重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

SUPPLEMENTARY INSTRUCTIONS

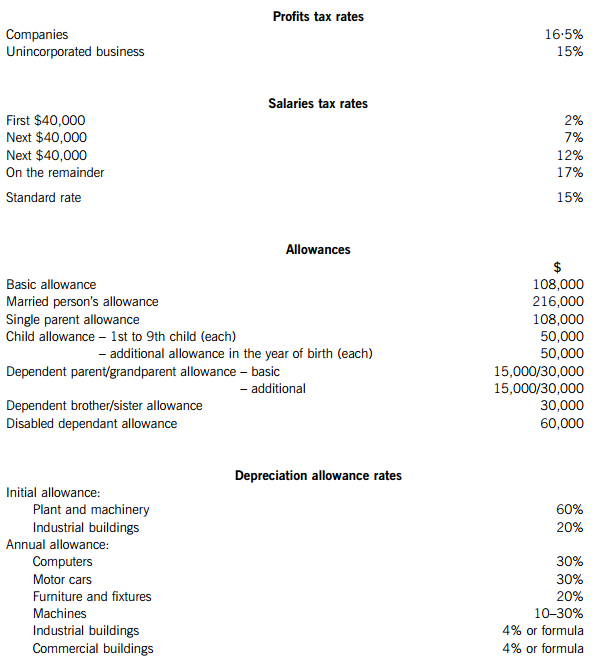

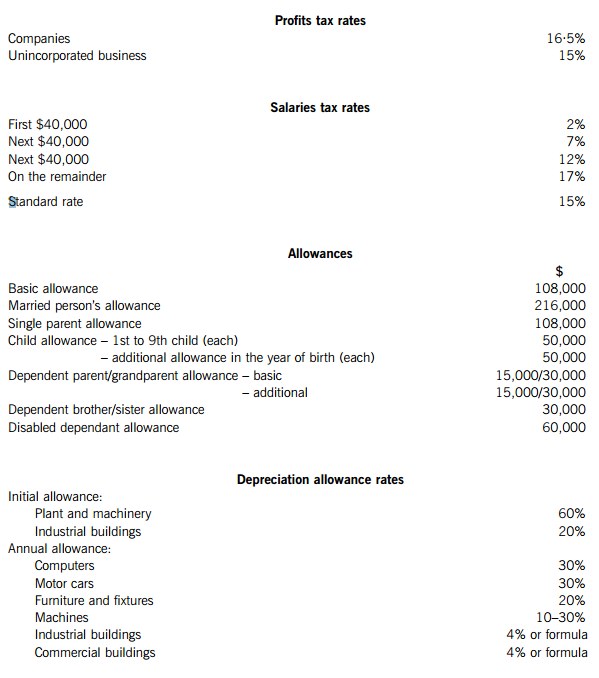

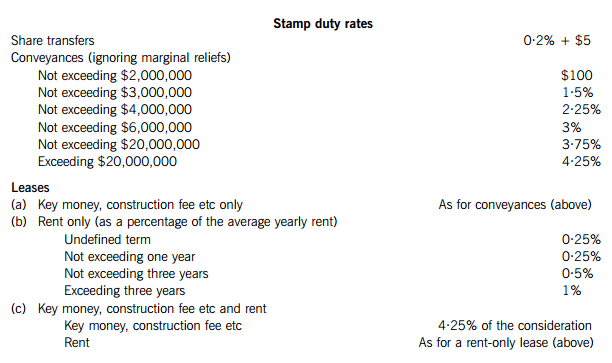

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

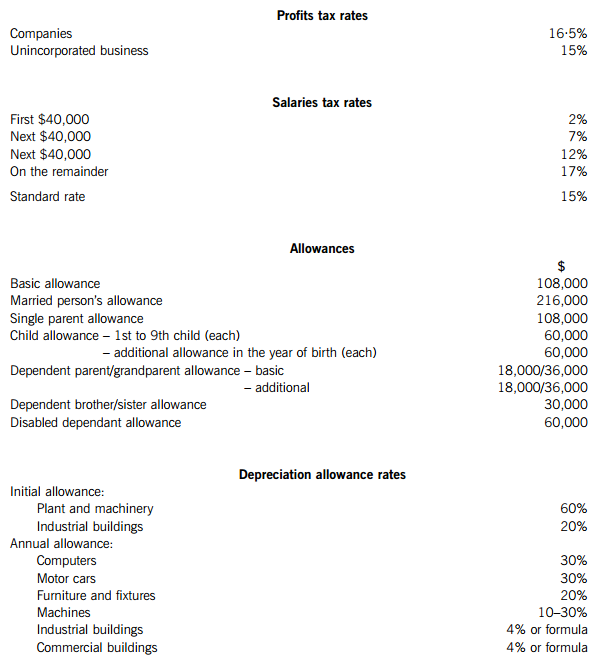

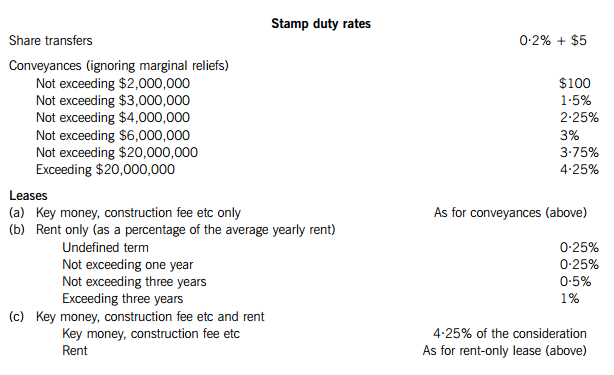

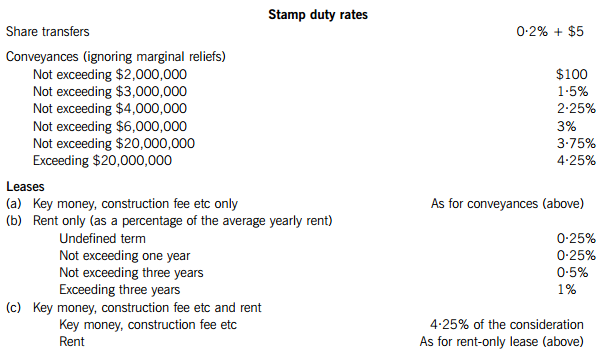

TAX RATES AND ALLOWANCES

The following 2011/12 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

Organic World Inc (the Parent), a company incorporated in the US, has since September 2006 wholly-owned a subsidiary in Hong Kong, Green HK Ltd (Green-HK). Green-HK operates a retail store in Hong Kong and imports organic goods from the Parent and sells the goods in the store. It closes its accounts on 31 December.

Starting from January 2010, the Parent also has another wholly-owned subsidiary in China, Green China Ltd (Green-China), which operates a similar retail store in Mainland China but not in Hong Kong. Green-China has been performing very well in these two years, showing continuous increases in profitability, but Green-HK’s business has been declining significantly.

The Chief Executive Officer (CEO) of Green-HK called a meeting at which the following was discussed:

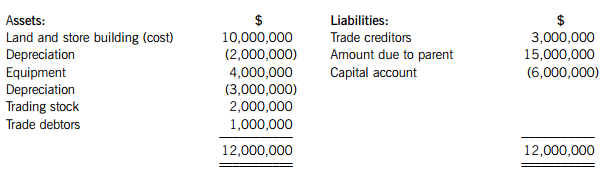

(1) The following extract of management accounts as at 30 November 2011 was presented:

(2) The Parent decided to cease the business in Hong Kong with effect from 1 January 2012. Before the store is closed on 31 December 2011, all the assets and liabilities of Green-HK would need to be cleared according to the following proposal:

(i) The land and store building would be sold to a potential purchaser, and the offer is still under negotiation. The tentative sale consideration is $12,000,000 comprising $11,000,000 for the land and $1,000,000 for the store building. The purchaser has counter-offered that if Green-HK were to demolish the building and sell the land site only, a higher offer might be considered. Based on Green-HK’s tax records, the land and building were acquired in July 2006 directly from the property developer at $10,000,000, 50% of which was attributed to the building. The CEO is wondering how the different modes of sale would impact the tax position of Green-HK. Moreover, the CEO is interested to know how much annual depreciation allowance the purchaser, who makes up his accounts to 31 March, might be entitled to claim if he continued to use the store as it is.

