重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The following scenario relates to questions 11–15.

Mighty IT Co provides hardware, software and IT services to small business customers.

Mighty IT Co has developed an accounting software package. The company offers a supply and installation service for $1,000 and a separate two-year technical support service for $500. Alternatively, it also offers a combined goods and services contract which includes both of these elements for $1,200. Payment for the combined contract is due one month after the date of installation.

In December 20X5, Mighty IT Co revalued its corporate headquarters. Prior to the revaluation, the carrying amount of the building was $2m and it was revalued to $2·5m.

Mighty IT Co also revalued a sales office on the same date. The office had been purchased for $500,000 earlier in the year, but subsequent discovery of defects reduced its value to $400,000. No depreciation had been charged on the sales office and any impairment loss is allowable for tax purposes.

Mighty It Co’s income tax rate is 30%.

In accordance with IFRS 15 Revenue from Contracts with Customers, when should Mighty IT Co recognise revenue from the combined goods and services contract?

A.Supply and install: on installation Technical support: over two years

B.Supply and install: when payment is made Technical support: over two years

C.Supply and install: on installation Technical support: on installation

D.Supply and install: when payment is made Technical support: when payment is made

In January 20X6, the accountant at Mighty IT Co produced the company’s draft financial statements for the year ended 31 December 20X5. He then realised that he had omitted to consider deferred tax on development costs. In 20X5, development costs of $200,000 had been incurred and capitalised. Development costs are deductible in full for tax purposes in the year they are incurred. The development is still in process at 31 December 20X5.

What adjustment is required to the income tax expense in Mighty IT Co’s statement of profit or loss for the year ended 31 December 20X5 to account for deferred tax on the development costs?

A.Increase of $200,000

B.Increase of $60,000

C.Decrease of $60,000

D.Decrease of $200,000

For each combined contract sold, what is the amount of revenue which Mighty IT Co should recognise in respect of the supply and installation service in accordance with IFRS 15?A.$700

B.$800

C.$1,000

D.$1,200

In accordance with IAS 12 Income Taxes, what is the impact of the property revaluations on the income tax expense of Mighty IT Co for the year ended 31 December 20X5?

A.Income tax expense increases by $180,000

B.Income tax expense increases by $120,000

C.Income tax expense decreases by $30,000

D.No impact on income tax expense

Mighty IT Co sells a combined contract on 1 January 20X6, the first day of its financial year.

In accordance with IFRS 15, what is the total amount for deferred income which will be reported in Mighty IT Co’s statement of financial position as at 31 December 20X6?

A.$400

B.$250

C.$313

D.$200

请帮忙给出每个问题的正确答案和分析,谢谢!

更多“The following scenario relates to questions 11–15.Mighty IT Co provides hardware, software”相关的问题

更多“The following scenario relates to questions 11–15.Mighty IT Co provides hardware, software”相关的问题

第1题

The following scenario relates to questions 6–10.

On 1 January 20X5, Blocks Co entered into new lease agreements as follows:

Agreement one This finance lease relates to a new piece of machinery. The fair value of the machine is $220,000. The agreement requires Blocks Co to pay a deposit of $20,000 on 1 January 20X5 followed by five equal annual instalments of $55,000, starting on 31 December 20X5. The implicit rate of interest is 11·65%.

Agreement two This three-year operating lease relates to a fleet of vans. The fair value of the vans is $120,000 and they have an estimated useful life of five years. The agreement requires Blocks Co to make no payment in year one and $48,000 in years two and three.

Agreement three This sale and leaseback relates to a cutting machine purchased by Blocks Co on 1 January 20X4 for $300,000. The carrying amount of the machine as at 31 December 20X4 was $250,000. On 1 January 20X5, it was sold to Cogs Co for $370,000 and Blocks Co will lease the machine back for five years, the remainder of its useful life, at $80,000 per annum.

According to IAS 17 Leases, which of the following is generally considered to be a characteristic of an operating, rather than a finance, lease?

A.Ownership of the assets is passed to the lessee by the end of the lease term

B.The lessor is responsible for the general maintenance and repair of the assets

C.The present value of the lease payments is approximately equal to the fair value of the asset

D.The lease term is for a major part of the useful life of the asset

For agreement one, what is the finance cost charged to profit or loss for the year ended 31 December 20X6?

