重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section B – TWO questions ONLY to be attempted

Sigra Co is a listed company producing confectionary products which it sells around the world. It wants to acquire Dentro Co, an unlisted company producing high quality, luxury chocolates. Sigra Co proposes to pay for the acquisition using one of the following three methods:

Method 1

A cash offer of $5·00 per Dentro Co share; or

Method 2

An offer of three of its shares for two of Dentro Co’s shares; or

Method 3

An offer of a 2% coupon bond in exchange for 16 Dentro Co’s shares. The bond will be redeemed in three years at its par value of $100.

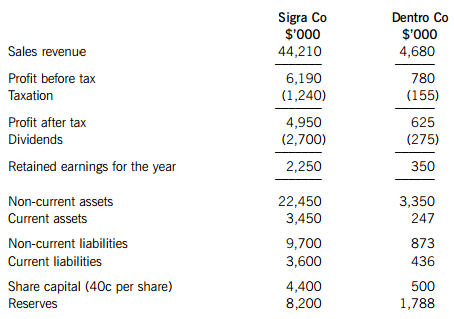

Extracts from the latest financial statements of both companies are as follows:

Sigra Co’s current share price is $3·60 per share and it has estimated that Dentro Co’s price to earnings ratio is 12·5% higher than Sigra Co’s current price to earnings ratio. Sigra Co’s non-current liabilities include a 6% bond redeemable in three years at par which is currently trading at $104 per $100 par value.

Sigra Co estimates that it could achieve synergy savings of 30% of Dentro Co’s estimated equity value by eliminating duplicated administrative functions, selling excess non-current assets and through reducing the workforce numbers, if the acquisition were successful.

Required:

(a) Estimate the percentage gain on a Dentro Co share under each of the above three payment methods. Comment on the answers obtained. (16 marks)

(b) In relation to the acquisition, the board of directors of Sigra Co are considering the following two proposals:

Proposal 1 Once Sigra Co has obtained agreement from a significant majority of the shareholders, it will enforce the remaining minority shareholders to sell their shares; and

Proposal 2 Sigra Co will offer an extra 3 cents per share, in addition to the bid price, to 30% of the shareholders of Dentro Co on a first-come, first-serve basis, as an added incentive to make the acquisition proceed more quickly.

Required:

With reference to the key aspects of the global regulatory framework for mergers and acquisitions, briefly discuss the above proposals. (4 marks)

更多“Section B – TWO questions ONLY to be attemptedSigra Co is a listed company producing confe”相关的问题

更多“Section B – TWO questions ONLY to be attemptedSigra Co is a listed company producing confe”相关的问题

第1题

fferent markets around the world. Although its main manufacturing base is in France and it uses the Euro (€) as its base currency, it also has a few subsidiary companies around the world. Lignum Co’s treasury division is considering how to approach the following three cases of foreign exchange exposure that it faces.

Case One

Lignum Co regularly trades with companies based in Zuhait, a small country in South America whose currency is the Zupesos (ZP). It recently sold machinery for ZP140 million, which it is about to deliver to a company based there. It is expecting full payment for the machinery in four months. Although there are no exchange traded derivative products available for the Zupesos, Medes Bank has offered Lignum Co a choice of two over-the-counter derivative products.

The first derivative product is an over-the-counter forward rate determined on the basis of the Zuhait base rate of 8·5% plus 25 basis points and the French base rate of 2·2% less 30 basis points.

Alternatively, with the second derivative product Lignum Co can purchase either Euro call or put options from Medes Bank at an exercise price equivalent to the current spot exchange rate of ZP142 per €1. The option premiums offered are: ZP7 per €1 for the call option or ZP5 per €1 for the put option.

The premium cost is payable in full at the commencement of the option contract. Lignum Co can borrow money at the base rate plus 150 basis points and invest money at the base rate minus 100 basis points in France.

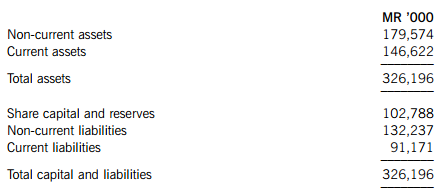

Case Two Namel Co is Lignum Co’s subsidiary company based in Maram, a small country in Asia, whose currency is the Maram Ringit (MR). The current pegged exchange rate between the Maram Ringit and the Euro is MR35 per €1. Due to economic difficulties in Maram over the last couple of years, it is very likely that the Maram Ringit will devalue by 20% imminently. Namel Co is concerned about the impact of the devaluation on its Statement of Financial Position.