(ii) All the store equipment would be donated to a charitable organisation in Hong Kong. Any remaining minor furniture and fixtures not accepted by the charity would be scrapped. The CEO is wondering if the net book value of the equipment would be eligible for a tax deduction as a charitable donation, and whether it would be better if the equipment was sold first and then the sale money was donated to the charity.

(iii) To clear the trading stock on hand, Green-HK would sell it to Green-China at a price to be mutually agreed. Discussions with Green-China so far indicate that the deal would not be made unless the price was fixed at 30% below the usual market price. Although this is not desirable to Green-HK, it was expected that the Parent would consent to this deal. The CEO is concerned about the impact of the deal on Green-HK, especially in the light of the recent development of the transfer pricing principle in Hong Kong.

(iv) The amount due to the Parent of $15,000,000 would be waived by the Parent since Green-HK would not be likely to have the ability to pay. Green-HK’s records indicated that most of the amount represents the purchase cost of goods imported from the Parent for sale in the store in previous years but which remained unsettled.

(3) All staff members would be made redundant. On top of the statutory amount of redundancy payment, Green-HK was considering paying an additional gratuity representing two months’ salary. Before making the decision, the CEO wants to assess whether these payments would be tax deductible to Green-HK.

(4) Based on the tax records, Green-HK has brought forward tax losses of around $2,000,000 from 2010/11. The tax written down values for the plant and machinery pools are insignificant.

Required:

As the tax advisor to Green HK Ltd (Green-HK), prepare a report for the Chief Executive Officer (CEO) addressing the tax issues raised in the meeting as follows, providing supporting calculations where appropriate.

(a) Sale of land and store building (per item (2)

(i) of the meeting notes): (i) The tax implication to Green-HK arising from the sale of the land and store building, including a computation of the applicable depreciation allowance for each year of ownership and in the year of disposal; (4 marks)

(ii) The impact of the potential purchaser’s counter-offer on the tax position of Green-HK; (4 marks)

(iii) The annual depreciation allowance that might be available to the purchaser upon his acquisition of the land and store building, assuming that the store continued to be used as it was. (3 marks)

(b) Donation of equipment (per item (2)

(ii) of the meeting notes): (i) Whether, and if so how, the donation would qualify as a tax deduction for Green-HK; (4 marks)

(ii) Whether, and if so how, the alternative suggested by the CEO would help Green-HK get the tax deduction. (3 marks)

(c) Sale of trading stock (per item (2)(iii) of the meeting notes):

(i) The tax implication to Green-HK arising from the sale of trading stock to Green China Ltd (Green-China) at the price suggested by Green-China;

Note: You are not required to discuss the transfer pricing implications in this part. (4 marks)

(ii) The impact of the current development of transfer pricing principles in Hong Kong on the suggested sale transaction. (5 marks)

(d) Waiver of inter-company balance by Organic Worldwide Inc (the Parent) (per item (2)(iv) of the meeting notes):

Whether, and if so to what extent, the waiver would be tax effective for Green-HK. If you consider it not tax effective, give suggestions. (4 marks)

(e) Redundancy payment and additional gratuity (per item (3) of the meeting notes):

Whether, and if so how, the redundancy payment and additional gratuity would be tax deductible to Green-HK. If applicable, give an alternative suggestion. (4 marks)

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (4 marks)

2.

Antony and Rebecca are a married couple who are seeking professional tax advice on their tax positions. The following information relates to their affairs for the year ended 31 March 2012:

(1) Antony was previously employed by Mix and Match Ltd, a Hong Kong-listed company. On 1 March 2011, he was offered a lump sum payment of $300,000 to join Modern Home Ltd (MHL), an interior decoration firm resident in Hong Kong, as head designer. On 1 April 2011 he accepted the offer, received the payment and started working for MHL.

(2) His salary with MHL is $100,000 per month. Antony contributed 5% of his total salary to MHL’s Mandatory Provident Fund Scheme; MHL contributed 10% to the Scheme.

(3) Antony received a ‘housing allowance’ of $30,000 per month. However, he only spent $25,000 per month on rent, government rates and management fees associated with his rented flat. His employment contract states that his rental allowance is designed to enable him to afford accommodation in Hong Kong, and that it may be applied by him towards rent or a home purchase. MHL requires Antony to provide a copy of his lease and monthly rental receipts, but has never queried the fact that he does not spend the whole of his housing allowance on accommodation.

(4) MHL provided Antony with a new car (cost $500,000) which he could, and did, use for private (50%) as well as business (50%) purposes. MHL also provided him with a petrol station card taken out in the name of MHL. Antony charged all his expenditure on petrol, totalling $48,000, to this card.

(5) MHL paid a club membership for Antony at the Hong Kong Designers Club. The annual membership fee was $32,000 and the membership was in Antony’s name. Antony regularly used the club for entertaining MHL’s clients. His total entertainment expenditure at the club was $38,000, of which MHL reimbursed him $28,000 upon production of vouchers showing client entertainment and promotion.

(6) Antony received a share option in the year of assessment 2009/10 while he was working for Mix and Match Ltd. Under the terms of his share option, Mix and Match Ltd would either pay him the cash value of his option or provide him with shares. Antony could not insist on receiving shares. The option became exercisable in the year of assessment 2011/12. When Antony exercised his option, Mix and Match Ltd exercised its right to pay cash instead of providing shares; and Antony received $100,000.

(7) After work hours, Antony devoted his time to writing numerous articles on interior design for magazines and newspapers. From this activity, he earned $90,000 in the year 2011/12.

(8) Antony earned $15,000 in royalties in 2011/12 from a book on interior design that he had written the previous year. The publisher who paid him the royalties is based in Singapore, and the book was published and sold only in Singapore.

(9) Rebecca is a housewife. In her spare time, she sells home products to friends on behalf of a Taiwan company. For this purpose, the company sends her a stock of products each month, and Rebecca arranges home parties to which she invites friends and demonstrates the products. She earns a commission of 20% of the gross sales proceeds of the goods she sells on behalf of the company. In the year of assessment 2011/12, Rebecca earned commissions totalling $80,000.

Required:

(a) Advise Antony and Rebecca of their respective tax positions for the year of assessment 2011/12. Support your advice with a computation of Antony’s salaries tax liability. (25 marks)

(b) Advise Rebecca of the compliance obligations, if any, imposed on her under the Inland Revenue Ordinance in respect of her sale of home products on behalf of the Taiwan company. (4 marks)

Section B – TWO questions ONLY to be attempted

3.

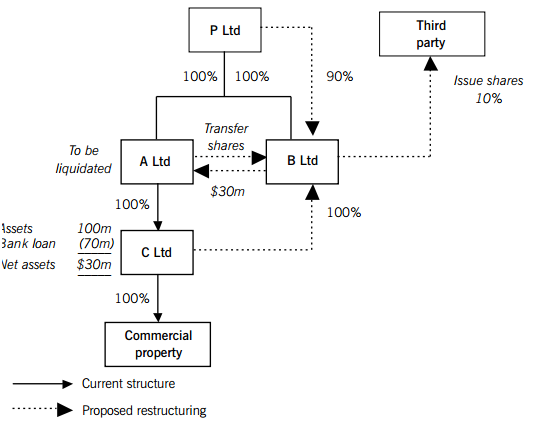

(a) Below is the group structure of P Ltd and its subsidiaries:

Under the current structure, P Ltd owns all the shares in A Ltd and B Ltd. A Ltd, in turn, owns all the shares in C Ltd. P Ltd is incorporated in Bermuda. A Ltd, B Ltd and C Ltd are all incorporated in Hong Kong. C Ltd owns a commercial property in Hong Kong, which is mortgaged in favour of the Citibank for an amount of $70 million.

It is proposed to restructure the group in January 2013 as follows:

Step 1: A Ltd will transfer 100% of the shares in C Ltd to B Ltd. The consideration will be $30 million payable to A Ltd, plus another $70 million payable direct to the Citibank on behalf of C Ltd.

Step 2: B Ltd will issue shares equivalent to 10% of its total new shareholdings to an unrelated third party for $4 million. The amount so raised will not be used in Step 1.

Step 3: A Ltd will then be liquidated.