A.$23,300

B.$12,451

C.$19,607

D.$16,891

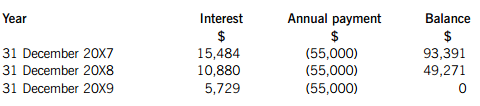

The following calculations have been prepared for agreement one: How will the finance lease obligation be shown in the statement of financial position as at 31 December 20X7?

A.$44,120 as a non-current liability and $49,271 as a current liability

B.$49,271 as a non-current liability and $44,120 as a current liability

C.$93,391 as a non-current liability

D.$93,391 as a current liability

For agreement three, what profit should be recognised for the year ended 31 December 20X5 as a result of the sale and leaseback?A.$24,000

B.$120,000

C.$70,000

D.$20,000

For agreement two, what would be the correct statement of profit or loss entries for the year ended 31 December 20X5?A.Depreciation of $24,000 and no lease rental expense

B.No depreciation and lease rental expense of $32,000

C.Depreciation of $24,000 and lease rental expense of $32,000

D.No depreciation and lease rental expense of $48,000

请帮忙给出每个问题的正确答案和分析,谢谢!

第2题

The following scenario relates to questions 1–5.

Aphrodite Co has a year end of 31 December and operates a factory which makes computer chips for mobile phones. It purchased a machine on 1 July 20X3 for $80,000 which had a useful life of ten years and is depreciated on the straight-line basis, time apportioned in the years of acquisition and disposal. The machine was revalued to $81,000 on 1 July 20X4. There was no change to its useful life at that date.

A fire at the factory on 1 October 20X6 damaged the machine leaving it with a lower operating capacity. The accountant considers that Aphrodite Co will need to recognise an impairment loss in relation to this damage. The accountant has ascertained the following information at 1 October 20X6:

(1) The carrying amount of the machine is $60,750.

(2) An equivalent new machine would cost $90,000.

(3) The machine could be sold in its current condition for a gross amount of $45,000. Dismantling costs would amount to $2,000.

(4) In its current condition, the machine could operate for three more years which gives it a value in use figure of $38,685.

In accordance with IAS 16 Property, Plant and Equipment, what is the depreciation charged to Aphrodite Co’s profit or loss in respect of the machine for the year ended 31 December 20X4?

A.$9,000

B.$8,000

C.$8,263

D.$8,500

What is the total impairment loss associated with Aphrodite Co’s machine at 1 October 20X6?A.$nil

B.$17,750

C.$22,065

D.$15,750

The accountant has decided that it is too difficult to reliably attribute cash flows to this one machine and that it would be more accurate to calculate the impairment on the basis of the factory as a cash-generating unit.

In accordance with IAS 36, which of the following is TRUE regarding cash generating units?

A.A cash-generating unit to which goodwill has been allocated should be tested for impairment every five years

B.A cash-generating unit must be a subsidiary of the parent

C.There is no need to consistently identify cash-generating units based on the same types of asset from period to period

D.A cash-generating unit is the smallest identifiable group of assets for which independent cash flows can be identified

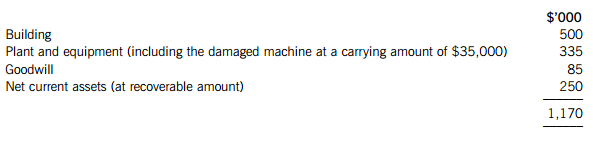

On 1 July 20X7, it is discovered that the damage to the machine is worse than originally thought. The machine is now considered to be worthless and the recoverable amount of the factory as a cash-generating unit is estimated to be $950,000.

At 1 July 20X7, the cash-generating unit comprises the following assets:

In accordance with IAS 36, what will be the carrying amount of Aphrodite Co’s plant and equipment when the impairment loss has been allocated to the cash-generating unit?

A.$262,500

B.$300,000

C.$237,288

D.$280,838

IAS 36 Impairment of Assets contains a number of examples of internal and external events which may indicate the impairment of an asset.

In accordance with IAS 36, which of the following would definitely NOT be an indicator of the potential impairment of an asset (or group of assets)?

A.An unexpected fall in the market value of one or more assets

B.Adverse changes in the economic performance of one or more assets

C.A significant change in the technological environment in which an asset is employed making its software effectively obsolete

D.The carrying amount of an entity’s net assets being below the entity’s market capitalisation

请帮忙给出每个问题的正确答案和分析,谢谢!

