重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

重要提示:

请勿将账号共享给其他人使用,违者账号将被封禁!

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Section A – BOTH questions are compulsory and MUST be attempted

Coeden Co is a listed company operating in the hospitality and leisure industry. Coeden Co’s board of directors met recently to discuss a new strategy for the business. The proposal put forward was to sell all the hotel properties that Coeden Co owns and rent them back on a long-term rental agreement. Coeden Co would then focus solely on the provision of hotel services at these properties under its popular brand name. The proposal stated that the funds raised from the sale of the hotel properties would be used to pay off 70% of the outstanding non-current liabilities and the remaining funds would be retained for future investments.

The board of directors are of the opinion that reducing the level of debt in Coeden Co will reduce the company’s risk and therefore its cost of capital. If the proposal is undertaken and Coeden Co focuses exclusively on the provision of hotel services, it can be assumed that the current market value of equity will remain unchanged after implementing the proposal.

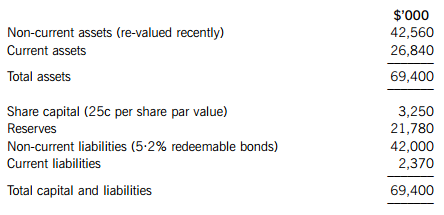

Coeden Co Financial Information

Extract from the most recent Statement of Financial Position

Coeden Co’s latest free cash flow to equity of $2,600,000 was estimated after taking into account taxation, interest and reinvestment in assets to continue with the current level of business. It can be assumed that the annual reinvestment in assets required to continue with the current level of business is equivalent to the annual amount of depreciation. Over the past few years, Coeden Co has consistently used 40% of its free cash flow to equity on new investments while distributing the remaining 60%. The market value of equity calculated on the basis of the free cash flow to equity model provides a reasonable estimate of the current market value of Coeden Co.

The bonds are redeemable at par in three years and pay the coupon on an annual basis. Although the bonds are not traded, it is estimated that Coeden Co’s current debt credit rating is BBB but would improve to A+ if the non-current liabilities are reduced by 70%.

Other Information

Coeden Co’s current equity beta is 1·1 and it can be assumed that debt beta is 0. The risk free rate is estimated to be 4% and the market risk premium is estimated to be 6%.

There is no beta available for companies offering just hotel services, since most companies own their own buildings. The average asset beta for property companies has been estimated at 0·4. It has been estimated that the hotel services business accounts for approximately 60% of the current value of Coeden Co and the property company business accounts for the remaining 40%.

Coeden Co’s corporation tax rate is 20%. The three-year borrowing credit spread on A+ rated bonds is 60 basis points and 90 basis points on BBB rated bonds, over the risk free rate of interest.

Required: (a) Calculate, and comment on, Coeden Co’s cost of equity and weighted average cost of capital before and after implementing the proposal. Briefly explain any assumptions made. (20 marks) (b) Discuss the validity of the assumption that the market value of equity will remain unchanged after the implementation of the proposal. (5 marks) (c) As an alternative to selling the hotel properties, the board of directors is considering a demerger of the hotel services and a separate property company which would own the hotel properties. The property company would take over 70% of Coeden Co’s long-term debt and pay Coeden Co cash for the balance of the property value. Required: Explain what a demerger is, and the possible benefits and drawbacks of pursuing the demerger option as opposed to selling the hotel properties. (8 marks)

更多“Section A – BOTH questions are compulsory and MUST be attemptedCoeden Co is a listed compa”相关的问题

更多“Section A – BOTH questions are compulsory and MUST be attemptedCoeden Co is a listed compa”相关的问题

第1题

are exported around the world. It is reviewing a proposal to set up a subsidiary company to manufacture a range of body and facial creams in Lanosia. These products will be sold to local retailers and to retailers in nearby countries.

Lanosia has a small but growing manufacturing industry in pharmaceutical products, although it remains largely reliant on imports. The Lanosian government has been keen to promote the pharmaceutical manufacturing industry through purchasing local pharmaceutical products, providing government grants and reducing the industry’s corporate tax rate. It also imposes large duties on imported pharmaceutical products which compete with the ones produced locally.

