the government, which lends money at a rate of 100 basis points below the 10-year government debt yield rate of 2·5%. Issue costs related to raising the finance are 2% of the gross finance required. The remaining 40% will be funded from Burung Co’s normal borrowing sources. It can be assumed that the debt capacity available to Burung Co is equal to the actual amount of debt finance raised for the project.

Burung Co has identified a company, Lintu Co, which operates in the same line of business as that of the project it is considering. Lintu Co is financed by 40 million shares trading at $3·20 each and $34 million debt trading at $94 per $100. Lintu Co’s equity beta is estimated at 1·5. The current yield on government treasury bills is 2% and it is estimated that the market risk premium is 8%. Lintu Co pays tax at an annual rate of 20%.

Both Burung Co and Lintu Co pay tax in the same year as when profits are earned.

Required:

(a) Calculate the adjusted present value (APV) for the project, correcting any errors made in the net present value estimate above, and conclude whether the project should be accepted or not. Show all relevant calculations. (15 marks)

(b) Comment on the corrections made to the original net present value estimate and explain the APV approach taken in part (a), including any assumptions made. (10 marks)

第8题

Section A – This ONE question is compulsory and MUST be attempted

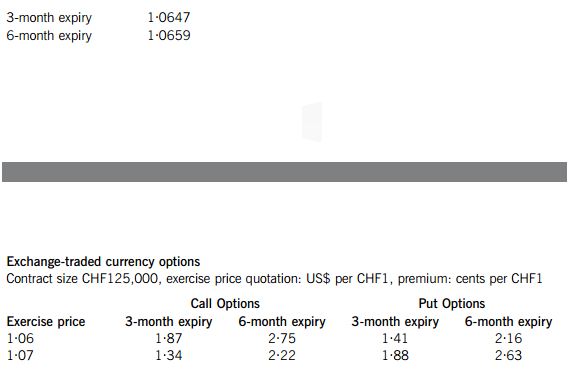

Cocoa-Mocha-Chai (CMC) Co is a large listed company based in Switzerland and uses Swiss Francs as its currency. It imports tea, coffee and cocoa from countries around the world, and sells its blended products to supermarkets and large retailers worldwide. The company has production facilities located in two European ports where raw materials are brought for processing, and from where finished products are shipped out. All raw material purchases are paid for in US dollars (US$), while all sales are invoiced in Swiss Francs (CHF).

Until recently CMC Co had no intention of hedging its foreign currency exposures, interest rate exposures or commodity price fluctuations, and stated this intent in its annual report. However, after consultations with senior and middle managers, the company’s new Board of Directors (BoD) has been reviewing its risk management and operations strategies.

The following two proposals have been put forward by the BoD for further consideration:

Proposal one

Setting up a treasury function to manage the foreign currency and interest rate exposures (but not commodity price fluctuations) using derivative products. The treasury function would be headed by the finance director. The purchasing director, who initiated the idea of having a treasury function, was of the opinion that this would enable her management team to make better decisions. The finance director also supported the idea as he felt this would increase his influence on the BoD and strengthen his case for an increase in his remuneration.

In order to assist in the further consideration of this proposal, the BoD wants you to use the following upcoming foreign currency and interest rate exposures to demonstrate how they would be managed by the treasury function:

(i) a payment of US$5,060,000 which is due in four months’ time; and

(ii) a four-year CHF60,000,000 loan taken out to part-fund the setting up of four branches (see proposal two below). Interest will be payable on the loan at a fixed annual rate of 2·2% or a floating annual rate based on the yield curve rate plus 0·40%. The loan’s principal amount will be repayable in full at the end of the fourth year.

Proposal two

This proposal suggested setting up four new branches in four different countries. Each branch would have its own production facilities and sales teams. As a consequence of this, one of the two European-based production facilities will be closed. Initial cost-benefit analysis indicated that this would reduce costs related to production, distribution and logistics, as these branches would be closer to the sources of raw materials and also to the customers. The operations and sales directors supported the proposal, as in addition to above, this would enable sales and marketing teams in the branches to respond to any changes in nearby markets more quickly. The branches would be controlled and staffed by the local population in those countries. However, some members of the BoD expressed concern that such a move would create agency issues between CMC Co’s central management and the management controlling the branches. They suggested mitigation strategies would need to be established to minimise these issues.

Response from the non-executive directors

When the proposals were put to the non-executive directors, they indicated that they were broadly supportive of the second proposal if the financial benefits outweigh the costs of setting up and running the four branches. However, they felt that they could not support the first proposal, as this would reduce shareholder value because the costs related to undertaking the proposal are likely to outweigh the benefits.

Additional information relating to proposal one

The current spot rate is US$1·0635 per CHF1. The current annual inflation rate in the USA is three times higher than Switzerland.

The following derivative products are available to CMC Co to manage the exposures of the US$ payment and the interest on the loan:

Exchange-traded currency futures

Contract size CHF125,000 price quotation: US$ per CHF1

It can be assumed that futures and option contracts expire at the end of the month and transaction costs related to these can be ignored.

Over-the-counter products

In addition to the exchange-traded products, Pecunia Bank is willing to offer the following over-the-counter derivative products to CMC Co:

(i) A forward rate between the US$ and the CHF of US$ 1·0677 per CHF1.

(ii) An interest rate swap contract with a counterparty, where the counterparty can borrow at an annual floating rate based on the yield curve rate plus 0·8% or an annual fixed rate of 3·8%. Pecunia Bank would charge a fee of 20 basis points each to act as the intermediary of the swap. Both parties will benefit equally from the swap contract.