Required:

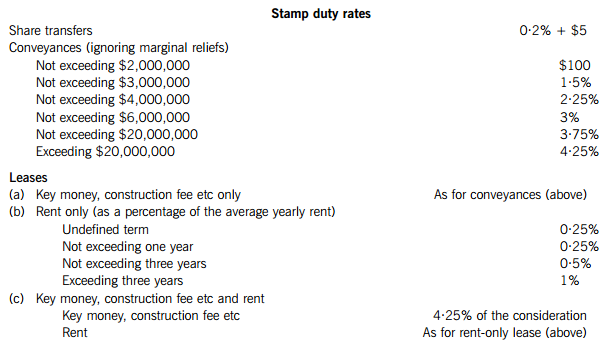

Explain the stamp duty implications arising from the transfer of the shares in C Ltd (Step 1). Clearly identify any available exemptions and analyse the extent to which these exemptions may be affected by Steps 2 and 3 in the restructuring proposal. (11 marks)

(b) After the restructuring, C Ltd will lease the commercial property to B Ltd for four years. Under the lease agreement, B Ltd will pay C Ltd $50,000 per month plus 3% of B Ltd’s gross turnover each month from the business conducted in the property. The market rental of the property is $80,000 per month.

Required:

Explain the stamp duty implications of this leasing arrangement. (5 marks)

4.

Home Design Inc (HDI) is a US corporation which is engaged in the business of purchasing furniture from factories in Mainland China and reselling them to customers around Asia, including Hong Kong.

HDI has engaged the services of an unrelated buying agent in Hong Kong, Buyer Ltd, to deal with suppliers on its behalf. Buyer Ltd is responsible for negotiating terms (as dictated by HDI) and placing purchase orders with suppliers’ representatives in Hong Kong, performing quality control services, and arranging shipment of the furniture either to HDI in the USA or directly to customers outside the USA according to the directions given by HDI.

In addition, Buyer Ltd maintains a showroom in Hong Kong, which potential customers visit from time to time to view samples. If buyers wish to place orders during such visits, they complete a purchase order form. which Buyer Ltd faxes to HDI’s office in the USA. HDI then follows up with customers out of its office in the USA. Buyer Ltd does not negotiate the terms of such sales. About 20% of all sales are made to customers in Hong Kong.

Required:

(a) Based on the Departmental Interpretation and Practice Note No. 21 entitled ‘Locality of Profits’, explain the practice adopted by the Commissioner of Inland Revenue for determining the source of trading profits. (4 marks)

(b) Discuss whether Home Design Inc’s profits from the trading transactions should be subject to, or exempt from, profits tax. If you consider that the profits are subject to profits tax, advise how Home Design Inc could restructure its activities to ensure that the profits would be exempt from tax. (12 marks)

5.

Auto Ltd is a company incorporated and carrying on business in Hong Kong. Despite continuous profitability since the commencement of its business, in the last year Auto Ltd has experienced a tremendous market downturn and incurred significant accounting losses. The sole shareholder of Auto Ltd, Mr Tan, is a non-Hong Kong resident. He understands that under his tax jurisdiction, tax losses incurred by a corporation can be carried back and applied to offset a corporation’s profits in the preceding year. Moreover, tax losses of a corporation resident in his tax jurisdiction can be transferred to another profitable corporation within the same group.

Required:

(a) Based on the Inland Revenue Ordinance, state the general rules governing the treatment of tax losses for corporations carrying on businesses in Hong Kong, assuming the corporations are not involved in any partnership. (4 marks)

(b) Mr Tan is considering disposing of the shares in Auto Ltd in order to capitalise the tax benefit arising from the tax losses carried forward by Auto Ltd.

Required:

Advise Mr Tan on the Hong Kong tax implications arising from the share disposal for the ability of Auto Ltd to carry forward its tax losses. (6 marks)

(c) If he does not sell the shares in Auto Ltd, Mr Tan intends to make a loan to Auto Ltd with interest in order to finance the company’s future operations.

Required:

Advise Mr Tan on the Hong Kong tax implications to Auto Ltd in respect of the interest incurred on this loan as currently proposed and, if appropriate, suggest a structure which will ensure that the loan interest will be deductible.

Note: You may assume that Mr Tan is not carrying on a money lending business when and by virtue of making the loan. (6 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

更多“SUPPLEMENTARY INSTRUCTIONS1. You should assume that the tax rates and allowances shown bel”相关的问题

更多“SUPPLEMENTARY INSTRUCTIONS1. You should assume that the tax rates and allowances shown bel”相关的问题

第1题

SUPPLEMENTARY INSTRUCTIONS

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

TAX RATES AND ALLOWANCES

The following 2011/12 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

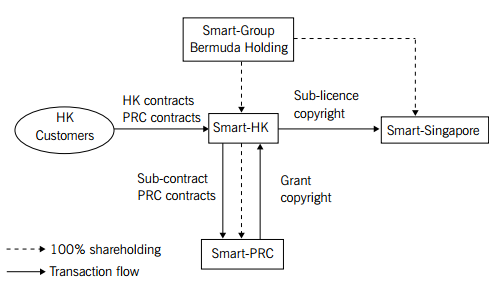

Smart HK Ltd (‘Smart-HK’) is a company incorporated and carrying on business in Hong Kong as a professional training service provider. Smart-HK has a subsidiary in the PRC (‘Smart–PRC’) and is ultimately owned by a Bermuda company which also owns a subsidiary in Singapore (‘Smart-Singapore’). The four companies are collectively known as the ‘Smart-Group’.

Recently, the shareholders of the Smart-Group decided to divest the whole group to Acquirer Group (‘A-Group’). A full-scale due diligence exercise is to be carried out by the A-Group.

You are the person in-charge of the tax due diligence review of Smart-HK, with the aim to assess the Hong Kong tax position of the company and whether there is any potential tax risk leading to unexpected additional tax liabilities after its acquisition by the A-Group. To facilitate the review, you are provided with the following information:

A simplified chart of the Smart-Group indicating the shareholdings and major transaction flows:

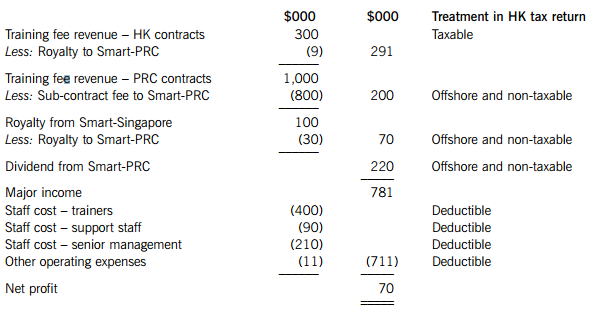

An extract of Smart-HK’s management accounts for the preceding year, indicating the Hong Kong tax treatment of each item:

Additional information about Smart-HK’s operations:

(1) Smart-HK provides training services to its customers in Hong Kong and the PRC, depending on customers’ needs. Separate contracts are signed for training in Hong Kong (‘HK Contracts’) and the PRC (‘PRC Contracts’). Smart-HK sub-contracts all its obligations under the PRC Contracts to Smart-PRC which agrees to fulfil the contract obligations on behalf of Smart-HK and run the training sessions in the PRC for the customers. The sub-contract fee payable to Smart-PRC is agreed at 80% of the gross service fee under the PRC Contracts. For each training session, experienced trainers are sent from Smart-HK to assist Smart-PRC, but no cost is charged for this by Smart-HK. Other support provided in Hong Kong for the PRC Contracts include liaison with customers, arranging itinerary etc. None of the customers are related to the Smart-Group, and all the service contracts (both HK and PRC Contracts) are negotiated and signed in Hong Kong.

(2) Smart-PRC is responsible for preparing the relevant training materials for use in the training sessions. It has been agreed that the copyright for these materials will remain with Smart-PRC. By virtue of the licence agreement between Smart-PRC and Smart-HK, Smart-HK is granted the right to use the training materials in Hong Kong and Singapore. The royalty payable is based on 3% of the training revenue received. Smart-HK has entered into a sub-licence agreement with Smart-Singapore under which Smart-Singapore is allowed to use the training materials for a royalty at 10% of the training revenue received.

(3) Smart-PRC is the wholly-owned subsidiary of Smart-HK. Each year, Smart-HK has recorded a considerable amount of dividend income from Smart-PRC. Based on the management representation, Smart-PRC has been making a very good return from its investment activities in the PRC, and these investments are mainly funded by the large amount of cash received from Smart-HK by way of sub-contract fees.

Required:

As the tax advisor of Acquirer Group in charge of the tax due diligence review, prepare a report for the directors of Acquirer Group, addressing the Hong Kong tax issues set out below relating to Smart-HK, including supporting calculations where appropriate.