Although politically stable, the recent worldwide financial crisis has had a significant negative impact on Lanosia. The country’s national debt has grown substantially following a bailout of its banks and it has had to introduce economic measures which are hampering the country’s ability to recover from a deep recession. Growth in real wages has been negative over the past three years, the economy has shrunk in the past year and inflation has remained higher than normal during this time.

On the other hand, corporate investment in capital assets, research and development, and education and training, has grown recently and interest rates remain low. This has led some economists to suggest that the economy should start to recover soon. Employment levels remain high in spite of low nominal wage growth.

Lanosian corporate governance regulations stipulate that at least 40% of equity share capital must be held by the local population. In addition at least 50% of members on the Board of Directors, including the Chairman, must be from Lanosia. Kilenc Co wants to finance the subsidiary company using a mixture of debt and equity. It wants to raise additional equity and debt finance in Lanosia in order to minimise exchange rate exposure. The small size of the subsidiary will have minimal impact on Kilenc Co’s capital structure. Kilenc Co intends to raise the 40% equity through an initial public offering (IPO) in Lanosia and provide the remaining 60% of the equity funds from its own cash funds.

Required:

(a) Discuss the key risks and issues that Kilenc Co should consider when setting up a subsidiary company in Lanosia, and suggest how these may be mitigated. (15 marks)

(b) The directors of Kilenc Co have learnt that a sizeable number of equity trades in Lanosia are conducted using dark pool trading systems.

Required:

Explain what dark pool trading systems are and how Kilenc Co’s proposed Initial Public Offering (IPO) may be affected by these. (5 marks)

第2题

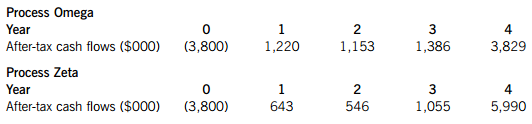

d into motor vehicle engines, will enable them to utilise fuel more efficiently. The component can be manufactured using either process Omega or process Zeta. Although this is an entirely new line of business for Tisa Co, it is of the opinion that developing either process over a period of four years and then selling the productions rights at the end of four years to another company may prove lucrative.

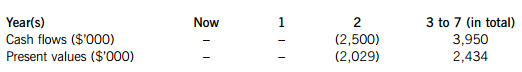

The annual after-tax cash flows for each process are as follows:

Tisa Co has 10 million 50c shares trading at 180c each. Its loans have a current value of $3·6 million and an average after-tax cost of debt of 4·50%. Tisa Co’s capital structure is unlikely to change significantly following the investment in either process.

Elfu Co manufactures electronic parts for cars including the production of a component similar to the one being considered by Tisa Co. Elfu Co’s equity beta is 1·40, and it is estimated that the equivalent equity beta for its other activities, excluding the component production, is 1·25. Elfu Co has 400 million 25c shares in issue trading at 120c each. Its debt finance consists of variable rate loans redeemable in seven years. The loans paying interest at base rate plus 120 basis points have a current value of $96 million. It can be assumed that 80% of Elfu Co’s debt finance and 75% of Elfu Co’s equity finance can be attributed to other activities excluding the component production.

Both companies pay annual corporation tax at a rate of 25%. The current base rate is 3·5% and the market risk premium is estimated at 5·8%.

Required:

(a) Provide a reasoned estimate of the cost of capital that Tisa Co should use to calculate the net present value of the two processes. Include all relevant calculations. (8 marks)

(b) Calculate the internal rate of return (IRR) and the modified internal rate of return (MIRR) for Process Omega. Given that the IRR and MIRR of Process Zeta are 26·6% and 23·3% respectively, recommend which process, if any, Tisa Co should proceed with and explain your recommendation. (8 marks)

(c) Elfu Co has estimated an annual standard deviation of $800,000 on one of its other projects, based on a normal distribution of returns. The average annual return on this project is $2,200,000.