第3题

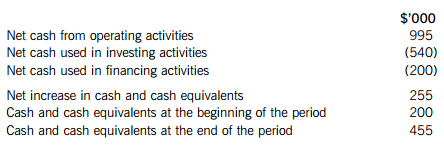

od of expansion.

An extract from the statement of cash flows for the year ended 31 December 20X7 for Top Trades Co is presented as follows:

Which of the following statements is correct according to the extract of Top Trades Co’s statement of cash flows?

A.The company has good working capital management

B.Net cash generated from financing activities has been used to fund the additions to non-current assets

C.Net cash generated from operating activities has been used to fund the additions to non-current assets

D.Existing non-current assets have been sold to cover the cost of the additions to non-current assets

第4题

requires an entity to first of all review the measurement of the assets, liabilities and consideration transferred in respect of the combination.

When the negative goodwill is confirmed, how is it then recognised?

A.It is credited directly to retained earnings

B.It is credited to profit or loss

C.It is debited to profit or loss

D.It is deducted from positive goodwill

第5题

e frequently.

Which of the following statements are true when using historical cost accounting compared to current value accounting in this type of market?

(1) Capital employed which is calculated using historical costs is understated compared to current value capital employed

(2) Historical cost profits are overstated in comparison to current value profits

(3) Capital employed which is calculated using historical costs is overstated compared to current value capital employed

(4) Historical cost profits are understated in comparison to current value profits

A.1 and 2

B.1 and 4

C.2 and 3

D.3 and 4

第6题

construction of a new piece of production equipment. The interest rate on the loan is 6% and is payable on maturity of the loan. The construction commenced on 1 November 20X1 but no construction took place between 1 December 20X1 to 31 January 20X2 due to employees taking industrial action. The asset was available for use on 30 September 20X2 having a construction cost of $6m.

What is the carrying amount of the production equipment in Bash Co’s statement of financial position as at 30 September 20X2?

A.$5,016,000

B.$6,270,000

C.$6,330,000

D.$6,360,000

第7题

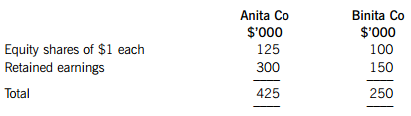

ita Co’s retained earnings amounted to $90,000.

On 30 September 20X7, extracts from the statements of financial position of the two companies were:

What is the total equity which should appear in Anita Co’s consolidated statement of financial position as at 30 September 20X7?

A.$125,000

B.$470,000

C.$345,000

D.$537,500

第8题

January 20X6. The fair value of the non-controlling interest in Marek Co at acquisition was $1·1m. At that date the fair values of Marek Co’s net assets were equal to their carrying amounts, except for a building which had a fair value of $1·5m above its carrying amount and 30 years remaining useful life.

During the year to 31 December 20X6, Marek Co sold goods to Rooney Co, giving rise to an unrealised profit in inventory of $550,000 at the year end. Marek Co’s profit after tax for the year ended 31 December 20X6 was $3·2m.

What amount will be presented as the non-controlling interest in the consolidated statement of financial position of Rooney Co as at 31 December 20X6?

A.$1,895,000

B.$1,495,000

C.$1,910,000

D.$1,880,000

第9题

entory had a carrying amount of $600,000 but a fair value of $800,000. By 31 December 20X5, 70% of this inventory had been sold by Sanka Co.

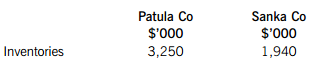

The individual statements of financial position at 31 December 20X5 for both companies show the following:

What will be the total inventories figure in the consolidated statement of financial position of Patula Co as at 31 December 20X5?

A.$5,250,000

B.$5,330,000

C.$5,130,000

D.$5,238,000

第10题

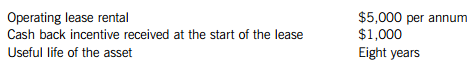

Shiba Co entered into a non-cancellable four-year operating lease to hire a photocopier on 1 January 20X7. The terms of the lease agreement were as follows:

What is the charge in the statement of profit or loss of Shiba Co for the year ended 31 December 20X7 in respect of this operating lease?

A.$2,375

B.$4,000

C.$4,750

D.$5,250

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!