(i) The Hong Kong profits tax implications of the training fee revenue from the PRC Contracts and the sub-contract fee payable to Smart-PRC. Your report should cover the contemporary principles/rules determining the taxability of the net income of $200,000 from the PRC training service, the arguments both for and against the offshore claim made by Smart-HK, the role played by Smart-PRC and whether you agree with the current profits tax treatments by Smart-HK;

Note: For the purpose of this part only, you should assume that all amounts are charged on an arm’s length basis. (14 marks)

(ii) Assuming that the training fees from the PRC Contracts are taxable in Hong Kong, the Hong Kong profits tax implications, if any, to Smart-HK of the sub-contract fee paid to Smart-PRC, taking into account the current transfer pricing rules and practices in Hong Kong. Your report should cover the current views of the Inland Revenue Department on charges made between associated enterprises, as set out in Departmental Interpretation and Practice Note (DIPN) 46 ‘Transfer pricing guidelines – Methodologies and related issues’;

Note: You are NOT required to make detailed references to the Double Taxation Arrangement between Hong Kong and the PRC. (10 marks)

(iii) Assuming that Smart-PRC is not carrying on business in Hong Kong, the Hong Kong profits tax implications to Smart-PRC in respect of the royalty received and the Hong Kong tax compliance obligations of Smart-HK in this context; (6 marks)

(iv) Other than the potential technical risks as discussed above, any other information that you would request from Smart-HK in order for you to assess its level of tax compliance in the context of the Hong Kong tax regime, giving brief explanations as to why the information is required. (6 marks)

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (4 marks)

2.

Mr Chan, a Malaysian, has been working in Hong Kong for World Ltd, a company resident in Hong Kong (the ‘Company’) since 1 April 2004, at a monthly salary of $80,000. Due to a failure in an important business project, Mr Chan was asked to resign and he submitted his resignation letter to the Company’s director on 31 March 2012, notifying that he would terminate his employment with effect from 1 April 2012. However, his official last day of work in the Company would be 29 March 2012, after deducting two days of entitled annual leave.

Other details of Mr Chan’s termination arrangement and payment are as follows:

(I) His total termination payment represented the following:

(i) his final salary accrued up to 31 March 2012;

(ii) compensation for the remaining balance of his entitled annual leave days as at 31 March 2012 of 15 days, of $40,000;

(iii) compensation for loss of office as agreed with the Company’s director, representing one month of his salary. It has been the practice of the Company to pay an annual discretionary bonus equivalent to one month’s salary;

(iv) his entitlement payment from the Company’s provident fund registered under the Occupational Retirement Scheme Ordinance in the amount of $300,000 (Mr Chan and the Company had contributed equal amounts to the provident fund). The accrued benefit attributable to Mr Chan’s service was $120,000; and

(v) compensation for the loss incurred by him from having to sell his car in Hong Kong as a result of his termination of $10,000.

(II) The Company’s director agreed to pay Mr Chan an extra sum of compensation of $200,000 after six months from the date of his termination on the condition that he did not work for the Company’s competitors during this period.

Mr Chan is planning to move back to Malaysia. Before he goes back, he is interested in investing in residential properties in Hong Kong. With various ideas in mind, he has approached you for advice on how to plan his investment in a tax effective manner. His plans and ideas are:

(1) He will acquire one or two residential units in Tsimshatsui and lease them out for rental.

(2) The acquisitions will be financed partly by his personal savings (around 50%) and partly by bank mortgage loans. It is expected that the rental income will not be sufficient to cover the mortgage interest.

(3) The residential units need to be renovated before they can be leased out. A substantial amount of renovation costs is expected to be incurred after the acquisition.

(4) In two to five years’ time, he may consider disposing of the units if property prices go up to a satisfactory level.

(5) He has no idea as to how the properties should be owned, by an individual or by a special purpose company. However, for the former, he prefers to have the properties owned by his daughter who is single, has always been living in the UK and has no connection with Hong Kong. He believes that this will lead to a tax-free position in respect of the rental received. Alternatively, he is considering setting up a company in an offshore tax haven to hold the properties so that Hong Kong tax can be avoided; with minimal local tax payable in the tax haven country.

Required:

(a) Advise Mr Chan of the general principles used for determining the taxability of each item of the termination payment received upon his cessation of employment.

Note: You are NOT required to calculate his assessable/chargeable income or tax payable. (14 marks)

(b) Compare the tax implications for the rental income received from the residential units if the properties are held by:

(i) an individual; and (3 marks)

(ii) a special purpose company. (4 marks)

(c) Comment on the extent to which the tax planning ideas as described in note 5 above are feasible. (3 marks)

(d) Explain the tax implications arising from the disposal of the residential units in two to five years’ time, including how these may be affected by the different ownership structures. (6 marks)

Section B – TWO questions ONLY to be attempted

3.

Mr Hui is working as the Regional IT Manager for GA Ltd (‘GAL’), a company incorporated and carrying on general insurance business in Hong Kong. As of 31 August 2012, Mr Hui will have reached the retirement age. He has been requested by his boss to extend his employment services for another two years, but with the following proposed changes in his appointment terms:

(1) The employment contract between Mr Hui and GAL will be terminated with effect from 1 September 2012.

(2) Mr Hui will set up a consulting company which will enter into a service agreement with GAL. Under the service agreement, the consulting company is obliged to provide IT related services to GAL and Mr Hui is designated as the individual to provide the required services.

(3) In return for the services provided by Mr Hui, GAL will pay a monthly fee to the consulting company in an amount equivalent to the monthly salary that Mr Hui currently receives. The payment will be made by direct bank transfer into the consulting company’s bank account. Moreover, a profit-sharing bonus will be payable to the consulting company on an annual basis, calculated based on the performance of GAL’s business for that year.

(4) Under the same service agreement, Mr Hui will be provided with an office together with secretarial and administrative support by GAL. However, he will not be allowed to take vacation for more than 30 days in a year.

(5) During the period of providing services to GAL, Mr Hui will continue to hold the title of Regional IT Manager, and will remain under the instruction and supervision of GAL’s Group IT Director, Mr Hui’s current boss.

(6) The service agreement also explicitly mentions that GAL does not act as the employer of Mr Hui and thus is not obliged to comply with any necessary employment regulations and reporting obligations. Mr Hui will undertake to enter into a separate employment contract with his consulting company so as to enable him to provide the required services to GAL. However, GAL will not be involved in, or responsible for, the arrangement between Mr Hui and his consulting company.

Required:

(a) Explain the criteria that the Inland Revenue Department will use to determine whether the proposed changes to Mr Hui’s appointment terms will be acceptable as a contract for consultancy services rather than of employment. Clearly identify the extent to which the terms specified in items (1) to (6) do/do not support the contention that GA Ltd no longer acts as Mr Hui’s employer. (11 marks)

(b) Assuming that the Inland Revenue Department considers that Mr Hui remains an employee of GA Ltd after 1 September 2012, advise on the tax implications, if any, including any compliance obligations imposed under the Inland Revenue Ordinance for Mr Hui, his consulting company and GA Ltd. (4 marks)

4.

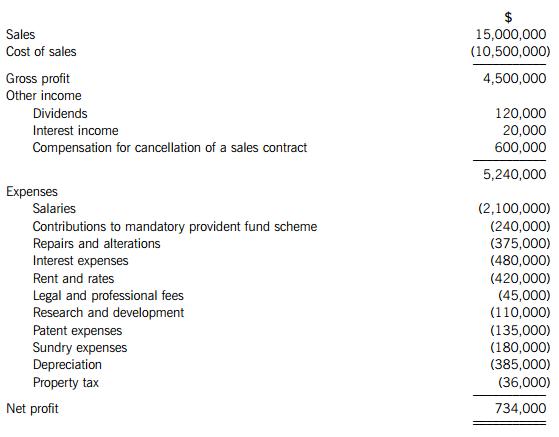

Compass Ltd and David Lo have been in a partnership, carrying on business as a manufacturer of computer games in Hong Kong for many years. For the year ended 31 March 2012 the partnership’s income statement contained the following particulars:

Required:

State, with reasons, the additional information that you would require in order to determine the profits tax payable by the partnership business for the year of assessment 2011/12.

5.