Required:

Estimate the project’s Value at Risk (VAR) at a 99% confidence level for one year and over the project’s life of five years. Explain what is meant by the answers obtained. (4 marks)

第3题

Section B – TWO questions ONLY to be attempted

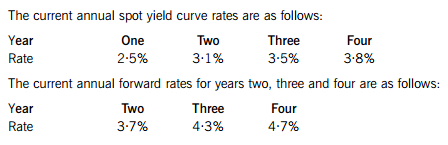

Sembilan Co, a listed company, recently issued debt finance to acquire assets in order to increase its activity levels. This debt finance is in the form. of a floating rate bond, with a face value of $320 million, redeemable in four years. The bond interest, payable annually, is based on the spot yield curve plus 60 basis points. The next annual payment is due at the end of year one.

Sembilan Co is concerned that the expected rise in interest rates over the coming few years would make it increasingly difficult to pay the interest due. It is therefore proposing to either swap the floating rate interest payment to a fixed rate payment, or to raise new equity capital and use that to pay off the floating rate bond. The new equity capital would either be issued as rights to the existing shareholders or as shares to new shareholders.

Ratus Bank has offered Sembilan Co an interest rate swap, whereby Sembilan Co would pay Ratus Bank interest based on an equivalent fixed annual rate of 3·76?% in exchange for receiving a variable amount based on the current yield curve rate. Payments and receipts will be made at the end of each year, for the next four years. Ratus Bank will charge an annual fee of 20 basis points if the swap is agreed.

Required:

(a) Based on the above information, calculate the amounts Sembilan Co expects to pay or receive every year on the swap (excluding the fee of 20 basis points). Explain why the fixed annual rate of interest of 3·76?% is less than the four-year yield curve rate of 3·8%. (6 marks)

(b) Demonstrate that Sembilan Co’s interest payment liability does not change, after it has undertaken the swap, whether the interest rates increase or decrease. (5 marks)

(c) Discuss the factors that Sembilan Co should consider when deciding whether it should raise equity capital to pay off the floating rate debt. (9 marks)

第4题

e directors of Ennea Co to discuss the future investment and financing strategy of the business. Ennea Co is a listed company operating in the haulage and shipping industry.

Proposal 1

To increase the company’s level of debt by borrowing a further $20 million and use the funds raised to buy back share capital.

Proposal 2

To increase the company’s level of debt by borrowing a further $20 million and use these funds to invest in additional non-current assets in the haulage strategic business unit.

Proposal 3

To sell excess non-current haulage assets with a net book value of $25 million for $27 million and focus on offering more services to the shipping strategic business unit. This business unit will require no additional investment in non-current assets. All the funds raised from the sale of the non-current assets will be used to reduce the company’s debt.

Ennea Co financial information

Extracts from the forecast financial position for the coming year

Ennea Co’s forecast after tax profit for the coming year is expected to be $26 million and its current share price is $3·20 per share. The non-current liabilities consist solely of a 6% medium term loan redeemable within seven years. The terms of the loan contract stipulates that an increase in borrowing will result in an increase in the coupon payable of 25 basis points on the total amount borrowed, while a reduction in borrowing will lower the coupon payable by 15 basis points on the total amount borrowed.

Ennea Co’s effective tax rate is 20%. The company’s estimated after tax rate of return on investment is expected to be 15% on any new investment. It is expected that any reduction in investment would suffer the same rate of return.

Required:

(a) Estimate and discuss the impact of each of the three proposals on the forecast statement of financial position, the earnings and earnings per share, and gearing of Ennea Co. (20 marks)

(b) An alternative suggestion to proposal three was made where the non-current assets could be leased to other companies instead of being sold. The lease receipts would then be converted into an asset through securitisation. The proceeds from the sale of the securitised lease receipts asset would be used to reduce the outstanding loan borrowings.