Given below is an extract from the current Statement of Financial Position of Namel Co.

The current assets consist of inventories, receivables and cash. Receivables account for 40% of the current assets. All the receivables relate to sales made to Lignum Co in Euro. About 70% of the current liabilities consist of payables relating to raw material inventory purchased from Lignum Co and payable in Euro. 80% of the non-current liabilities consist of a Euro loan and the balance are borrowings sourced from financial institutions in Maram.

Case Three

Lignum Co manufactures a range of farming vehicles in France which it sells within the European Union to countries which use the Euro. Over the previous few years, it has found that its sales revenue from these products has been declining and the sales director is of the opinion that this is entirely due to the strength of the Euro. Lignum Co’s biggest competitor in these products is based in the USA and US$ rate has changed from almost parity with the Euro three years ago, to the current value of US$1·47 for €1. The agreed opinion is that the US$ will probably continue to depreciate against the Euro, but possibly at a slower rate, for the foreseeable future.

Required:

Prepare a report for Lignum Co’s treasury division that:

(i) Briefly explains the type of currency exposure Lignum Co faces for each of the above cases; (3 marks)

(ii) Recommends which of the two derivative products Lignum Co should use to manage its exposure in case one and advises on alternative hedging strategies that could be used. Show all relevant calculations; (9 marks)

(iii) Computes the gain or loss on Namel Co’s Statement of Financial Position, due to the devaluation of the Maram Ringit in case two, and discusses whether and how this exposure should be managed; (8 marks)

(iv) Discusses how the exposure in case three can be managed. (3 marks) Professional marks will be awarded in question 2 for the structure and presentation of the report. (4 marks)

第2题

Section A – BOTH questions are compulsory and MUST be attempted

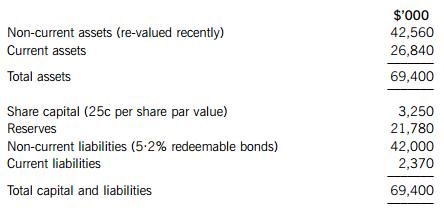

Coeden Co is a listed company operating in the hospitality and leisure industry. Coeden Co’s board of directors met recently to discuss a new strategy for the business. The proposal put forward was to sell all the hotel properties that Coeden Co owns and rent them back on a long-term rental agreement. Coeden Co would then focus solely on the provision of hotel services at these properties under its popular brand name. The proposal stated that the funds raised from the sale of the hotel properties would be used to pay off 70% of the outstanding non-current liabilities and the remaining funds would be retained for future investments.

The board of directors are of the opinion that reducing the level of debt in Coeden Co will reduce the company’s risk and therefore its cost of capital. If the proposal is undertaken and Coeden Co focuses exclusively on the provision of hotel services, it can be assumed that the current market value of equity will remain unchanged after implementing the proposal.

Coeden Co Financial Information

Extract from the most recent Statement of Financial Position

Coeden Co’s latest free cash flow to equity of $2,600,000 was estimated after taking into account taxation, interest and reinvestment in assets to continue with the current level of business. It can be assumed that the annual reinvestment in assets required to continue with the current level of business is equivalent to the annual amount of depreciation. Over the past few years, Coeden Co has consistently used 40% of its free cash flow to equity on new investments while distributing the remaining 60%. The market value of equity calculated on the basis of the free cash flow to equity model provides a reasonable estimate of the current market value of Coeden Co.

The bonds are redeemable at par in three years and pay the coupon on an annual basis. Although the bonds are not traded, it is estimated that Coeden Co’s current debt credit rating is BBB but would improve to A+ if the non-current liabilities are reduced by 70%.

Other Information

Coeden Co’s current equity beta is 1·1 and it can be assumed that debt beta is 0. The risk free rate is estimated to be 4% and the market risk premium is estimated to be 6%.

There is no beta available for companies offering just hotel services, since most companies own their own buildings. The average asset beta for property companies has been estimated at 0·4. It has been estimated that the hotel services business accounts for approximately 60% of the current value of Coeden Co and the property company business accounts for the remaining 40%.

Coeden Co’s corporation tax rate is 20%. The three-year borrowing credit spread on A+ rated bonds is 60 basis points and 90 basis points on BBB rated bonds, over the risk free rate of interest.