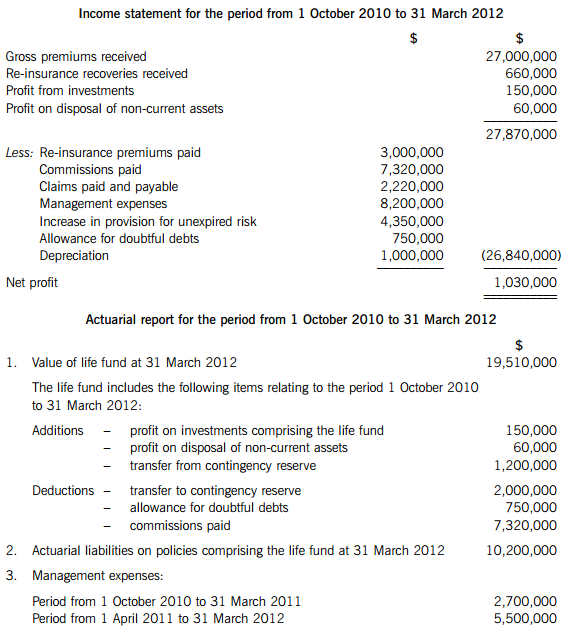

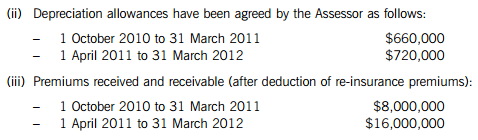

(a) Take Care Insurance Ltd (‘TCIL’) commenced its life insurance business in Hong Kong on 1 October 2010. TCIL makes up accounts to 31 March each year and has submitted an actuarial report for the period from 1 October 2010 to 31 March 2012. The following information has been extracted from its accounts and the actuarial report:

Other information:

(i) All insurance contracts were executed in Hong Kong.

The director of TCIL understands that there are two alternative methods for ascertaining the company’s assessable profits under the Inland Revenue Ordinance:

(1) the ‘per cent premium’ method (under s.23(1)(a)); and

(2) the ‘adjusted surplus’ method (under s.23(1)(b)).

The director has approached you for advice on the two methods.

Required:

(i) Compute the assessable profits of Take Care Insurance Ltd for the years of assessment 2010/11 and 2011/12 under each of the two alternative methods, clearly identifying the basis period; (7 marks)

(ii) Advise Take Care Insurance Ltd, from a tax perspective, on the factors to be considered in choosing between the two methods. (4 marks)

(b) On 1 June 2012, Ms Yan purchased shares in a Hong Kong private company from her relative in Singapore. The contract for the purchase and sale of the shares was executed in Singapore. Neither the contract nor the transfer has yet been submitted to the Stamp Duty Office for stamping.

Required:

Explain Ms Yan’s obligations under the Stamp Duty Ordinance, clearly identifying the instruments, if any, that have to be stamped, and if so, how, when and by whom. (4 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第2题

SUPPLEMENTARY INSTRUCTIONS

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

TAX RATES AND ALLOWANCES

The following 2010/11 tax rates and allowances are to be used in answering the questions.

Section A – BOTH questions are compulsory and MUST be attempted

1.

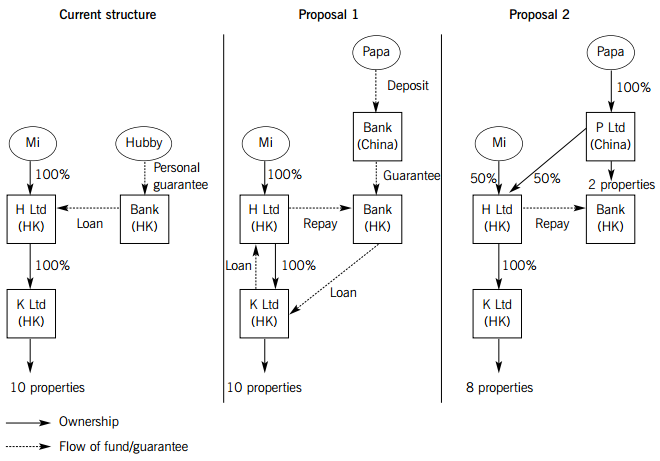

Ms Mi (Mi) is the sole shareholder of H Ltd, which was incorporated in Hong Kong during December 2010 for the purpose of acquiring the shares in K Ltd at the cost of $50 million. K Ltd is a Hong Kong incorporated company holding ten properties in Hong Kong. These properties are classified as ‘trading stock’ in K Ltd’s accounts on the basis that they are held for sale at a profit. The acquisition cost was financed by a bank loan which was secured by a personal guarantee given by Mi’s husband (Hubby). The current structure is illustrated on the left hand side of the diagram below:

You recently met Mi who advised you that she was going to divorce her husband. Thereafter, her husband will withdraw his personal guarantee on the bank loan, leading to the loan to be called back by the bank. Mi has sought help from her father (Papa), who has given two proposals for her consideration. These two proposals, as illustrated in the diagrams above, have the following details:

Proposal 1: A new bank loan will be extended from the bank to K Ltd, which is secured by a deposit placed by Papa with the Bank’s associate in China. K Ltd will on-lend the bank loan money to H Ltd interest free, to enable H Ltd to repay the old bank loan. Papa’s deposit will earn interest at the same rate that K Ltd pays on the new bank loan minus a 0.5% bank fee.

Proposal 2: Papa will invest, via P Ltd, a company incorporated in China, into H Ltd as a 50% shareholder. H Ltd could use the additional fund to repay the bank loan. However, he is neutral as to whether the 50% shareholding is acquired by way of new shares issued by H Ltd to him directly, or the sale of shares in H Ltd from Mi to him. If Mi sells her 50% shareholding to Papa, she will lend the money, interest-free, to H Ltd. Mi anticipates that she will make a significant profit on the sale and since K Ltd is trading in properties, she is concerned that her profit from the sale of the shares will also be taxed. Moreover, under this proposal, Papa also requests that after the shareholding change, K Ltd will sell two properties to P Ltd at cost, which is about 30% below the current market price.

Apart from the above two proposals from Papa, Mi also discussed with you the following alternative:

Proposal 3: K Ltd will change the strategy for holding the properties from trading to investment. These properties will be leased out to earn rental income. K Ltd will then assign its income rights under these leases to an independent party for a lump sum consideration. The lump sum will either be paid up as dividend or lent to H Ltd interest-free, to enable H Ltd to repay the existing bank loan.

As a friend of Mi as well as a professional tax consultant, you have promised Mi to review the above proposals from a Hong Kong tax perspective, and write a report to her.

Required:

Prepare a report for Ms Mi addressing the tax issues set out below, including supporting calculations where appropriate.

(a) Current structure – Comment on the tax effectiveness of the current funding structure in terms of the funding cost incurred by H Ltd. (2 marks)

(b) Proposal 1 – As compared with the current funding structure, advise whether there are any profits tax implications arising from Proposal 1 for:

(i) H Ltd; and (1 mark)

(ii) K Ltd. (4 marks)

(c) Proposal 2 – Advise on:

(i) The profits tax and stamp duty implications for H Ltd and P Ltd, if P Ltd subscribes for new shares to be issued by H Ltd directly to P Ltd; (2 marks)

(ii) The profits tax and stamp duty implications for Ms Mi if she sells 50% of her shareholding in H Ltd to P Ltd. Discuss also whether Ms Mi’s concern that her tax position will be affected by K Ltd’s property trading business is valid; and (15 marks)

(iii) The profits tax and stamp duty implications for K Ltd if it sells the two properties to P Ltd at cost. (8 marks)

(d) Proposal 3 – Advise on the profits tax implications for K Ltd arising from the change of holding strategy for the properties and the subsequent assignment of its income rights under the leases. (4 marks)

Notes:

1. Where appropriate, the effect of the HK–China Double Tax Arrangement (the DTA) on the transactions should be mentioned, but you are not required to discuss the detailed provisions in the DTA.

2. You should ignore provisional tax and overseas tax throughout this question.

3. You are not required to discuss any accounting treatments, and their relevant standards or principles in relation to the transactions in this case.

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (2 marks)

2.

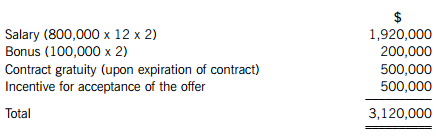

Kelvin King, a Canadian resident, has been offered a new job in a Hong Kong resident company (the Company) under a two-year contract from 1 April 2012 to 31 March 2014. The following draft total remuneration package has been offered for his consideration:

Other major terms of the contract include:

(1) Kelvin is not allowed to work for another company engaged in the same business or industry for 12 months after the cessation or expiration of his contract with the Company.

(2) Subject to application by Kelvin and approval by the Company, a staff quarter can be provided by the Company at a rent equivalent to 5% of Kelvin’s monthly salary. Details of the choices of quarters are available in the Personnel Department upon request.

