重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Which of the following statements are true when using historical cost accounting compared to current value accounting in this type of market?

(1) Capital employed which is calculated using historical costs is understated compared to current value capital employed

(2) Historical cost profits are overstated in comparison to current value profits

(3) Capital employed which is calculated using historical costs is overstated compared to current value capital employed

(4) Historical cost profits are understated in comparison to current value profits

A.1 and 2

B.1 and 4

C.2 and 3

D.3 and 4

更多“Trasten Co operates in an emerging market with a fast-growing economy where prices increas”相关的问题

更多“Trasten Co operates in an emerging market with a fast-growing economy where prices increas”相关的问题

第1题

Trasten Co operates in an emerging market with a fast-growing economy where prices increase frequently.

Which of the following statements are true when using historical cost accounting compared to current value accounting in this type of market?

(1) Capital employed which is calculated using historical costs is understated compared to current value capital employed

(2) Historical cost profits are overstated in comparison to current value profits

(3) Capital employed which is calculated using historical costs is overstated compared to current value capital employed

(4) Historical cost profits are understated in comparison to current value profits

A.1 and 2

B.1 and 4

C.2 and 3

D.3 and 4

第2题

(b) The Superior Fitness Co (SFC), which is well established in Mayland, operates nine centres. Each of SFC’s

centres is similar in size to those of HFG. SFC also provides dietary plans and fitness programmes to its clients.

The directors of HFG have decided that they wish to benchmark the performance of HFG with that of SFC.

Required:

Discuss the problems that the directors of HFG might experience in their wish to benchmark the performance

of HFG with the performance of SFC, and recommend how such problems might be successfully addressed.

(7 marks)

第3题

Kyanite Pizzas Co (Kyanite) operates a large chain of fast food restaurants. You are an audit supervisor of Jasper & Co and are currently preparing the audit programmes for the audit of Kyanite’s financial statements for the year ended 31 March 2016. You are reviewing the notes of last week’s meeting between the audit manager and finance director where two material issues were discussed.

(i) Property, plant and equipment

In the past Kyanite has received negative press reports over the condition of its fast food restaurants, with comments suggesting they are old fashioned and tired looking. Therefore during the year the company undertook a full review of all its assets and carried out extensive refurbishments to the majority of its restaurants. This review resulted in a significant amount of ageing fixtures and fittings being disposed of and a significant amount of capital expenditure was invested in all remaining restaurants. (6 marks)

(ii) Equity The refurbishment was financed via a share issue in April 2015 at a premium of $1·6 million. (4 marks)

Required:

Describe substantive procedures you should perform. to obtain sufficient and appropriate audit evidence in relation to the above two matters.

Note: The mark allocation is shown against each of the two matters above.

第4题

Balotelli Beach Hotel Co (Balotelli) operates a number of hotels providing accommodation, leisure facilities and restaurants. You are an audit senior of Mario & Co and are currently conducting the audit of Balotelli for the year ended 31 December 20X4. During the course of the audit a number of events and issues have been brought to your attention: Food poisoning Balotelli's directors received correspondence in November 20X4 from a group of customers who attended a wedding at one of the company's hotels. They have alleged that they suffered severe food poisoning from food eaten at the hotel and are claiming substantial damages. Management has stated that based on discussions with their lawyers, the claim is unlikely to be successful. Required In relation to the claim regarding the alleged food poisoning, which of the following audit procedures would provide the auditor with the MOST reliable audit evidence regarding the likely outcome of the litigation?

A、Request a written representation from management supporting their assertion that the claim will not be successful

B、Send an enquiry letter to the lawyers of Balotelli to obtain their view as to the probability of the claim being successful

C、Review the correspondence from the customers claiming food poisoning to assess whether Balotelli has a present obligation as a result of a past event

D、Review board minutes to understand why the directors believe that the claim will not be successful

第5题

Gad Co, a listed company, operatesa fleet of fishing trawlers. In the last financial year it reported profitafter tax of $420,000.

The company has recently signed along-term contract to supply a large supermarket chain with fresh fish. The newcontract will increase profits significantly, but it requires investment in aprocessing and packaging warehouse costing $2 million. The expected return oninvestment is 15% per annum.

There are two options beingconsidered to finance the required investment.

(1) A one for two rights issue

(2) An issue of 8% irredeemableloan stock at par.

Gad Co currently has 500,000 $1ordinary shares in issue with a market price of $11 and has no long term debt finance.Over 50% of the shares are owned by members of the founding Gadus family. Thecompany pays tax at a rate of 30% per year.

Required:

Evaluate the two financing optionsbeing considered, supporting your evaluation with both analysis and criticaldiscussion. Refer to any wider factors that should be considere.

第6题

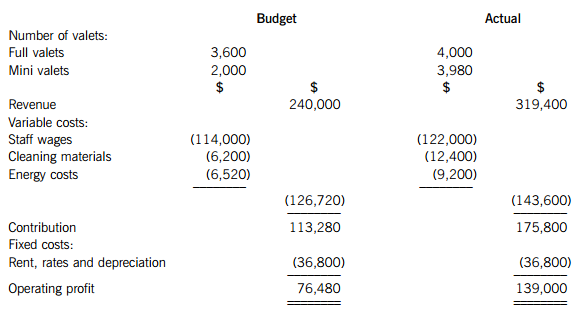

Valet Co is a car valeting (cleaning) company. It operates in the country of Strappia, which has been badly affected by the global financial crisis. Petrol and food prices have increased substantially in the last year and the average disposable household income has decreased by 30%. Recent studies have shown that the average car owner keeps their car for five years before replacing it, rather than three years as was previously the case. Figures over recent years also show that car sales in Strappia are declining whilst business for car repairs is on the increase.