Required:

Explain what the securitisation process would involve and what would be the key barriers to Ennea Co undertaking the process. (5 marks)

第5题

Section A – BOTH questions are compulsory and MUST be attempted

Nente Co, an unlisted company, designs and develops tools and parts for specialist machinery. The company was formed four years ago by three friends, who own 20% of the equity capital in total, and a consortium of five business angel organisations, who own the remaining 80%, in roughly equal proportions. Nente Co also has a large amount of debt finance in the form. of variable rate loans. Initially the amount of annual interest payable on these loans was low and allowed Nente Co to invest internally generated funds to expand its business. Recently though, due to a rapid increase in interest rates, there has been limited scope for future expansion and no new product development.

The Board of Directors, consisting of the three friends and a representative from each business angel organisation, met recently to discuss how to secure the company’s future prospects. Two proposals were put forward, as follows:

Proposal 1

To accept a takeover offer from Mije Co, a listed company, which develops and manufactures specialist machinery tools and parts. The takeover offer is for $2·95 cash per share or a share-for-share exchange where two Mije Co shares would be offered for three Nente Co shares. Mije Co would need to get the final approval from its shareholders if either offer is accepted;

Proposal 2

To pursue an opportunity to develop a small prototype product that just breaks even financially, but gives the company exclusive rights to produce a follow-on product within two years.

The meeting concluded without agreement on which proposal to pursue.

After the meeting, Mije Co was consulted about the exclusive rights. Mije Co’s directors indicated that they had not considered the rights in their computations and were willing to continue with the takeover offer on the same terms without them.

Currently, Mije Co has 10 million shares in issue and these are trading for $4·80 each. Mije Co’s price to earnings (P/E) ratio is 15. It has sufficient cash to pay for Nente Co’s equity and a substantial proportion of its debt, and believes that this will enable Nente Co to operate on a P/E level of 15 as well. In addition to this, Mije Co believes that it can find cost-based synergies of $150,000 after tax per year for the foreseeable future. Mije Co’s current profit after tax is $3,200,000.

The following financial information relates to Nente Co and to the development of the new product.

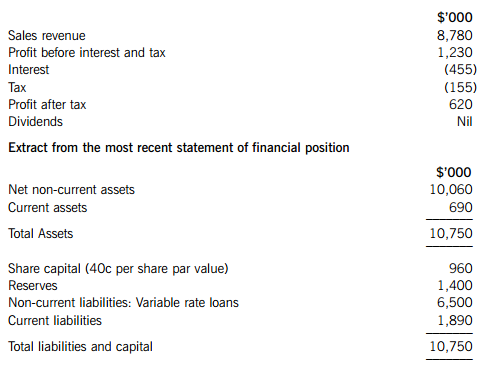

Nente Co financial information

Extract from the most recent income statement

In arriving at the profit after tax amount, Nente Co deducted tax allowable depreciation and other non-cash expenses totalling $1,206,000. It requires an annual cash investment of $1,010,000 in non-current assets and working capital to continue its operations.

Nente Co’s profits before interest and tax in its first year of operation were $970,000 and have been growing steadily in each of the following three years, to their current level. Nente Co’s cash flows grew at the same rate as well, but it is likely that this growth rate will reduce to 25% of the original rate for the foreseeable future.

Nente Co currently pays interest of 7% per year on its loans, which is 380 basis points over the government base rate, and corporation tax of 20% on profits after interest. It is estimated that an overall cost of capital of 11% is reasonable compensation for the risk undertaken on an investment of this nature.

New product development (Proposal 2)

Developing the new follow-on product will require an investment of $2,500,000 initially. The total expected cash flows and present values of the product over its five-year life, with a volatility of 42% standard deviation, are as follows:

Required:

Prepare a report for the Board of Directors of Nente Co that:

(i) Estimates the current value of a Nente Co share, using the free cash flow to firm methodology; (7 marks)

(ii) Estimates the percentage gain in value to a Nente Co share and a Mije Co share under each payment offer; (8 marks)

(iii) Estimates the percentage gain in the value of the follow-on product to a Nente Co share, based on its cash flows and on the assumption that the production can be delayed following acquisition of the exclusive rights of production; (8 marks)

(iv) Discusses the likely reaction of Nente Co and Mije Co shareholders to the takeover offer, including the assumptions made in the estimates above and how the follow-on product’s value can be utilised by Nente Co. (8 marks)

Professional marks will be awarded in question 1 for the presentation, structure and clarity of the answer. (4 marks)

第6题

not the company should adopt a triple bottom line (TBL) reporting system in order to demonstrate Kengai Co’s level of sustainable development. Kengai Co’s competitors are increasingly adopting TBL reporting and the Chairman feels that it would be beneficial to follow suit. The CEO, on the other hand, feels that pursuing TBL reporting would be expensive and is not necessary.