(3) Kelvin is entitled to benefit from the Company’s medical insurance scheme, which allows him to receive outpatient services at no cost. The annual premium per employee paid by the Company under the scheme is $6,000.

(4) Kelvin is entitled to annual leave of three weeks.

(5) Kelvin is given an option to choose one of two share-based benefits under the Company’s Staff Incentive Scheme:

(i) Share option benefit – Kelvin will be granted an option to purchase 30,000 shares in the Company at a favourable option price. The options are unconditional.

(ii) Share award benefit – Kelvin will be granted 25,000 shares in the Company. Half of the share award has no vesting period, while the other half has a vesting period of 18 months during which Kelvin is required to remain in employment with the Company; and he is only entitled to these shares at the end of the vesting period.

Kelvin does not own a property in Hong Kong, nor does he have any plan to buy one in the short term. It is likely that he will rent a furnished apartment near his workplace as he has been advised that the Company quarter is unfurnished and has no club facilities.

Kelvin plans to return to Canada after the contract expires on 31 March 2014. He is thinking of choosing the share option benefit as he believes that if he exercises the share option after he returns to Canada, no Hong Kong tax will be payable.

The Company will allow Kelvin to restructure his two-year remuneration package as long as the total remuneration package (other than the share-based benefits) at the end of the contract does not exceed $3,120,000.

Required:

As tax consultant to Kelvin King, write a letter to him giving advice on the following:

(a) The Hong Kong salaries tax position of the draft package. Note: you are NOT required to calculate his assessable/chargeable income or tax payable. (20 marks)

(b) How Kelvin should restructure his remuneration package so as to minimise the amount of salaries tax he will have to pay in Hong Kong. (6 marks)

Professional marks will be awarded in question 2 for the appropriateness of the format and presentation of the letter and the effectiveness with which its advice is communicated. (2 marks)

Section B – TWO questions ONLY to be attempted

3.

(a) AB Ltd, a Hong Kong resident company, is organising a pop music concert to be staged in Hong Kong in January 2012. AB Ltd has appointed another Hong Kong resident company, CD Ltd, to procure performances by various overseas artists at the concert. CD Ltd has entered into an agreement with Mr X, the US resident manager of a US resident pop star, for the performance of that pop star at the concert for a fee of $3,000,000. AB Ltd will pay $3,300,000 to CD Ltd, which will then pay $3,000,000 to Mr X. The fee payable by Mr X to the US pop star is $2,700,000.

Required:

Explain the withholding obligations, if any, imposed under the Inland Revenue Ordinance on each of the parties concerned and compute, with explanations, the amount of tax to be withheld. (8 marks)

(b) KK Ltd is carrying on a trading business in Hong Kong, preparing accounts to 31 March each year. On 1 February 2011, it entered into a lease agreement to lease a motor vehicle, which has since been used in KK Ltd’s business, from an unrelated leasing company. The lease agreement is for a term of 24 months, with a monthly lease payment of $45,000 commencing from 1 February 2011. The cash cost of the motor vehicle was $840,000. The agreement provides KK Ltd with an option to acquire the motor vehicle at the end of the lease period upon payment of a small residual amount; and it is expected that the residual value will be higher than the exercise price.

Required:

Explain the tax implications of the lease agreement to KK Ltd, clearly identifying the expenditures it is entitled to claim with respect to the motor vehicle for the year of assessment 2010/11. (9 marks)

4.

MRS (HK) Ltd (MRS-HK) is a Hong Kong-incorporated company, which is resident and carrying on business in Hong Kong. During the month of July 2011, MRS-HK sent a team of five specialist staff to its associated company in China, MRS (China) Ltd (MRS-China), to work for them on a China project for a period of two weeks. All the associated costs including accommodation and meals were settled by MRS-China.

After the assignment, MRS-HK intended to issue a debit note to MRS-China seeking to recover the related employment costs of the five specialist staff on this project in the amount of HK$50,000. However, MRS-HK was subsequently advised by MRS-China that recharging these employment costs would result in China individual income tax being payable by the five specialist staff. All five of the specialist staff members are resident in Hong Kong.

Required:

(a) Discuss the Hong Kong salaries tax positions of the five specialist staff of MRS (HK) Ltd in respect of their services performed in China during July 2011.

Note: For the purpose of this part of the question only, you should answer based on the Hong Kong Inland Revenue Ordinance, and ignore the application of the double tax arrangement between Hong Kong and the PRC. (6 marks)

(b) Based on Article 14 of the double taxation agreement (DTA) signed between Hong Kong and the PRC, which is extracted below, explain how the recharge by MRS (HK) Ltd to recover the employment costs from MRS (China) Ltd may affect the exemption from China tax available to the five specialist staff members. You should clearly identify the crucial factors necessary for the DTA exemption to be available.

‘Article 14 Income from Employment

1. Subject to the provisions of Articles 15, 17, 18, 19 and 20, salaries, wages and other similar remuneration derived by a resident of One Side in respect of an employment shall be taxable only in that Side unless the employment is exercised in the Other Side. If the employment is exercised in the Other Side, such remuneration as is derived therefrom may be taxed in that Other Side.

2. Notwithstanding the provisions of paragraph 1 of this Article, remuneration derived by a resident of One Side in respect of an employment exercised in the Other Side shall be taxable only in the first-mentioned Side if all the following conditions are satisfied:

(a) the recipient is present in the Other Side for a period or periods not exceeding in the aggregate 183 days in any 12-month period commencing or ending in the taxable period concerned, and

(b) the remuneration is paid by, or on behalf of, an employer who is not a resident of the Other Side, and

(c) the remuneration is not borne by a permanent establishment which the employer has in the Other Side.’ (6 marks)

(c) Assuming that both Hong Kong salaries tax and China individual income tax will be imposed on the five specialist staff in relation to the services rendered in China, advise on the possible relief or measures that are available to them to avoid double taxation, based on the Hong Kong Inland Revenue Ordinance and Article 21 of the double taxation agreement signed between Hong Kong and the PRC as extracted below.

‘Article 21 Methods for Elimination of Double Taxation

2. In the Hong Kong Special Administrative Region, double taxation shall be avoided as follows:

Subject to the provisions of the tax laws of the Hong Kong Special Administrative Region … Mainland tax paid in the Mainland of China in accordance with the provisions of this Arrangement in respect of any item of income derived from sources in the Mainland of China by a resident of the Hong Kong Special Administrative Region shall be allowed as a credit against Hong Kong Special Administrative Region tax imposed on that resident. However, the amount of the credit shall not exceed the amount of Hong Kong Special Administrative Region tax in respect of that item of income computed in accordance with the tax laws and regulations of the Hong Kong Special Administrative Region.’ (5 marks)

5.

(a) Mr Look carries on a consultancy business in the form. of a sole proprietorship in Hong Kong. He closes his accounts on 31 December each year. In the course of preparing his profits tax computation for the year of assessment 2010/11, Mr Look discovered that an expense of $10,000, being the cost of hiring a member of temporary staff for a special project during the year ended 31 December 2005, had been omitted from his business accounts and thus this deduction was not claimed in the tax return for 2005/06. He wonders whether he can now ask the Inland Revenue Department to revise the assessment for 2005/06.

Required:

Advise Mr Look of his right of action, if any, to revise the assessment for 2005/06 to take into account the cost of hiring the temporary member of staff during the year 2005. (9 marks)

(b) David Pang owns a flat in Regent Court, a residential building in Causeway Bay. The residential building has 150 flats in total. According to the deed of mutual covenants, the roof of the residential building is part of the building common area, and each owner of an individual flat is entitled to the same number of undivided shares in the building common area.

On 1 June 2010, David Pang, as the chairman of the Incorporated Owner of Regent Court, entered into an agreement with a company, granting it the right to erect a neon advertising sign on the roof for a licence fee of $100,000 per annum. The licence fee is to be used to meet the building management expenses.

Recently, David Pang received from the Inland Revenue Department a property tax return for the year of assessment 2010/11. The return was addressed to ‘The Incorporated Owner of Regent Court’. As David Pang considers that the roof is not a flat, the Incorporated Owner of Regent Court is not the owner and the fee is not directly paid to the owners of the flats, he believes that they should not be liable to property tax.