Required: (a) Calculate, and comment on, Coeden Co’s cost of equity and weighted average cost of capital before and after implementing the proposal. Briefly explain any assumptions made. (20 marks) (b) Discuss the validity of the assumption that the market value of equity will remain unchanged after the implementation of the proposal. (5 marks) (c) As an alternative to selling the hotel properties, the board of directors is considering a demerger of the hotel services and a separate property company which would own the hotel properties. The property company would take over 70% of Coeden Co’s long-term debt and pay Coeden Co cash for the balance of the property value. Required: Explain what a demerger is, and the possible benefits and drawbacks of pursuing the demerger option as opposed to selling the hotel properties. (8 marks)

第3题

are exported around the world. It is reviewing a proposal to set up a subsidiary company to manufacture a range of body and facial creams in Lanosia. These products will be sold to local retailers and to retailers in nearby countries.

Lanosia has a small but growing manufacturing industry in pharmaceutical products, although it remains largely reliant on imports. The Lanosian government has been keen to promote the pharmaceutical manufacturing industry through purchasing local pharmaceutical products, providing government grants and reducing the industry’s corporate tax rate. It also imposes large duties on imported pharmaceutical products which compete with the ones produced locally.

Although politically stable, the recent worldwide financial crisis has had a significant negative impact on Lanosia. The country’s national debt has grown substantially following a bailout of its banks and it has had to introduce economic measures which are hampering the country’s ability to recover from a deep recession. Growth in real wages has been negative over the past three years, the economy has shrunk in the past year and inflation has remained higher than normal during this time.

On the other hand, corporate investment in capital assets, research and development, and education and training, has grown recently and interest rates remain low. This has led some economists to suggest that the economy should start to recover soon. Employment levels remain high in spite of low nominal wage growth.

Lanosian corporate governance regulations stipulate that at least 40% of equity share capital must be held by the local population. In addition at least 50% of members on the Board of Directors, including the Chairman, must be from Lanosia. Kilenc Co wants to finance the subsidiary company using a mixture of debt and equity. It wants to raise additional equity and debt finance in Lanosia in order to minimise exchange rate exposure. The small size of the subsidiary will have minimal impact on Kilenc Co’s capital structure. Kilenc Co intends to raise the 40% equity through an initial public offering (IPO) in Lanosia and provide the remaining 60% of the equity funds from its own cash funds.

Required:

(a) Discuss the key risks and issues that Kilenc Co should consider when setting up a subsidiary company in Lanosia, and suggest how these may be mitigated. (15 marks)

(b) The directors of Kilenc Co have learnt that a sizeable number of equity trades in Lanosia are conducted using dark pool trading systems.

Required:

Explain what dark pool trading systems are and how Kilenc Co’s proposed Initial Public Offering (IPO) may be affected by these. (5 marks)

第4题

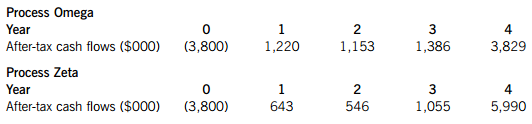

d into motor vehicle engines, will enable them to utilise fuel more efficiently. The component can be manufactured using either process Omega or process Zeta. Although this is an entirely new line of business for Tisa Co, it is of the opinion that developing either process over a period of four years and then selling the productions rights at the end of four years to another company may prove lucrative.

The annual after-tax cash flows for each process are as follows:

Tisa Co has 10 million 50c shares trading at 180c each. Its loans have a current value of $3·6 million and an average after-tax cost of debt of 4·50%. Tisa Co’s capital structure is unlikely to change significantly following the investment in either process.

Elfu Co manufactures electronic parts for cars including the production of a component similar to the one being considered by Tisa Co. Elfu Co’s equity beta is 1·40, and it is estimated that the equivalent equity beta for its other activities, excluding the component production, is 1·25. Elfu Co has 400 million 25c shares in issue trading at 120c each. Its debt finance consists of variable rate loans redeemable in seven years. The loans paying interest at base rate plus 120 basis points have a current value of $96 million. It can be assumed that 80% of Elfu Co’s debt finance and 75% of Elfu Co’s equity finance can be attributed to other activities excluding the component production.

Both companies pay annual corporation tax at a rate of 25%. The current base rate is 3·5% and the market risk premium is estimated at 5·8%.

Required:

(a) Provide a reasoned estimate of the cost of capital that Tisa Co should use to calculate the net present value of the two processes. Include all relevant calculations. (8 marks)

(b) Calculate the internal rate of return (IRR) and the modified internal rate of return (MIRR) for Process Omega. Given that the IRR and MIRR of Process Zeta are 26·6% and 23·3% respectively, recommend which process, if any, Tisa Co should proceed with and explain your recommendation. (8 marks)

(c) Elfu Co has estimated an annual standard deviation of $800,000 on one of its other projects, based on a normal distribution of returns. The average annual return on this project is $2,200,000.