Required:

(a) Explain what TBL reporting involves and how it would help demonstrate Kengai Co’s sustainable development. Support your explanation by including examples of proxies that can be used to indicate the impact of the factors that would be included in a TBL report. (8 marks)

(b) Discuss how producing a TBL report may help Kengai Co’s management focus on improving the financial position of the company. Illustrate the discussion with examples where appropriate. (10 marks)

第7题

ut its main line of business is developing surveillance systems and intruder alarms. It has decided to sell a number of companies that it considers are peripheral to its core activities. One of these subsidiary companies is Tyche Co, a company involved in managing the congestion monitoring and charging systems that have been developed by Proteus Co. Tyche Co is a profitable business and it is anticipated that its revenues and costs will continue to increase at their current rate of 8% per year for the foreseeable future.

Tyche Co’s managers and some employees want to buy the company through a leveraged management buy-out. An independent assessment estimates Tyche Co’s market value at $81 million if Proteus Co agrees to cancel its current loan to Tyche Co. The managers and employees involved in the buy-out will invest $12 million for 75% of the equity in the company, with another $4 million coming from a venture capitalist for the remaining 25% equity.

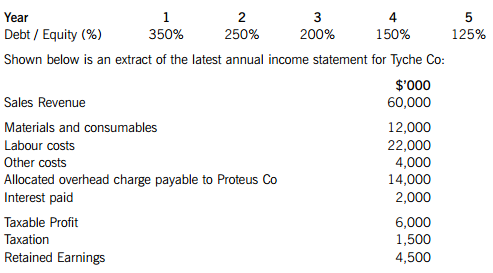

Palaemon Bank has agreed to lend the balance of the required funds in the form. of a 9% loan. The interest is payable at the end of the year, on the loan amount outstanding at the start of each year. A covenant on the loan states that the following debt-equity ratios should not be exceeded at the end of each year for the next five years:

As part of the management buy-out agreement, it is expected that Proteus Co will provide management services costing $12 million for the first year of the management buy-out, increasing by 8% per year thereafter.

The current tax rate is 25% on profits and it is expected that 25% of the after-tax profits will be payable as dividends every year. The remaining profits will be allocated to reserves. It is expected that Tyche Co will repay $3 million of the outstanding loan at the end of each of the next five years from the cash flows generated from its business activity.

Required:

(a) Briefly discuss the possible benefits to Proteus Co of disposing Tyche Co through a management buy-out. (4 marks)

(b) Calculate whether the debt-equity covenant imposed by Palaemon Bank on Tyche Co will be breached over the five-year period. (9 marks)

(c) Discuss briefly the implications of the results obtained in part (b) and outline two possible actions Tyche Co may take if the covenant is in danger of being breached. (5 marks)

第8题

Section B – TWO questions ONLY to be attempted

Levante Co has identified a new project for which it will need to increase its long-term borrowings from $250 million to $400 million. This amount will cover a significant proportion of the total cost of the project and the rest of the funds will come from cash held by the company.

The current $250 million borrowing is in the form. of a 4% bond which is trading at $98·71 per $100 and is due to be redeemed at par in three years. The issued bond has a credit rating of AA. The new borrowing will also be raised in the form. of a traded bond with a par value of $100 per unit. It is anticipated that the new project will generate sufficient cash flows to be able to redeem the new bond at $100 par value per unit in five years. It can be assumed that coupons on both bonds are paid annually.

Both bonds would be ranked equally for payment in the event of default and the directors expect that as a result of the new issue, the credit rating for both bonds will fall to A. The directors are considering the following two alternative options when issuing the new bond:

(i) Issue the new bond at a fixed coupon of 5% but at a premium or discount, whichever is appropriate to ensure full take up of the bond; or

(ii) Issue the new bond at a coupon rate where the issue price of the new bond will be $100 per unit and equal to its par value.