Valet Co offers two types of valet – a full valet and a mini valet. A full valet is an extensive clean of the vehicle, inside and out; a mini valet is a more basic clean of the vehicle. Until recently, four similar businesses operated in Valet Co’s local area, but one of these closed down three months ago after a serious fire on its premises. Valet Co charges customers $50 for each full valet and $30 for each mini valet and this price never changes. Their budget and actual figures for the last year were as follows:

The budgeted contribution to sales ratios for the two types of valet are 44·6% for full valets and 55% for mini valets.

Required:

(a) Using the data provided for full valets and mini valets, calculate:

(i) The total sales mix contribution variance; (4 marks)

(ii) The total sales quantity contribution variance. (4 marks)

(b) Briefly describe the sales mix contribution variance and the sales quantity contribution variance. (2 marks)

(c) Discuss the SALES performance of the business for the period, taking into account your calculations from part (a) AND the information provided in the scenario. (10 marks)

第7题

to the following three audits of financial statements for the year ending 31 December 2006:

(a) Blythe Co is a new audit client. This private company is a local manufacturer and distributor of sportswear. The

company’s finance director, Peter, sees little value in the audit and put it out to tender last year as a cost-cutting

exercise. In accordance with the requirements of the invitation to tender your firm indicated that there would not

be an interim audit.

(b) Huggins Co, a long-standing client, operates a national supermarket chain. Your firm provided Huggins Co with

corporate financial advice on obtaining a listing on a recognised stock exchange in 2005. Senior management

expects a thorough examination of the company’s computerised systems, and are also seeking assurance that

the annual report will not attract adverse criticism.

(c) Gray Co has been an audit client since 1999 after your firm advised management on a successful buyout. Gray

provides communication services and software solutions. Your firm provides Gray with technical advice on

financial reporting and tax services. Most recently you have been asked to conduct due diligence reviews on

potential acquisitions.

Required:

For these assignments, compare and contrast:

(i) the threats to independence;

(ii) the other professional and practical matters that arise; and

(iii) the implications for allocating staff.

(15 marks)

第8题

Section B – TWO questions ONLY to be attempted

(a) You are an audit manager in Weller & Co, an audit firm which operates as part of an international network of firms. This morning you received a note from a partner regarding a potential new audit client:

‘I have been approached by the audit committee of the Plant Group, which operates in the mobile telecommunications sector. Our firm has been invited to tender for the audit of the individual and group financial statements for the year ending 31 March 2013, and I would like your help in preparing the tender document. This would be a major new client for our firm’s telecoms audit department.

The Plant Group comprises a parent company and six subsidiaries, one of which is located overseas. The audit committee is looking for a cost effective audit, and hopes that the strength of the Plant Group’s governance and internal control mean that the audit can be conducted quickly, with a proposed deadline of 31 May 2013. The Plant Group has expanded rapidly in the last few years and significant finance was raised in July 2012 through a stock exchange listing.’

Required:

Identify and explain the specific matters to be included in the tender document for the audit of the Plant Group. (8 marks)

(b) Weller & Co is facing competition from other audit firms, and the partners have been considering how the firm’s revenue could be increased. Two suggestions have been made: 1. Audit partners and managers can be encouraged to sell non-audit services to audit clients by including in their remuneration package a bonus for successful sales. 2. All audit managers should suggest to their audit clients that as well as providing the external audit service, Weller & Co can provide the internal audit service as part of an ‘extended audit’ service. Required: Comment on the ethical and professional issues raised by the suggestions to increase the firm’s revenue. (8 marks)

第9题

Sunflower Stores Co (Sunflower) operates 25 food supermarkets. The company’s year end is 31 December 2012. The audit manager and partner recently attended a planning meeting with the finance director and have provided you with the planning notes below.

You are the audit senior, and this is your first year on this audit. In order to familiarise yourself with Sunflower, the audit manager has asked you to undertake some research in order to gain an understanding of Sunflower, so that you are able to assist in the planning process. He has then asked that you identify relevant audit risks from the notes below and also consider how the team should respond to these risks.

Sunflower has spent $1·6 million in refurbishing all of its supermarkets; as part of this refurbishment programme their central warehouse has been extended and a smaller warehouse, which was only occasionally used, has been disposed of at a profit. In order to finance this refurbishment, a sum of $1·5 million was borrowed from the bank. This is due to be repaid over five years.

The company will be performing a year-end inventory count at the central warehouse as well as at all 25 supermarkets on 31 December. Inventory is valued at selling price less an average profit margin as the finance director believes that this is a close approximation to cost.

Prior to 2012, each of the supermarkets maintained their own financial records and submitted returns monthly to head office. During 2012 all accounting records have been centralised within head office. Therefore at the beginning of the year, each supermarket’s opening balances were transferred into head office’s accounting records. The increased workload at head office has led to some changes in the finance department and in November 2012 the financial controller left. His replacement will start in late December.

Required:

(a) List FIVE sources of information that would be of use in gaining an understanding of Sunflower Stores Co, and for each source describe what you would expect to obtain. (5 marks)

(b) Using the information provided, describe FIVE audit risks and explain the auditor’s response to each risk in planning the audit of Sunflower Stores Co. (10 marks)

(c) The finance director of Sunflower Stores Co is considering establishing an internal audit department. Required: Describe the factors the finance director should consider before establishing an internal audit department. (5 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!