Required:

Estimate the project’s Value at Risk (VAR) at a 99% confidence level for one year and over the project’s life of five years. Explain what is meant by the answers obtained. (4 marks)

第5题

Section B – TWO questions ONLY to be attempted

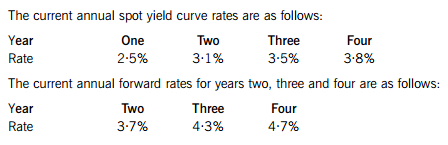

Sembilan Co, a listed company, recently issued debt finance to acquire assets in order to increase its activity levels. This debt finance is in the form. of a floating rate bond, with a face value of $320 million, redeemable in four years. The bond interest, payable annually, is based on the spot yield curve plus 60 basis points. The next annual payment is due at the end of year one.

Sembilan Co is concerned that the expected rise in interest rates over the coming few years would make it increasingly difficult to pay the interest due. It is therefore proposing to either swap the floating rate interest payment to a fixed rate payment, or to raise new equity capital and use that to pay off the floating rate bond. The new equity capital would either be issued as rights to the existing shareholders or as shares to new shareholders.

Ratus Bank has offered Sembilan Co an interest rate swap, whereby Sembilan Co would pay Ratus Bank interest based on an equivalent fixed annual rate of 3·76?% in exchange for receiving a variable amount based on the current yield curve rate. Payments and receipts will be made at the end of each year, for the next four years. Ratus Bank will charge an annual fee of 20 basis points if the swap is agreed.

Required:

(a) Based on the above information, calculate the amounts Sembilan Co expects to pay or receive every year on the swap (excluding the fee of 20 basis points). Explain why the fixed annual rate of interest of 3·76?% is less than the four-year yield curve rate of 3·8%. (6 marks)

(b) Demonstrate that Sembilan Co’s interest payment liability does not change, after it has undertaken the swap, whether the interest rates increase or decrease. (5 marks)

(c) Discuss the factors that Sembilan Co should consider when deciding whether it should raise equity capital to pay off the floating rate debt. (9 marks)

第6题

e directors of Ennea Co to discuss the future investment and financing strategy of the business. Ennea Co is a listed company operating in the haulage and shipping industry.

Proposal 1

To increase the company’s level of debt by borrowing a further $20 million and use the funds raised to buy back share capital.

Proposal 2

To increase the company’s level of debt by borrowing a further $20 million and use these funds to invest in additional non-current assets in the haulage strategic business unit.

Proposal 3

To sell excess non-current haulage assets with a net book value of $25 million for $27 million and focus on offering more services to the shipping strategic business unit. This business unit will require no additional investment in non-current assets. All the funds raised from the sale of the non-current assets will be used to reduce the company’s debt.

Ennea Co financial information

Extracts from the forecast financial position for the coming year

Ennea Co’s forecast after tax profit for the coming year is expected to be $26 million and its current share price is $3·20 per share. The non-current liabilities consist solely of a 6% medium term loan redeemable within seven years. The terms of the loan contract stipulates that an increase in borrowing will result in an increase in the coupon payable of 25 basis points on the total amount borrowed, while a reduction in borrowing will lower the coupon payable by 15 basis points on the total amount borrowed.

Ennea Co’s effective tax rate is 20%. The company’s estimated after tax rate of return on investment is expected to be 15% on any new investment. It is expected that any reduction in investment would suffer the same rate of return.

Required:

(a) Estimate and discuss the impact of each of the three proposals on the forecast statement of financial position, the earnings and earnings per share, and gearing of Ennea Co. (20 marks)

(b) An alternative suggestion to proposal three was made where the non-current assets could be leased to other companies instead of being sold. The lease receipts would then be converted into an asset through securitisation. The proceeds from the sale of the securitised lease receipts asset would be used to reduce the outstanding loan borrowings.

Required:

Explain what the securitisation process would involve and what would be the key barriers to Ennea Co undertaking the process. (5 marks)

第7题

Section A – BOTH questions are compulsory and MUST be attempted

Nente Co, an unlisted company, designs and develops tools and parts for specialist machinery. The company was formed four years ago by three friends, who own 20% of the equity capital in total, and a consortium of five business angel organisations, who own the remaining 80%, in roughly equal proportions. Nente Co also has a large amount of debt finance in the form. of variable rate loans. Initially the amount of annual interest payable on these loans was low and allowed Nente Co to invest internally generated funds to expand its business. Recently though, due to a rapid increase in interest rates, there has been limited scope for future expansion and no new product development.