The following extracts are provided on the current government bond yield curve and yield spreads for the sector in which Levante Co operates:

Required:

(a) Calculate the expected percentage fall in the market value of the existing bond if Levante Co’s bond credit rating falls from AA to A. (3 marks)

(b) Advise the directors on the financial implications of choosing each of the two options when issuing the new bond. Support the advice with appropriate calculations. (7 marks)

(c) Among the criteria used by credit agencies for establishing a company’s credit rating are the following: industry risk, earnings protection, financial flexibility and evaluation of the company’s management.

Briefly explain each criterion and suggest factors that could be used to assess it. (8 marks)

第9题

our months’ time on 1 May 2012. It expects to make a full repayment of the borrowed amount nine months from now. Currently there is some uncertainty in the markets, with higher than normal rates of inflation, but an expectation that the inflation level may soon come down. This has led some economists to predict a rise in interest rates and others suggesting an unchanged outlook or maybe even a small fall in interest rates over the next six months.

Although Alecto Co is of the opinion that it is equally likely that interest rates could increase or fall by 0·5% in four months, it wishes to protect itself from interest rate fluctuations by using derivatives. The company can borrow at LIBOR plus 80 basis points and LIBOR is currently 3·3%. The company is considering using interest rate futures, options on interest rate futures or interest rate collars as possible hedging choices.

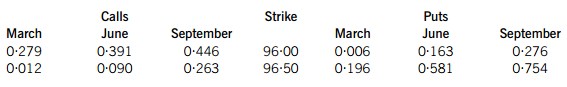

The following information and quotes from an appropriate exchange are provided on Euro futures and options. Margin requirements may be ignored.

Three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25

March 96·27

June 96·16

September 95·90

Options on three month Euro futures, €1,000,000 contract, tick size 0·01% and tick value €25. Option premiums are in annual %.

It can be assumed that settlement for both the futures and options contracts is at the end of the month. It can also be assumed that basis diminishes to zero at contract maturity at a constant rate and that time intervals can be counted in months.

Required:

(a) Briefly discuss the main advantage and disadvantage of hedging interest rate risk using an interest rate collar instead of options. (4 marks)

(b) Based on the three hedging choices Alecto Co is considering and assuming that the company does not face any basis risk, recommend a hedging strategy for the €22,000,000 loan. Support your recommendation with appropriate comments and relevant calculations in €. (17 marks)

(c) Explain what is meant by basis risk and how it would affect the recommendation made in part (b) above. (4 marks)

第10题

Section A – BOTH questions are compulsory and MUST be attempted

Tramont Co is a listed company based in the USA and manufactures electronic devices. One of its devices, the X-IT, is produced exclusively for the American market. Tramont Co is considering ceasing the production of the X-IT gradually over a period of four years because it needs the manufacturing facilities used to make the X-IT for other products.

The government of Gamala, a country based in south-east Asia, is keen to develop its manufacturing industry and has offered Tramont Co first rights to produce the X-IT in Gamala and sell it to the USA market for a period of four years. At the end of the four-year period, the full production rights will be sold to a government-backed company for Gamalan Rupiahs (GR) 450 million after tax (this amount is not subject to inflationary increases). Tramont Co has to decide whether to continue production of the X-IT in the USA for the next four years or to move the production to Gamala immediately.

Currently each X-IT unit sold makes a unit contribution of $20. This unit contribution is not expected to be subject to any inflationary increase in the next four years. Next year’s production and sales estimated at 40,000 units will fall by 20% each year for the following three years. It is anticipated that after four years the production of the X-IT will stop. It is expected that the financial impact of the gradual closure over the four years will be cost neutral (the revenue from sale of assets will equal the closure costs). If production is stopped immediately, the excess assets would be sold for $2·3 million and the costs of closure, including redundancy costs of excess labour, would be $1·7 million.