Required:

(a) Advise CMC Co on an appropriate hedging strategy to manage the foreign exchange exposure of the US$ payment in four months’ time. Show all relevant calculations, including the number of contracts bought or sold in the exchange-traded derivative markets. (15 marks)

(b) Demonstrate how CMC Co could benefit from the swap offered by Pecunia Bank. (6 marks)

(c) As an alternative to paying the principal on the loan as one lump sum at the end of the fourth year, CMC Co could pay off the loan in equal annual amounts over the four years similar to an annuity. In this case, an annual interest rate of 2% would be payable, which is the same as the loan’s gross redemption yield (yield to maturity).

Required: Calculate the modified duration of the loan if it is repaid in equal amounts and explain how duration can be used to measure the sensitivity of the loan to changes in interest rates. (7 marks)

(d) Prepare a memorandum for the Board of Directors (BoD) of CMC Co which:

(i) Discusses proposal one in light of the concerns raised by the non-executive directors; and (9 marks)

(ii) Discusses the agency issues related to proposal two and how these can be mitigated. (9 marks)

Professional marks will be awarded in part (d) for the presentation, structure, logical flow and clarity of the memorandum. (4 marks)

第9题

ories throughout Europe. It sells its own-brand items, which are produced by small manufacturers located in Africa, who work solely for Strom Co. The recent European sovereign debt crisis has affected a number of countries in the European Union (EU). Consequently, Strom Co has found trading conditions to be extremely difficult, putting pressure on profits and sales revenue.

The sovereign debt crisis in Europe resulted in countries finding it increasingly difficult and expensive to issue government bonds to raise funds. Two main reasons have been put forward to explain why the crisis took place: firstly, a number of countries continued to borrow excessive funds, because their expenditure exceeded taxation revenues; and secondly, a number of countries allocated significant sums of money to support their banks following the ‘credit crunch’ and the banking crisis.

In order to prevent countries defaulting on their debt obligations and being downgraded, the countries in the EU and the International Monetary Fund (IMF) established a fund to provide financial support to member states threatened by the risk of default, credit downgrades and excessive borrowing yields. Strict economic conditions known as austerity measures were imposed on these countries in exchange for receiving financial support.

The austerity measures have affected Strom Co negatively, and the years 2011 and 2012 have been particularly bad, with sales revenue declining by 15% and profits by 25% in 2011, and remaining at 2011 levels in 2012. On investigation, Strom Co noted that clothing retailers selling clothes at low prices and at high prices were not affected as badly as Strom Co or other mid-price retailers. Indeed, the retailers selling low-priced clothes had increased their profits, and retailers selling luxury, expensive clothes had maintained their profits over the last two to three years.

In order to improve profitability, Strom Co’s board of directors expects to cut costs where possible. A significant fixed cost relates to quality control, which includes monitoring the working conditions of employees of Strom Co’s clothing manufacturers, as part of its ethical commitment.

Required:

(a) Explain the role and aims of the International Monetary Fund (IMF) and discuss possible reasons why the austerity measures imposed on European Union (EU) countries might have affected Strom Co negatively. (10 marks)

(b) Suggest, giving reasons, why the austerity measures might not have affected clothing retailers at the high and low price range, as much as the mid-price range retailers like Strom Co. (4 marks)

(c) Discuss the risks to Strom Co of reducing the costs relating to quality control and how the detrimental impact of such reductions in costs could be decreased. (6 marks)

第10题

nt centres. It sets investment limits for each department based on a three-year cycle. Projects selected by departments would have to fall within the investment limits set for each of the three years. All departments would be required to maintain a capital investment monitoring system, and report on their findings annually to Arbore Co’s board of directors.

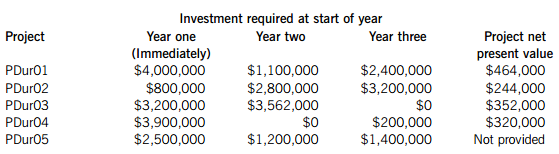

The Durvo department is considering the following five investment projects with three years of initial investment expenditure, followed by several years of positive cash inflows. The department’s initial investment expenditure limits are $9,000,000, $6,000,000 and $5,000,000 for years one, two and three respectively. None of the projects can be deferred and all projects can be scaled down but not scaled up.

PDur05 project’s annual operating cash flows commence at the end of year four and last for a period of 15 years. The project generates annual sales of 300,000 units at a selling price of $14 per unit and incurs total annual relevant costs of $3,230,000. Although the costs and units sold of the project can be predicted with a fair degree of certainty, there is considerable uncertainty about the unit selling price. The department uses a required rate of return of 11% for its projects, and inflation can be ignored.

The Durvo department’s managing director is of the opinion that all projects which return a positive net present value should be accepted and does not understand the reason(s) why Arbore Co imposes capital rationing on its departments. Furthermore, she is not sure why maintaining a capital investment monitoring system would be beneficial to the company.

Required:

(a) Calculate the net present value of project PDur05. Calculate and comment on what percentage fall in the selling price would need to occur before the net present value falls to zero. (6 marks)

(b) Formulate an appropriate capital rationing model, based on the above investment limits, that maximises the net present value for department Durvo. Finding a solution for the model is not required. (3 marks)

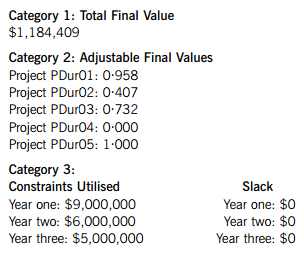

(c) Assume the following output is produced when the capital rationing model in part (b) above is solved:

Required:

Explain the figures produced in each of the three output categories. (5 marks)

(d) Provide a brief response to the managing director’s opinions by:

(i) Explaining why Arbore Co may want to impose capital rationing on its departments; (2 marks)

(ii) Explaining the features of a capital investment monitoring system and discussing the benefits of maintaining such a system. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!