Required:

Advise David Pang whether the Inland Revenue Department is empowered under the Inland Revenue Ordinance to issue a 2010/11 property tax return in the name of ‘The Incorporated Owner of Regent Court’; and whether it is liable to property tax. (8 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第3题

SUPPLEMENTARY INSTRUCTIONS

1. You should assume that the tax rates and allowances shown below will continue to apply for the foreseeable future.

2. Calculations and workings should be rounded down to the nearest HK$.

3. Apportionments need only be made to the nearest month, unless the law and prevailing practice require otherwise.

4. All workings should be shown.

TAX RATES AND ALLOWANCES

The following 2010/11 tax rates and allowances are to be used in answering the questions.

1.

HK Engineering Co Ltd (HK Co), a Hong Kong-incorporated company carrying on business in Hong Kong, was successfully awarded a contract in Vietnam to help the Vietnam government with a new water plant project. A meeting has been scheduled with the Vietnam government’s representatives to discuss the details of the main contract. Prior to the meeting, the project manager, Mr Man, called for a meeting with other senior management staff, the details of which are as minuted below. All amounts are in HK$.

Minutes of Meeting on 1 June 2010 on Project Victory

Attendance:

Man (Project Manager)

FF (Finance Director)

TT (Treasurer)

EE (Chief Engineer)

1. Man briefly explained the scope of the work as required, including:

(a) the contract comprises two elements: supply of heavy equipment and the installation of the equipment on site;

(b) the total contract value is equivalent to $20 million covering both elements; and

(c) the duration of the project is estimated to be six months.

2. EE suggested that the equipment be purchased from one of their existing suppliers in Mainland China. Due to their long established relationship with this supplier, EE has confidence in negotiating the best terms and deal, with all the purchase orders and shipping documentation being dealt with directly in Hong Kong. The purchase cost is estimated to be around $8 million.

However, for the installation services, apart from employing local Vietnamese workers to perform. the on-site work, EE would need to send a team of experienced engineers from Hong Kong to Vietnam to supervise the work. As a result, the total staff costs for the project are estimated to be $4 million.

3. TT suggested that the $8 million purchase cost of the equipment be funded by the company’s current bank loan facility with interest at the rate of 5% per annum.

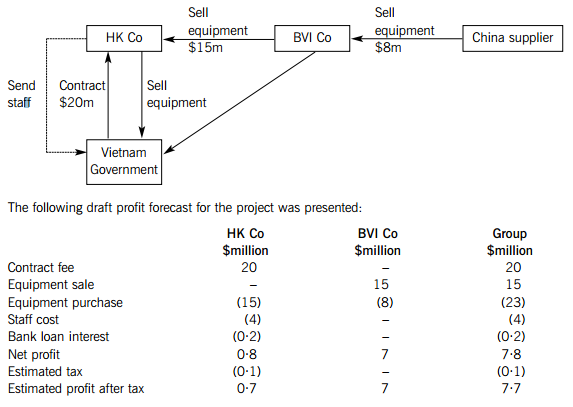

4. FF proposed the following structure using another member of the HK Co group, incorporated in the British Virgin Islands, BVI Co, in order to maximise the after-tax profit of the group:

5. Man appreciated the proposal explained by FF but questioned whether the structure would be challenged by the Inland Revenue Department as tax avoidance. Moreover, he is considering establishing a local subsidiary in Vietnam to sign the contract, as a start-up to expand HK Co’s business into the Vietnam market. FF agreed to solicit professional tax opinion on these aspects.

Required:

As the tax advisor of HK Engineering Co Ltd (HK Co), prepare a report for Mr Man addressing the tax issues set out below, including supporting calculations where appropriate.

(a) Assuming that a Vietnam subsidiary, wholly owned by HK Co, is established, the contract is to be signed by the Vietnam subsidiary and the equipment and staff are supplied by HK Co as outlined in point 2 of the minutes, advise on:

(i) The Hong Kong profits tax implications for HK Co with respect to the profits arising from the contract, together with any other matters on which you would recommend HK Co to obtain further advice; (4 marks)

(ii) How the supply of the equipment and staff should be dealt with in view of the current transfer pricing practice in Hong Kong. (8 marks)

Note: You are NOT required to comment on the Hong Kong-Vietnam tax treaty.

(b) Assuming that no Vietnam subsidiary is set up, and the structure proposed by the Finance Director (FF) as outlined in point 4 of the minutes is adopted, advise on:

(i) The Hong Kong profits tax implications for HK Co arising from the contract. You should specifically consider both the taxability of the contract value of $20 million, and the deductibility of the equipment purchase cost, staff costs and loan interest; (17 marks)

(ii) What the Hong Kong profits tax implications will be for BVI Co arising from the sale of the equipment to HK Co. (9 marks)

Professional marks will be awarded in question 1 for the appropriateness of the format and presentation of the report and the effectiveness with which its advice is communicated. (2 marks)

2.

Mr and Mrs Kwok are a married couple with no children. Mr Kwok has been working for a Hong Kong-listed company (the Company) since 1 August 2002. He had the intention to resign on 1 August 2010 but the Company had requested that he stay on for one more year. In recognition of his agreement to stay, the Company agreed to pay him an extra incentive of $50,000 on 1 August 2011. As the time is approaching, Mr Kwok is seeking professional tax advice on his tax position if he resigns effective from 1 August 2011 based on the following information:

Upon ceasing employment on 1 August 2011, Mr Kwok expects to receive the following final payments:

(1) A lump sum incentive payment of $50,000, as agreed in 2010, for Mr Kwok’s agreeing to extend his services for one year.

(2) An estimated amount of $100,000 representing his bonus entitlement in respect of the financial year 2011. This amount is estimated based on last year’s payment. The final figure will only be available in April 2012. Should the final figure exceed the payment of $100,000, the top-up will be paid to him in mid-April 2012. The Company has agreed that if the final figure is lower than $100,000 he will not be asked to pay anything back.

(3) Payment for leave not taken amounting to $20,000, including some leave days brought forward from 2010.

(4) Retirement benefit calculated in accordance with the rules governing the Company’s retirement plan which is duly registered under the Occupational Retirement Schemes Ordinance. Mr Kwok has met with the Company’s personnel manager, and he was asked to make a choice amongst the following options:

(i) leaving the Company by way of resignation (i.e. termination of service) and withdrawing his ‘leaving service benefit’ in the lump sum of $1,000,000;

(ii) leaving the Company by way of early retirement (subject to his supervisor’s consent) and withdrawing his ‘retirement benefit’ in the lump sum of $1,000,000 (same as the ‘leaving service benefit’ under (i) above);

(iii) leaving the Company by way of early retirement (subject to his supervisor’s consent) and withdrawing his ‘retirement benefit’ as a periodic pension in the amount of $10,000 per month commencing 1 August 2011 until his death.

Following his retirement, Mr Kwok will continue to serve the Company in the capacity of an independent consultant for a tenure of two years under the following terms:

(5) Mr Kwok will be obliged to provide services as and when required by the Company at an hourly rate of $1,000; but will be given advance notice of not less than 24 hours.

(6) Mr and Mrs Kwok are allowed to continue to occupy the Company’s staff quarters, subject to him continuing to pay the same rental contribution of $5,000 per month (see (10) below).

(7) At the expiry of the tenure, subject to the Company’s satisfaction with Mr Kwok’s service, Mr Kwok may be entitled to a gratuity of $10,000. Mr Kwok has also provided the following additional information:

(8) His annual taxable income reported in the tax return for the year of assessment 2010/11 is $1,000,000. He understands that when he is demanded to pay tax on his income for 2010/11, he will also be required to pay the provisional tax for 2011/12 based on the full-year income for 2010/11. He is concerned about the additional cash burden in meeting the provisional tax liability after ceasing employment.

(9) His monthly salary is $80,000 but he only receives $76,000 each month after deducting 5% as his contribution to the Company’s retirement plan. He understands that the Company is also obliged to contribute the same amount into the plan.

(10) He and his wife have been living in the Company’s quarter since August 2002. A monthly rental contribution of $5,000 has been deducted from his salary. The market rental of the quarter is $8,000 per month. Mr Kwok understands that he has been paying tax on this housing benefit but he has no idea about how the taxable value is calculated.

(11) His annual bonus for the financial year 2010 in the amount of $100,000 was received in April 2011.

(12) Mrs Kwok owns a property in Hong Kong and has been leasing it out for a monthly rental of $6,000. The property is still under mortgage and the monthly mortgage payment is $3,000, including $1,000 as interest. For tax reporting purposes, Mrs Kwok has each year declared the rental income of $3,000 per month and paid property tax thereon.