The following information relates to the production of the X-IT moving to Gamala. The Gamalan project will require an initial investment of GR 230 million, to pay for the cost of land and buildings (GR 150 million) and machinery (GR 80 million). The cost of machinery is tax allowable and will be depreciated on a straight-line basis over the next four years, at the end of which it will have a negligible value.

Tramont Co will also need GR 40 million for working capital immediately. It is expected that the working capital requirement will increase in line with the annual inflation rate in Gamala. When the project is sold, the working capital will not form. part of the sale price and will be released back to Tramont Co.

Production and sales of the device are expected to be 12,000 units in the first year, rising to 22,000 units, 47,000 units and 60,000 units in the next three years respectively.

The following revenues and costs apply to the first year of operation: – Each unit will be sold for $70;

– The variable cost per unit comprising of locally sourced materials and labour will be GR 1,350, and;

– In addition to the variable cost above, each unit will require a component bought from Tramont Co for $7, on which Tramont Co makes $4 contribution per unit;

– Total fixed costs for the first year will be GR 30 million.

The costs are expected to increase by their countries’ respective rates of inflation, but the selling price will remain fixed at $70 per unit for the four-year period.

The annual corporation tax rate in Gamala is 20% and Tramont Co currently pays corporation tax at a rate of 30% per year. Both countries’ corporation taxes are payable in the year that the tax liability arises. A bi-lateral tax treaty exists between the USA and Gamala, which permits offset of overseas tax against any USA tax liability on overseas earnings. The USA and Gamalan tax authorities allow losses to be carried forward and written off against future profits for taxation purposes.

Tramont Co has decided to finance the project by borrowing the funds required in Gamala. The commercial borrowing rate is 13% but the Gamalan government has offered Tramont Co a 6% subsidised loan for the entire amount of the initial funds required. The Gamalan government has agreed that it will not ask for the loan to be repaid as long as Tramont Co fulfils its contract to undertake the project for the four years. Tramont Co can borrow dollar funds at an interest rate of 5%.

Tramont Co’s financing consists of 25 million shares currently trading at $2·40 each and $40 million 7% bonds trading at $1,428 per $1,000. Tramont Co’s quoted beta is 1·17. The current risk free rate of return is estimated at 3% and the market risk premium is 6%. Due to the nature of the project, it is estimated that the beta applicable to the project if it is all-equity financed will be 0·4 more than the current all-equity financed beta of Tramont Co. If the Gamalan project is undertaken, the cost of capital applicable to the cash flows in the USA is expected to be 7%.

The spot exchange rate between the dollar and the Gamalan Rupiah is GR 55 per $1. The annual inflation rates are currently 3% in the USA and 9% in Gamala. It can be assumed that these inflation rates will not change for the foreseeable future. All net cash flows arising from the project will be remitted back to Tramont Co at the end of each year.

There are two main political parties in Gamala: the Gamala Liberal (GL) Party and the Gamala Republican (GR) Party. Gamala is currently governed by the GL Party but general elections are due to be held soon. If the GR Party wins the election, it promises to increase taxes of international companies operating in Gamala and review any commercial benefits given to these businesses by the previous government.

Required:

Prepare a report for the Board of Directors of Tramont Co that

(i) Evaluates whether or not Tramont Co should undertake the project to produce the X-IT in Gamala and cease its production in the USA immediately. In the evaluation, include all relevant calculations in the form. of a financial assessment and explain any assumptions made;

Note: it is suggested that the financial assessment should be based on present value of the operating cash flows from the Gamalan project, discounted by an appropriate all-equity rate, and adjusted by the present value of all other relevant cash flows. (27 marks)

(ii) Discusses the potential change in government and other business factors that Tramont Co should consider before making a final decision. (8 marks)

Professional marks will be awarded in question 1 for the format, structure and presentation of the answer. (4 marks)

警告:系统检测到您的账号存在安全风险

警告:系统检测到您的账号存在安全风险

为了保护您的账号安全,请在“上学吧”公众号进行验证,点击“官网服务”-“账号验证”后输入验证码“”完成验证,验证成功后方可继续查看答案!