The Board of Directors, consisting of the three friends and a representative from each business angel organisation, met recently to discuss how to secure the company’s future prospects. Two proposals were put forward, as follows:

Proposal 1

To accept a takeover offer from Mije Co, a listed company, which develops and manufactures specialist machinery tools and parts. The takeover offer is for $2·95 cash per share or a share-for-share exchange where two Mije Co shares would be offered for three Nente Co shares. Mije Co would need to get the final approval from its shareholders if either offer is accepted;

Proposal 2

To pursue an opportunity to develop a small prototype product that just breaks even financially, but gives the company exclusive rights to produce a follow-on product within two years.

The meeting concluded without agreement on which proposal to pursue.

After the meeting, Mije Co was consulted about the exclusive rights. Mije Co’s directors indicated that they had not considered the rights in their computations and were willing to continue with the takeover offer on the same terms without them.

Currently, Mije Co has 10 million shares in issue and these are trading for $4·80 each. Mije Co’s price to earnings (P/E) ratio is 15. It has sufficient cash to pay for Nente Co’s equity and a substantial proportion of its debt, and believes that this will enable Nente Co to operate on a P/E level of 15 as well. In addition to this, Mije Co believes that it can find cost-based synergies of $150,000 after tax per year for the foreseeable future. Mije Co’s current profit after tax is $3,200,000.

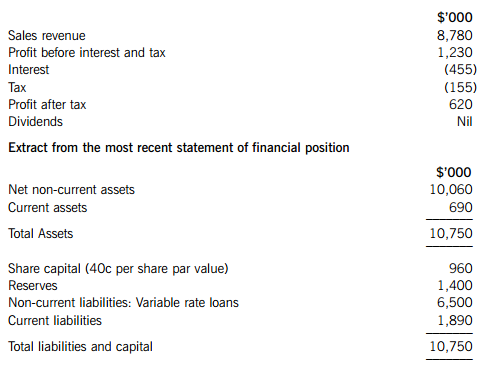

The following financial information relates to Nente Co and to the development of the new product.

Nente Co financial information

Extract from the most recent income statement

In arriving at the profit after tax amount, Nente Co deducted tax allowable depreciation and other non-cash expenses totalling $1,206,000. It requires an annual cash investment of $1,010,000 in non-current assets and working capital to continue its operations.

Nente Co’s profits before interest and tax in its first year of operation were $970,000 and have been growing steadily in each of the following three years, to their current level. Nente Co’s cash flows grew at the same rate as well, but it is likely that this growth rate will reduce to 25% of the original rate for the foreseeable future.

Nente Co currently pays interest of 7% per year on its loans, which is 380 basis points over the government base rate, and corporation tax of 20% on profits after interest. It is estimated that an overall cost of capital of 11% is reasonable compensation for the risk undertaken on an investment of this nature.

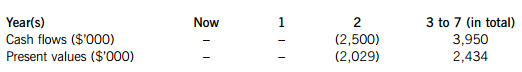

New product development (Proposal 2)

Developing the new follow-on product will require an investment of $2,500,000 initially. The total expected cash flows and present values of the product over its five-year life, with a volatility of 42% standard deviation, are as follows:

Required:

Prepare a report for the Board of Directors of Nente Co that:

(i) Estimates the current value of a Nente Co share, using the free cash flow to firm methodology; (7 marks)

(ii) Estimates the percentage gain in value to a Nente Co share and a Mije Co share under each payment offer; (8 marks)

(iii) Estimates the percentage gain in the value of the follow-on product to a Nente Co share, based on its cash flows and on the assumption that the production can be delayed following acquisition of the exclusive rights of production; (8 marks)

(iv) Discusses the likely reaction of Nente Co and Mije Co shareholders to the takeover offer, including the assumptions made in the estimates above and how the follow-on product’s value can be utilised by Nente Co. (8 marks)

Professional marks will be awarded in question 1 for the presentation, structure and clarity of the answer. (4 marks)

第8题

not the company should adopt a triple bottom line (TBL) reporting system in order to demonstrate Kengai Co’s level of sustainable development. Kengai Co’s competitors are increasingly adopting TBL reporting and the Chairman feels that it would be beneficial to follow suit. The CEO, on the other hand, feels that pursuing TBL reporting would be expensive and is not necessary.