Required:

As his tax consultant, write a letter to Mr Kwok giving advice on the following:

(a) The general principles for determining the taxability of each item of final payment received by Mr Kwok upon his cessation of employment on 1 August 2011, assuming that he leaves the Company’s employment by way of resignation; that is, he chooses option (4)(i) above.

Note: You are NOT required to calculate the assessable/chargeable income or tax payable. (11 marks)

(b) The tax consequences, if any, to Mr Kwok if he chooses to leave the Company’s employment by way of retirement; and in this respect, whether his tax position would be different under the options of (4)(ii) and (4)(iii) above.

Note: You are NOT required to calculate the assessable/chargeable income or tax payable. (5 marks)

(c) The estimated tax positions of Mr and Mrs Kwok for the year of assessment 2011/12, and future years if applicable, based on the information available, together with any suggested actions available for Mr and Mrs Kwok’s consideration to help ease the cash burden required to meet their provisional tax liability for 2011/12 and/or improve their overall tax position in future years.

Notes:

(1) You should support your advice with calculations of assessable/chargeable income in so far as the information provided permits but are NOT required to calculate the tax payable.

(2) You should assume that Mr Kwok will keep 31 March as the ending date of his basis period. (12 marks)

Professional marks will be awarded in question 2 for the appropriateness of the format and presentation of the letter and the effectiveness with which its advice is communicated. (2 marks)

Section B – TWO questions ONLY to be attempted

3.

John Yuan is a PRC citizen working in the PRC. His brother, Peter Yuan, is a tax resident living and working in Hong Kong as a registered stockbroker under Part VI of the Securities Ordinance. Since 2008, Peter has been engaged in buying and selling shares listed in both Hong Kong and the US via internet banking. The share-trading is operated through two securities accounts, one in the name of Peter Yuan and the other in the name of John Yuan. Peter usually receives instructions or guidance from John through emails or telephone calls with regard to the identities of shares to buy or sell, the acceptable price range, the period of holding etc. However, at critical moments, he will exercise his discretion to maximise his brother’s interests or minimise his loss. Peter regularly collects updated market news and analysts’ reports and sends them to John. At the end of each month, Peter prepares a transaction summary for John showing the details of the transactions done on John’s account during the month. The average size of John’s portfolio per annum is around $20 million, and the average holding period for the shares is between 10 and 30 days. Since 2008, John’s portfolio has made a profit of around $2 million.

Required:

(a) Discuss whether or not John Yuan is liable to Hong Kong tax in respect of the profits arising from the trading of shares listed in Hong Kong and the US.

Note:

(1) For this part only, you are NOT required to discuss court case decisions in detail. Where applicable, only Departmental Interpretation and Practice Notes issued by the Inland Revenue Department should be relied upon.

(2) You are NOT required to examine in detail the impact of electronic commerce on the determination of source of profits. (10 marks)

(b) Assuming that Hong Kong tax is payable by John Yuan, advise whether the Inland Revenue Department can collect tax from Peter Yuan on behalf of John Yuan, and whether Peter Yuan is protected by the Inland Revenue Ordinance from any claims by John Yuan in respect of any tax paid on his behalf. (5 marks)

4.

(a) ‘It is a fundamental principle that stamp duty is charged on instruments, not on transactions.’

Required:

Comment on the effect of this statement, outlining the ways in which Hong Kong law ensures that certain transactions must be evidenced by a document in writing and giving a concrete example of how this principle can be used to avoid liability to Hong Kong stamp duty. (4 marks)

(b) The management of Tai Cheong Ltd (TCL) is considering acquiring all of the shares in Sun Cheong Ltd (SCL) for $500,000, which is the fair market value of these shares. SCL is a business competitor of TCL that is in financial difficulties; and has a substantial tax loss brought forward. Upon obtaining control of SCL, TCL will transfer part of its profitable retail business to TCL. SCL will then lease TCL’s retail shop in Mongkok from TCL. The term of the lease will be for six years and, under the lease agreement, SCL will pay 1% of the gross revenue from its retail business to TCL as the lease rental, subject to a maximum of $800,000 per annum. The gross revenue from the retail business is expected to be around $9 million per annum for the next few years.

Required:

(i) State the general rules governing the treatment of tax losses for corporations in Hong Kong; (3 marks)

(ii) Advise on the profits tax implications and stamp duty implications for Tai Cheong Ltd and Sun Cheong Ltd if Tai Cheong Ltd decides to acquire the shares of Sun Cheong Ltd and to lease the retail shop to Sun Cheong Ltd. (8 marks)

5.

Buying Co Ltd (Buying Co) is interested in acquiring all the shares in Selling Co Ltd (Selling Co) from its current shareholder, Mr Shum. The consideration will be based on Selling Co’s financial position as at 30 June 2011. In the course of conducting the tax due diligence on Selling Co, the finance director of Buying Co obtained the following extracted information:

In drafting the share sale and purchase agreement, the lawyer of Buying Co requested a tax indemnity from Mr Shum to the effect that, after the shareholding change, any extra tax cost suffered by Selling Co in relation to any transactions or events that occurred prior to the shareholding change would be indemnified by Mr Shum. However, this was not agreed to by Mr Shum’s lawyer. Instead, Mr Shum sent a letter to Buying Co advising that he guaranteed that all tax assessments have been finalised and Selling Co has no outstanding tax disputes with the Inland Revenue Department (IRD); and in case any tax queries were raised by the IRD in respect of the years prior to the shareholding change, he was prepared to take full responsibility to deal with the disputes with the IRD on behalf of Selling Co.

Required:

Advise the directors of Buying Co Ltd on any potential tax risks that may be faced by Buying Co Ltd in respect of the acquisition of Selling Co Ltd in terms of tax compliance and whether the guarantee letter from Mr Shum is sufficient and effective to protect Buying Co Ltd in the event of a tax challenge being raised for any prior year.

请帮忙给出每个问题的正确答案和分析,谢谢!

第4题

he new premises in the

year ending 31 March 2009 and explain, using illustrative calculations, how any additional recoverable input

tax will be calculated in future years. (5 marks)

第5题

h the maximum

possible investment, borrowing to finance the subscription and the implications of selling the shares.

(7 marks)

Note: you should assume that Vostok Ltd and its trade qualify for the purposes of the enterprise investment

scheme and you are not required to list the conditions that need to be satisfied by the company, its

shares or its business activities.

第6题

invest in his company,

Vostok Ltd. He also requires advice on the recoverability of input tax relating to the purchase of new premises.

The following information has been obtained from a meeting with Gagarin.

Vostok Ltd:

– An unquoted UK resident company.

– Gagarin owns 100% of the company’s ordinary share capital.

– Has 18 employees.

– Provides computer based services to commercial companies.

– Requires additional funds to finance its expansion.

Funds required by Vostok Ltd:

– Vostok Ltd needs to raise £420,000.

– Vostok Ltd will issue 20,000 shares at £21 per share on 31 August 2008.

– The new shareholder(s) will own 40% of the company.

– Part of the money raised will contribute towards the purchase of new premises for use by Vostok Ltd.

Gagarin’s initial thoughts:

– The minimum investment will be 5,000 shares and payment will be made in full on subscription.

– Gagarin has a number of wealthy business contacts who may be interested in investing.

– Gagarin has heard that it may be possible to obtain tax relief for up to 60% of the investment via the enterprise

investment scheme.

Wealthy business contacts:

– Are all UK resident higher rate taxpayers.

– May wish to borrow the funds to invest in Vostok Ltd if there is a tax incentive to do so.

New premises:

– Will cost £446,500 including value added tax (VAT).

– Will be used in connection with all aspects of Vostok Ltd’s business.

– Will be sold for £600,000 plus VAT in six years time.

– Vostok Ltd will waive the VAT exemption on the sale of the building.

The VAT position of Vostok Ltd:

– In the year ending 31 March 2009, 28% of Vostok Ltd’s supplies will be exempt for the purposes of VAT.

– This percentage is expected to reduce over the next few years.

– Irrecoverable input tax due to the company’s partially exempt status exceeds the de minimis limits.

Required:

(a) Prepare notes for Gagarin to use when speaking to potential investors. The notes should include:

(i) The tax incentives immediately available in respect of the amount invested in shares issued in

accordance with the enterprise investment scheme; (5 marks)

第7题

e UK without

giving rise to a UK income tax liability. (2 marks)

第8题

nd/or provide him with

interest-free loan finance for this purpose without increasing his UK income tax liability; (3 marks)

第9题

ale of the paintings

can be minimised. (2 marks)

第10题

the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!