Required:

(a) Explain what TBL reporting involves and how it would help demonstrate Kengai Co’s sustainable development. Support your explanation by including examples of proxies that can be used to indicate the impact of the factors that would be included in a TBL report. (8 marks)

(b) Discuss how producing a TBL report may help Kengai Co’s management focus on improving the financial position of the company. Illustrate the discussion with examples where appropriate. (10 marks)

第9题

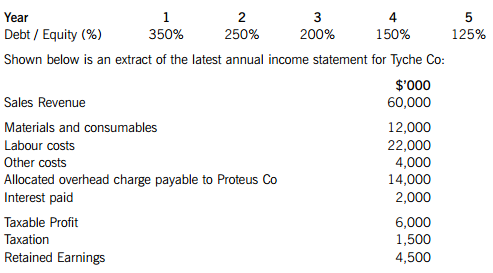

ut its main line of business is developing surveillance systems and intruder alarms. It has decided to sell a number of companies that it considers are peripheral to its core activities. One of these subsidiary companies is Tyche Co, a company involved in managing the congestion monitoring and charging systems that have been developed by Proteus Co. Tyche Co is a profitable business and it is anticipated that its revenues and costs will continue to increase at their current rate of 8% per year for the foreseeable future.

Tyche Co’s managers and some employees want to buy the company through a leveraged management buy-out. An independent assessment estimates Tyche Co’s market value at $81 million if Proteus Co agrees to cancel its current loan to Tyche Co. The managers and employees involved in the buy-out will invest $12 million for 75% of the equity in the company, with another $4 million coming from a venture capitalist for the remaining 25% equity.

Palaemon Bank has agreed to lend the balance of the required funds in the form. of a 9% loan. The interest is payable at the end of the year, on the loan amount outstanding at the start of each year. A covenant on the loan states that the following debt-equity ratios should not be exceeded at the end of each year for the next five years:

As part of the management buy-out agreement, it is expected that Proteus Co will provide management services costing $12 million for the first year of the management buy-out, increasing by 8% per year thereafter.

The current tax rate is 25% on profits and it is expected that 25% of the after-tax profits will be payable as dividends every year. The remaining profits will be allocated to reserves. It is expected that Tyche Co will repay $3 million of the outstanding loan at the end of each of the next five years from the cash flows generated from its business activity.

Required:

(a) Briefly discuss the possible benefits to Proteus Co of disposing Tyche Co through a management buy-out. (4 marks)

(b) Calculate whether the debt-equity covenant imposed by Palaemon Bank on Tyche Co will be breached over the five-year period. (9 marks)

(c) Discuss briefly the implications of the results obtained in part (b) and outline two possible actions Tyche Co may take if the covenant is in danger of being breached. (5 marks)

第10题

Section B – TWO questions ONLY to be attempted

Levante Co has identified a new project for which it will need to increase its long-term borrowings from $250 million to $400 million. This amount will cover a significant proportion of the total cost of the project and the rest of the funds will come from cash held by the company.

The current $250 million borrowing is in the form. of a 4% bond which is trading at $98·71 per $100 and is due to be redeemed at par in three years. The issued bond has a credit rating of AA. The new borrowing will also be raised in the form. of a traded bond with a par value of $100 per unit. It is anticipated that the new project will generate sufficient cash flows to be able to redeem the new bond at $100 par value per unit in five years. It can be assumed that coupons on both bonds are paid annually.

Both bonds would be ranked equally for payment in the event of default and the directors expect that as a result of the new issue, the credit rating for both bonds will fall to A. The directors are considering the following two alternative options when issuing the new bond:

(i) Issue the new bond at a fixed coupon of 5% but at a premium or discount, whichever is appropriate to ensure full take up of the bond; or

(ii) Issue the new bond at a coupon rate where the issue price of the new bond will be $100 per unit and equal to its par value.

The following extracts are provided on the current government bond yield curve and yield spreads for the sector in which Levante Co operates:

Required:

(a) Calculate the expected percentage fall in the market value of the existing bond if Levante Co’s bond credit rating falls from AA to A. (3 marks)

(b) Advise the directors on the financial implications of choosing each of the two options when issuing the new bond. Support the advice with appropriate calculations. (7 marks)

(c) Among the criteria used by credit agencies for establishing a company’s credit rating are the following: industry risk, earnings protection, financial flexibility and evaluation of the company’s management.

Briefly explain each criterion and suggest factors that could be used to assess it. (8 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!